- Advertisement -

- Advertisement -

High Yield

Emerging Markets

Diversification

ETFs

Allocator Interviews

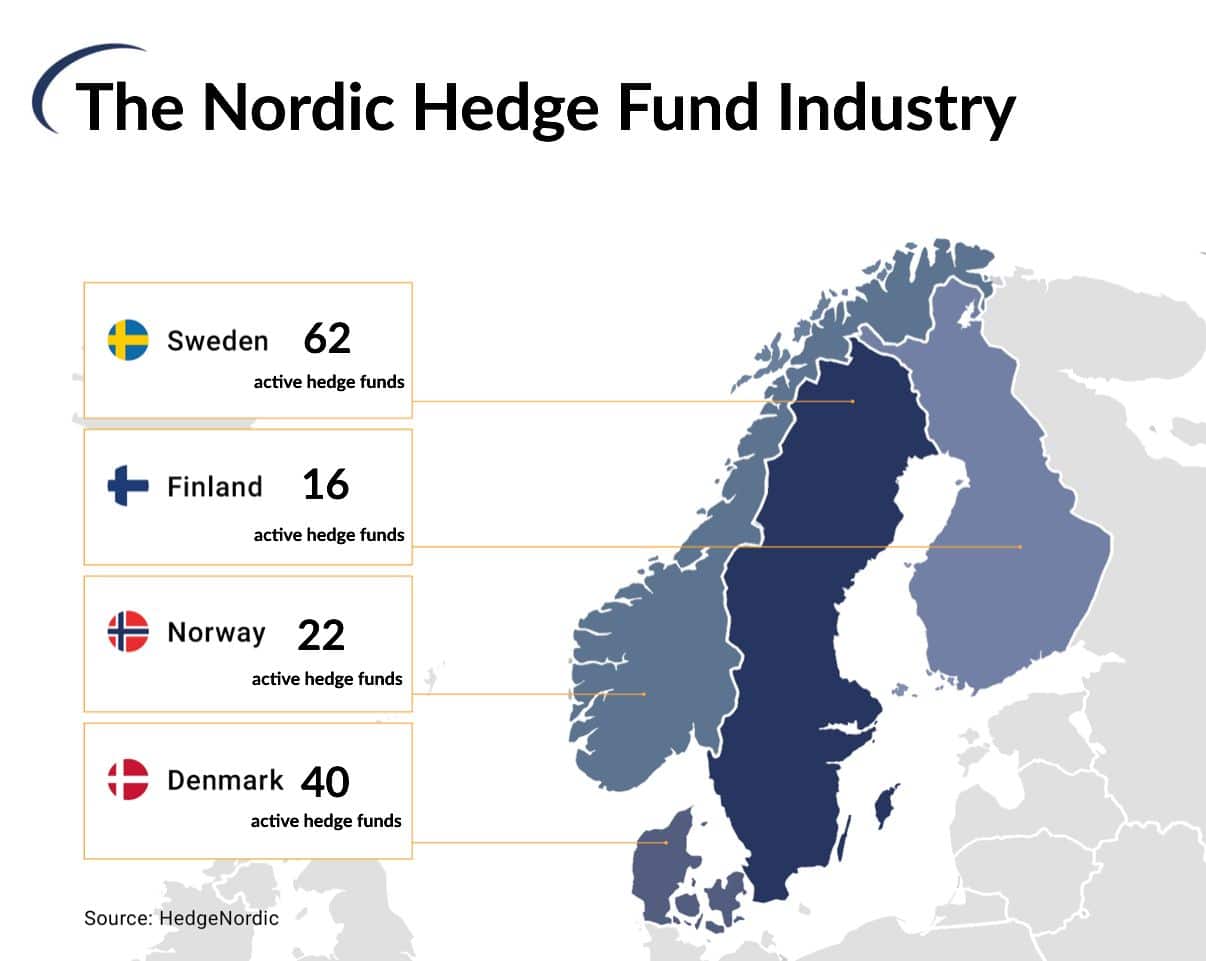

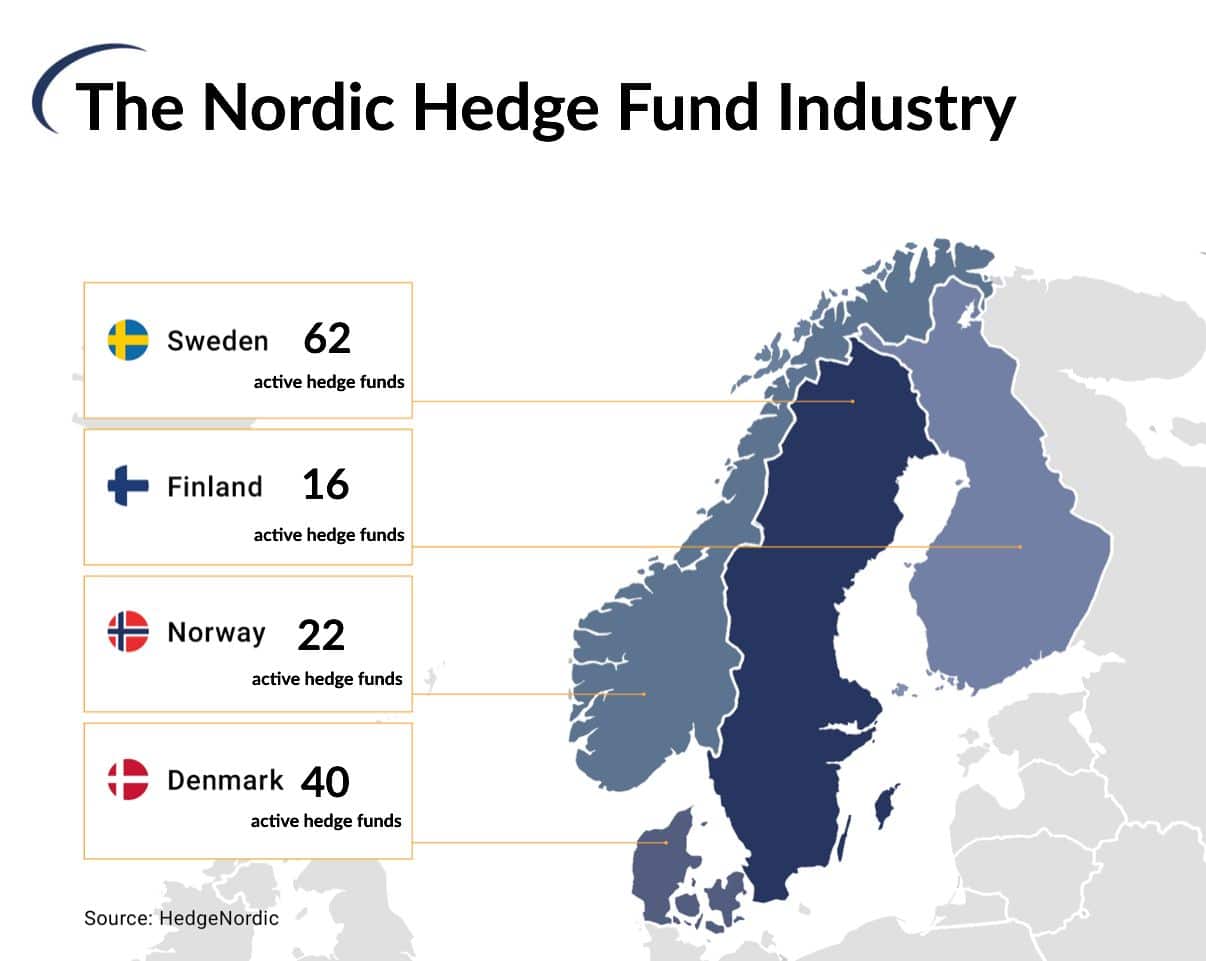

Nordic Hedge IndexNHX

Your Single Access Point to the Nordic Hedge Fund Universe

Your Single Access Point to the Nordic Hedge Fund Universe