By Adi Mackic, Man AHL – “I Feel the Need, the Need for Speed.” At Man AHL, we empathise with what is probably Maverick’s most famous quote in 1986’s ‘Top Gun.” Following trends quickly and being responsive to emergent (or dissipating) changes in market directions, is a design goal for all of our trend- following strategies. In this article, we argue that more responsive trend-following strategies provide attractive risk-management properties over slower implementations and are more complementary to traditional investments.

What is ‘Speed’ in Trend-Following?

Academic studies have shown that trends exist in markets over different time horizons, with some persisting for a few days or weeks, and others running for several months.1 By ‘speed’, we mean trend-length sensitivity; ‘fast’ and ‘slow’ trend systems focus on capturing the short- and long- end of this spectrum, respectively. There are a variety of algorithms that can be used to identify trends. In this article, we investigate performance characteristics of a suite of double exponentially weighted moving-average crossover (‘MAC’) models. These, or variations thereof, have been in use at Man AHL for around three decades and still represent the model with greatest risk allocation in our trend-following strategies. The choice of trading speeds is chosen to both span the range of trends we are seeking to capture, and minimise correlation between the models.

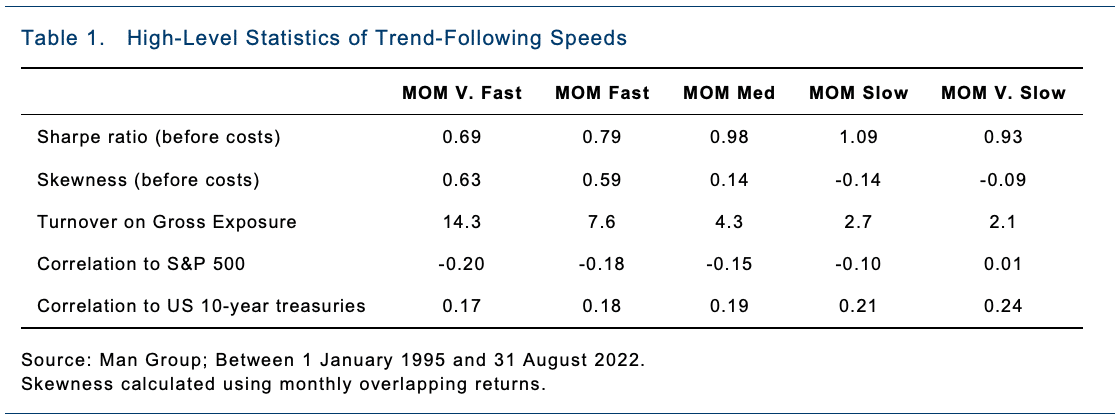

To determine performance characteristics of strategies with different speeds, we backtest each strategy from 1995 through to 2022 across the 50 most liquid futures and FX forward markets and apply equal risk allocations across asset classes. Individual markets are volatility scaled such that each has equal risk weight within an asset class. High-level results are shown in Table 1.

As expected, turnover decreases with slower speeds. Reassuringly, Sharpe ratios are all significantly positive. Skewness is positive for almost all speeds, but is more so for fast strategies.

What’s interesting in Table 1 is the apparent trade-off between Sharpe ratio and skewness; risk-adjusted returns increase with slower speed, but risk- management properties, via skewness, deteriorate. The intuition here is that faster models cut off losses quickly when a trend reverses, cutting off that left tail, while still allowing profits to run.

The Need for Speed

Our analysis thus far has shown that returns from our MAC models at different speeds are positive in the long term and are lowly correlated to each other. A systematic mindset says that this diversification should be captured by trading all the speeds, thereby increasing risk-adjusted returns and, with the judicious use of leverage, returns themselves.

But what weights should we allocate to each model speed?

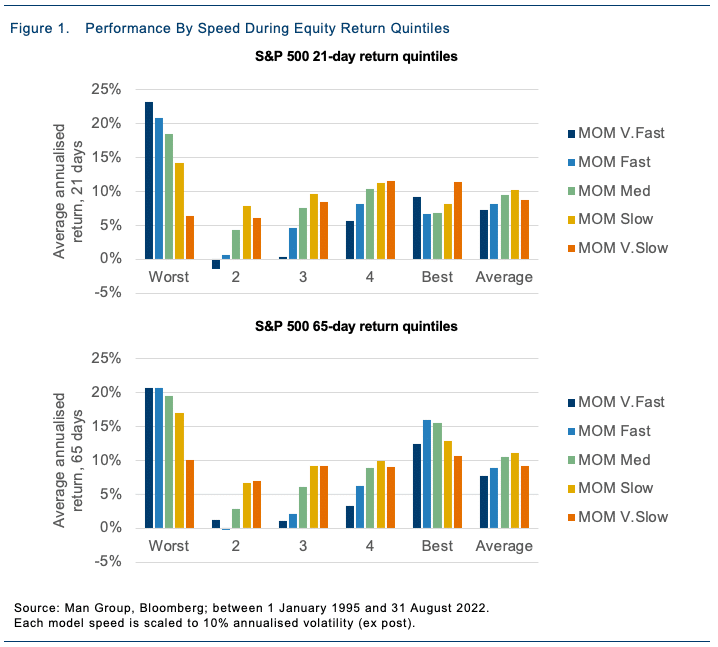

At Man AHL, we find a persuasive argument for having proportionate weights to fast trend models through the analysis of ‘Crisis Alpha’ (i.e. trend-following’s historically observed property of performing well in risk-off environments). In Figure 1, we plot the performance of each of our speeds by S&P 500 return quintile – around one month holding period on the top, and around three months on the lower plot.

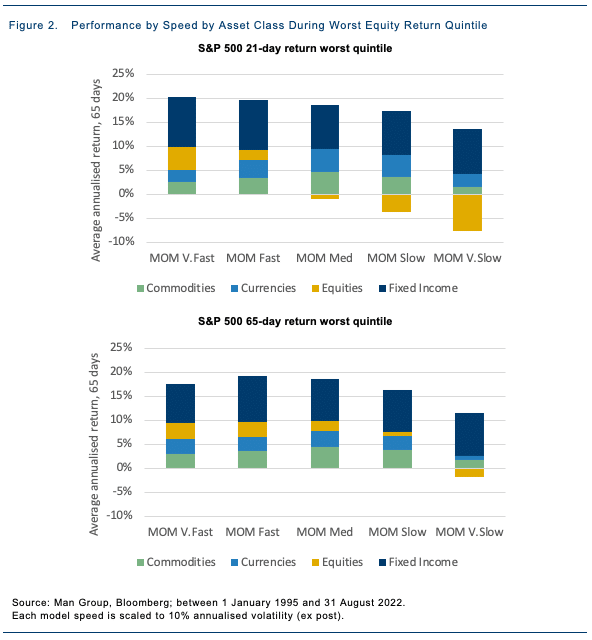

The average annualised return for both time horizons studies generally improves as speed of trading decreases. However, convexity and performance when the S&P 500 is in its worst quintile, our ‘Crisis Alpha’, increases as the speed is intensified. We further investigate this effect by examining the asset class performance by speed during the worst S&P 500 return quintile (across 21- and 65-day returns, Figure 2).

First, we find that regardless of speed, trend systems generate their ‘Crisis Alpha’ from gains in all asset classes, not just equities.

Second, positive equity attributions are typically a feature of faster trend models. The slowest trend speed cannot shift to a short position over a 1- or 3-month horizon. To us, this is crucial given that investors may often review performance, and therefore investments, on a monthly or quarterly basis. This was of great significance during the short-lived Covid-led equity rout in Q1 2020. If ‘Crisis Alpha’ is a desired outcome of an allocation to trend following, then a responsive trend system is key to ensure that outcome.

The Need for Execution

As always, the real world has the potential to get in the way. Transaction costs impact faster trading speeds disproportionately because of the higher turnover and therefore more frequent crossing of the bid-offer spread. Using Man AHL’s trading cost models, built using three decades of experience trading trend- following strategies at scale, we find that risk-adjusted returns after costs are materially lower for faster speeds over the long term. Interestingly, skewness properties remain largely intact, and unaffected by the addition of costs. Moreover, during ‘Crisis Alpha’, average returns at faster speeds are impacted more once transaction costs are included, but remain the best performer during equity weakness.

It stands to reason, therefore, that efficient execution is the gatekeeper to being able to trade fast. Maverick may have felt the need for speed, but he needed his F-14 to get there. Man AHL’s F-14 is a purpose- built execution platform, with two cornerstones. First, algorithms are tuned to Man AHL’s style of trading. Second, flow is disguised to minimise the predictability of trades and hence reduce the negative impact of high-frequency traders. Broadly, we find that Man AHL reduces transaction costs by a factor of two over bank algorithms.

Diversification in a Traditional Portfolio

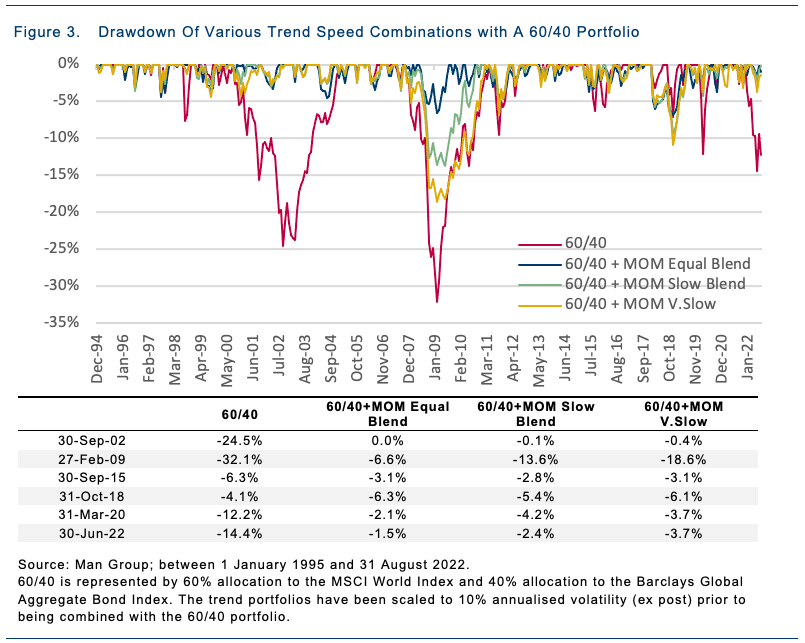

To our knowledge, very few investors own solely trend- following strategies. Instead, they tend to be used as part of a portfolio. If the aim of the trend-following allocation is to boost the defensive properties of a portfolio, then perhaps a more responsive system – allocating more to fast trend models – may suit best, in our view. We explore this below by comparing the drawdown profile of a traditional 60/40 portfolio combined with various trend strategies, ranging from very slow, a slow blend and finally an equal blend across all speeds. All trend strategies are adjusted to reflect 10% return volatility before being combined with the 60/40 portfolio. In order to emphasise any drawdown impact, we choose an equal allocation between the two components.

Figure 3 shows the drawdown chart of each combined portfolio as well as the 60/40 portfolio without an allocation to a trend strategy, alongside values at key drawdown episodes. Here, drawdowns are defined as peak-to-current returns at each point in time. As expected, all combinations with a trend strategy deliver some degree of risk mitigation compared to the traditional portfolio. Moreover, the degree of downside mitigation typically improves with greater allocation to faster speeds.

The results suggest that, just like Maverick, investors in trend-following, particularly those seeking defensive properties, should feel the need for speed.

[1] Moskowitz, T., Y. Ooi, and L. Pedersen (2012), “Time series momentum”, Journal of Financial Economics, 104(2), 228–250.

Please see Important Information regarding hypothetical results here.

Disclaimer:

Opinions expressed are those of the author and may not be shared by all personnel of Man Group plc (‘Man’). These opinions are subject to change without notice, are for information purposes only and do not constitute an offer or invitation to make an investment in any financial instrument or in any product to which any member of Man’s group of companies provides investment advisory or any other services. Any forward-looking statements speak only as of the date on which they are made and are subject to risks and uncertainties that may cause actual results to differ materially from those contained in the statements. Unless stated otherwise this information is communicated by Man Solutions Limited which is authorised and regulated in the UK by the Financial Conduct Authority. In the United States this material is presented by Man Investments Inc. (‘Man Investments’). Man Investments is registered as a broker-dealer with the US Securities and Exchange Commission (‘SEC’) and is a member of the Financial Industry Regulatory Authority (‘FINRA’). Man Investments is also a member of Securities Investor Protection Corporation (‘SIPC’). Man Investments is a wholly owned subsidiary of Man Group plc. (‘Man Group’). The registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed Man Investments. In the US, Man Investments can be contacted at 1345 Avenue of the Americas, 21st floor, New York, NY 10105, Telephone: (212) 649-6600