Stockholm (HedgeNordic.com) – Supporeted by gains in all substrategies, the Nordic Hedge Index (NHX) advanced by 0,97% in December to lock in its strongest annual gains since ist record year in 2009 (+14,95%) to finish 2013 7,43% higher. The index value of 152,6 represents an all time high for NHX.

Managed Futures were the strongest sub strategy in December, advancing 1,46% in December. The sprint towards year end helped the sub strategy to finish the year up by almost one per cent after being the only sub strategy for much of the year to fall behind its 2012 closing index value. A detailed review oft the Nordic CTAs Q4 and annual performance can by viewed here: NHX CTA Q4.

Equity strategies were up by 1,19% in December, finishing the year with double digit gains of 11,9% making it the strongest hedge fund strategy within the NHX in 2013. Fund of hedgefunds advaced by nearly one per cent in December, bringing the gains for 2013 to 5,58%. Only half of the Nordic FoHF had reported their numbers by January 21st.

Fixed income strategies, the strongest performers in 2012, were least advanced but could add 0,4% in December or 9,66% for the full year. With 14 funds in NHX fixed income, this is the smallest group among the sub strategies. Nordic Multi Strategy hedge funds appreciated by 0,4% in December, and 3,63% for 2013.

The country breakdown among the Nordic countries puts NHX Norway on top of the table by a large margin, appreciating by 1,5% in December and 16,8% for the full year. Despite adding 1,19% in December, CTA heavy NHX Finland is the only Nordic region to record red numbers for 2013, loosing 0,81% for the year. NHX Sweden gained 0,86% in December (6,6% YTD) and NHX Denmark 0,54% for the month, or 3,4% in 2013.

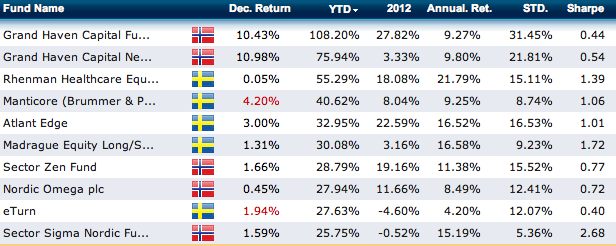

Top performing funds in December were the two strategies managed by Norwegian / Swiss Grand Haven Capital. Grand Haven Capital Neutral Fund appreciated by 10,98% in December and Grand Haven Capital Fund by 10,43%. Both funds are also the highest net performers for the full year, rocketing up by 76% and 108% respectively. HedgeNordic interviewed the portfolio managers of GHC just recently: Interview Grand Haven.

Estlander & Partners Alphatrend II in December gained 7,74% (-1,17% YTD), Alandsbanken Commodity Fund 5,08% (12,77% YTD) and Sector Euro Power Fund 4,96% (-0,93% YTD.)

A table of the ten top performing funds in 2013 across all sub strategies can be viewed below.

Picture: (c) McIek—shutterstock.com