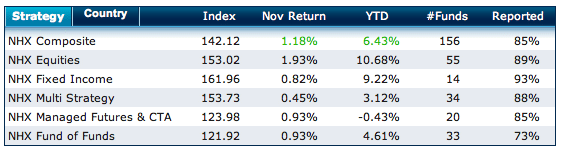

Stockholm (HedgeNordic.com) – The Nordic Hedge Index (NHX) continued to extend its advance, adding 1,18% November. NHX recorded its fifth positive month in succession to lock in a 6,43% appreciation for the year.

All five substrategies ended the month in positive territoriy. NHX equities made the strongest gains reporting 1,93% in November. Equity strategies are also the highest advancers year to date in 2013, up an impressive 10,68%.

NHX Fixed Income, the smalest substrategy withinNHX represented by 14 funds, appreciated by an average of 0,82% for the month and advanced to be the second strongest category year to date, up 9,22%

Despite gaining 0,93% in November, Manged Futures are still the only NHX strategy in negative territory for 2013, 0,43% below last years closing prices.

NHX Fund of Funds also appreciated by 0,93% for the month and are 4,61% up YTD. Sector Polaris (+8,53%), DnB Prisma (8,28%) and SEB True Market Neutral are the strongest representatives in the subsegment year to date.

Multi Strategy Funds were the smalest gainers, adding an average of 0,45% in November (3,12% YTD). Alandsbanken AGPII Defined Risk 12 (+3,15%), Norron Select (+2,2%) and currency fund GMM (+2%) managed to outperform the index for the month.

Managers from Denmark (+1,47%) and Sweden (+1,37% MTD) were the most profitable in November, while Norwegian managers added just short of one per cent. Only Finish hedge funds found themselves in negative territory, posting declines of -0,22% to extend the years losses to nearly 2%. NHX Norway is in a runaway lead for the year up 15,22%, almost three times the 5,69% Swedish managers advanced in 2013.

Adapto Nordic recorded its best monthly return since inception, up 16,14% for the month catapulting the funds anual performance from negative territory to a strong 12,54% in 2012. After very strong numbers in October, Grand Haven Capital again landed in the top three performers with both funds, Grand Haven Capital Fund and Grand Haven Capital Neutral Fund which gained 10,52% and 9,93% respectively in November to lead the tables of all 156 Nordic hedge funds in the NHX database, up 88,53% and 58,53% for 2013. Another fund that regularly made the top five best performing funds and won the award as „Best Nordic Equity Fund 2012“, Rhenman Healthcare Equity L/S returned 9,31% in November and is up a stunning 55,22% for 2013. A very difficult year for DNB ECO Absolute Return Fund gave some consolation to management and investors with a 5,5% positive return in November, but still remains one of the weakest funds in the HedgeNordic databases down over 17% in 2013.

Next to Grand Havens two funds and Rhenman Healthcare Equity L/S, Brummer & Partners Manticore (34,95%), Atlant Edge (29,08%) and Madrague Equity L/S (28,39%) are the strongest gainers among the Nordic hedge fund managers in NHX year to date.

Bild (c) aboutpixel.de—Thomas-Pieruschek