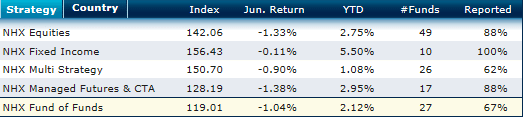

Stockholm (HedgeNordic.com) – The Nordic Hedge Index (NHX) dropped by 1,1% in June, it´s first monthly decline since October 2012 to close at an index value of 137,06. Hardest hit where Managed Futures, down 1,38% for the month (+2,95% YTD) and NHX Equities, down 1,33% in June (+2,75% YTD). With fund of funds giving up -1,04% Multi Strat -0,9% and Fixed Income funds -0,11% all of the Index´ five sub-strategies closed June in negative territory.

Looking at the indices by country, the picture stays similar for the month. While Finish managers in average lost the most, down -2,00% in June and Norwegian managers are down -1,23% also Swedish (-1,01%) and Danish managers (-0,75%) could not buckle the negative trend.

For the first six months of the year, Norwegian managers advanced the strongest in average, up by 6,56% ahead of managers from Finland (+5,2%) and Sweden (+1,66%). Danish managers stuck to their colors and were the only region to show red numbers for the first two quarters, down 0,09%.

Best performing funds in June were Norwegian Sector EuroPower Fund, up 5,13% in June (-0,09% YTD) ahead of Manticore out of the Brummer & Partner family (+3,86% est in June) and Shepherd Energy Fund gaining 3,06%.

Among the best performing equity hedge funds in the Nordic region for the first six months are Rhenman & Partners up 27,44% and Norwegian Sector Zen up 17% and Nordic Omega up 14%, despite all funds losing money in June.

The top five spots of best performing fixed income hedge funds so far in 2013 all go to Danish funds: Danske Invest Hedge Mortage Arbitrage (+9,47%) HP Hedge (8,72%) Danske Invest Hedge Fixed Income (7,61%) Asgard (+7,61%) and Midgard (7,16%).

Turning to the Multi Strategy group, Alandsbanken AGPII Defined Risk 12 is strongest performer year to date, up nearly 8%. “Our strong performance is mainly attributed to our successful macro analysis and to our commodity strategies. While we do employ trend-following strategies, among others, they don’t dominate the portfolio which limitted the drawdown in the end of H1”, Mats Ohlson at Alandsbaken Sverige explains to HedgeNordic. Asymetric Global Macro (+7,17%) and ALFA Rubicon Fund (+5,26%) complete the top three in the category.

Estlander & Partners Alpha Trend Program leads the way so far in the group of Nordic CTA, up 12,04% year to date ahead of Warren Short Term Trading (+8,43%) and Estlander & Partners Freedom Program (+6,39%).

A new listing in the NHX, Storebrand Selecta is best performing fund of hedge funds so far in 2013 up 7,9% despite losing 0,34% in June ahead of Sector Polaris (+6%) and DnB NOR Prisma (+5%). “The fund has seen consistent performance from its long/short managers, while at the same time keeping the net exposure within the range of 35-45%.” Ivar Waage, portfolio manager for Storebrand Selecta tells HedgeNordic.com.

Best performing Swedish funds year to date is Rhenman Healthcare Equity L/S (+27,44%) “We have YTD been able to take advantage of the strong performance in the biotech sub-sector, which has partly been driven by increasing M&A activity. Our exposure to pharmaceuticals has been very limited during the period and this, among other things, has generated considerable alpha YTD.”, Carl Grevelius, Partner and Head of Sales & Marketing at Rhenman & Partners told HedgeNordic.

Runners up among the best Swedish hedge funds are Gladiator (11%) DNB TMT Absolute Return (10,17%) QQM Equity Hedge (9,93%) and Nordic Absolute Return (8%).

DNB ECO Absolute Return is at the bottom of the table of Swedish hedge funds for the year, losing 15,77% YTD. Since November 2012 the fund reported negative numbers every single month.

The Nordic Hedge Fund Index (NHX) is an equal weighted hedge fund index derived from the performance of hedge fund managers and advisors within the universe of Nordic hedge funds. The index is based on data reported directly to HEDGENORDIC by the hedge fund managers themselves. Currently, 129 Nordic hedge funds report numbers to compose NHX. The index aims to represent the entire universe of Nordic hedge funds.

Bild: (c) shutterstock—Thomas-Pajot