Stockholm (HedgeNordic) – After a solid 2022 marked by strong momentum, 2023 presented significant challenges for many CTAs. The year saw trendiness plummet and remain below long-term average levels amid shifting market narratives. Swedish CTA specialist RPM Risk & Portfolio Management holds a cautious outlook for CTA performance in 2024, mindful of the historical difficulties CTAs face during periods around business cycle turning points. Despite this caution, there is optimism for an uptick in trendiness in the latter half of 2024, driven by accelerating economic growth and the upcoming US presidential election in November.

“2023 was a challenging year for many CTAs,” reiterates Mikael Stenbom, Founder and CEO of RPM. In March of last year, financial markets experienced a short-lived panic following the bankruptcy of the Silicon Valley Bank (SVB) and its repercussions, severely impacting the performance of the trend-following industry. March 13th was the worst day in the 23-year history of the SG CTA Index, with March 10th and 15th also proving to be particularly challenging.

“Disregarding that event, CTAs did quite well in a year where market directions switched in tune with ever-changing analyst- and media-driven narratives.”

“Disregarding that event, CTAs did quite well in a year where market directions switched in tune with ever-changing analyst- and media-driven narratives,” argues Stenbom. “The changing headlines of inflation, financial meltdown, recession, inflation again, soft landing and more, seemed to hinder any sustained price trends to develop until after the Fed statement in early November.” Although some CTAs performed exceptionally well in 2023, Stenbom considers that the general absence of positive performance from the CTA industry was not entirely surprising given the stellar performance in 2022. “A strong CTA year is often followed by a weaker one. The reasons for this may differ.”

Early Days of 2024

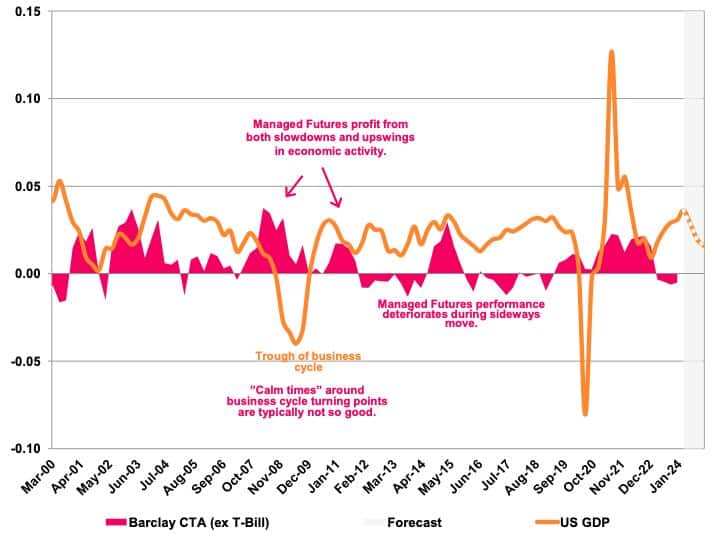

In the early days of 2024, Stenbom continues to observe a lack of consensus and conviction in most markets. “Uncertainty still prevails, trends are generally absent. This is nothing new and we expect it to stay this way for a while,” asserts the founder of RPM. In 2023, particularly in the United States, economic growth proved more resilient than anticipated in the face of rapidly rising interest rates. However, as the US business cycle shifted direction and accelerated instead of slowing down, CTA performance suffered accordingly. “Periods around business cycle turning points are typically less attractive from a return perspective,” notes the team at RPM.

Looking ahead, the global economy is expected to slow down again this year, although avoiding a recession. The base scenario of a soft landing coupled with unprecedented levels of uncertainty, especially related to election risks, does not inspire hope for a market environment with high levels of trendiness. “As the business cycle is expected to change direction once again, CTA performance in general will probably be affected negatively, at least in the first half of 2024,” says the team at RPM.

“As the business cycle is expected to change direction once again, CTA performance in general will probably be affected negatively, at least in the first half of 2024.”

Therefore, RPM is looking to keep a broadly diversified portfolio for its RPM Evolving CTA Fund, which invests in CTAs in the so-called “evolving phase.” In particular, the team plans to maintain a larger-than-average allocation to shorter-term trading strategies.“However, the sheer scale of uncertainty makes it more likely that a more-negative-than-expected scenario will unfold which should trigger trends and provide CTAs with profitable trading opportunities,” argues the team.

“It is, however, hard to imagine that the current backdrop of increasing global political tensions, climate change, energy transition, escalating de-globalization, wars in Ukraine and the Middle East, inflation still lurking, US presidential election, and more, will fail to impact markets for much longer,” concludes Stenbom.