Stockholm (HedgeNordic) – Many institutional investors require a track record from hedge funds before making allocations. Younger funds without a long track record, however, delivered higher returns than more established ones in the recent past, according to a study by Preqin and alternatives asset management firm 50 South Capital.

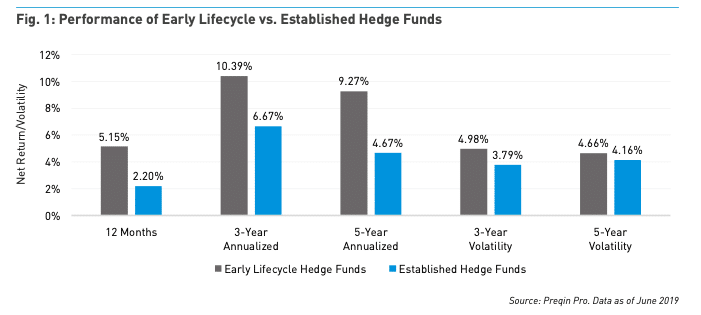

Hedge funds early in their lifecycle are outperforming established players by 3.7 percent and 4.6 percent on a third- and five-year annualized basis, correspondingly. Early lifecycle hedge funds are defined as vehicles within the first three years of their existence. Once the funds reach the three-year threshold, they are classified as established funds. The study conducted by Preqin and 50 South Capital covers the period between January 2012 and June 2019. The monthly returns in the first three years of a fund’s life are labelled as “early lifecycle managers” returns, whereas the monthly returns of funds older than three years are tagged as “established managers” returns.

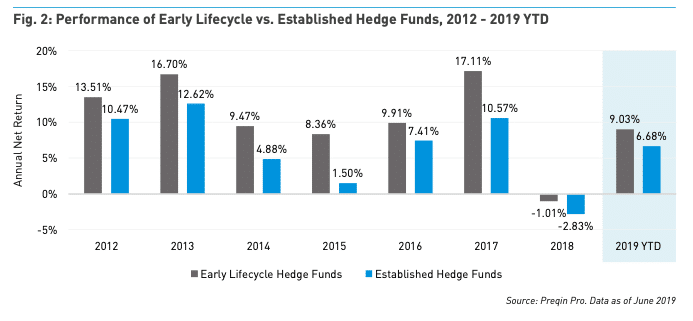

The study suggests that investors would have generated higher returns by investing in early lifecycle hedge funds. “Preqin data shows that, in 2019, only half of hedge fund investors would consider evaluating an early lifecycle hedge fund, and even fewer would actually invest,” says the report that accompanies the study. “When we evaluate the performance of managers in their early years, though, the argument for investing early is very compelling.” Hedge funds early in their lifecycle outperformed more established hedge fund by almost 4 percent on an annual basis over the period of the study. Besides, early lifecycle hedge funds outperformed more established funds in every year covered by the study.

The outperformance by early lifecycle hedge funds was achieved with just slightly higher volatility in returns, which means this group of funds outperformed more established funds on a risk-adjusted basis as well. The outperformance of early lifecycle funds persists across strategies, according to the study, with one minor exception. Established macro funds outperformed early lifecycle macro managers by 0.49 percent during the 12 months that ended June 2019. Over the entire study period of 2012 to mid-2019, however, early lifecycle macro funds outperformed established ones by 10.9 percent.

“When evaluating the annualized returns of early lifecycle managers since 2012, the three- and five-year returns are higher across each top-level strategy bucket than the overall average return for established managers,” writes the study. “This suggests that the opportunity for outperformance from early lifecycle managers may be more strongly correlated to the characteristics of a fund’s early life than to a particular strategy.”

The complete report can be downloaded below: