Stockholm (HedgeNordic) – 2019 had been a good year for Nordic CTAs until the end of the summer. After Nordic CTAs fell 2.9 percent on average in September, early estimates are showing that October could turn out to be slightly more painful for the group. Global CTA indices depict a similar development for the entire trend-following industry.

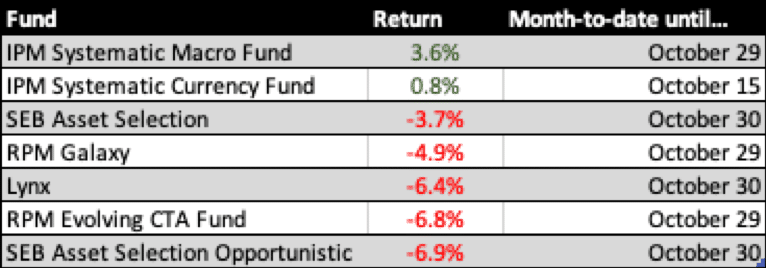

SEB Asset Selection, a systematic trend-follower that invests across four different asset classes, was down 3.7 percent month-to-date through October 30. The fund managed by the SEB Global Quant team led by Hans-Olov Bornemann was up 5.6 percent in the first three quarters of 2019. SEB Asset Selection Opportunistic, a more aggressive version of SEB Asset Selection, fell by 6.9 percent this month through the end of Wednesday of this week.

RPM Evolving CTA Fund, which invests in a select group of CTAs that are in their so-called evolving phase, was down 6.8 percent month-to-date through October 29. RPM Galaxy, RPM’s multi-CTA fund investing in a group of large and established CTA managers, fell by 4.9 percent over the same period. In the first three quarters of the year, RPM Evolving CTA Fund was up 10.6 percent while RPM Galaxy was down 2.1 percent.

Systematic trend-following fund Lynx (Sweden), the best-performing member of the NHX CTA in the first three quarters of 2019 with a gain of 23.2 percent, fell by 6.4 percent month-to-date through October 30. On October 1, Lynx Asset Management launched Lynx Constellation, a systematic fund designed to exhibit low correlation with both traditional markets such as equities and bonds and trend-following strategies.

IPM Systematic Macro Fund, a systematic and fundamentals-focused macro strategy not based on trends typical CTAs seek to exploit, had a strong October. The flagship strategy of Stockholm-based systematic asset manager, Informed Portfolio Management (IPM), gained an estimated 3.6 percent month-to-date through October 29.

Trend-following Alfa Axiom Fund, which is part of the 16-member NHX CTA, ceased to operate earlier this month.