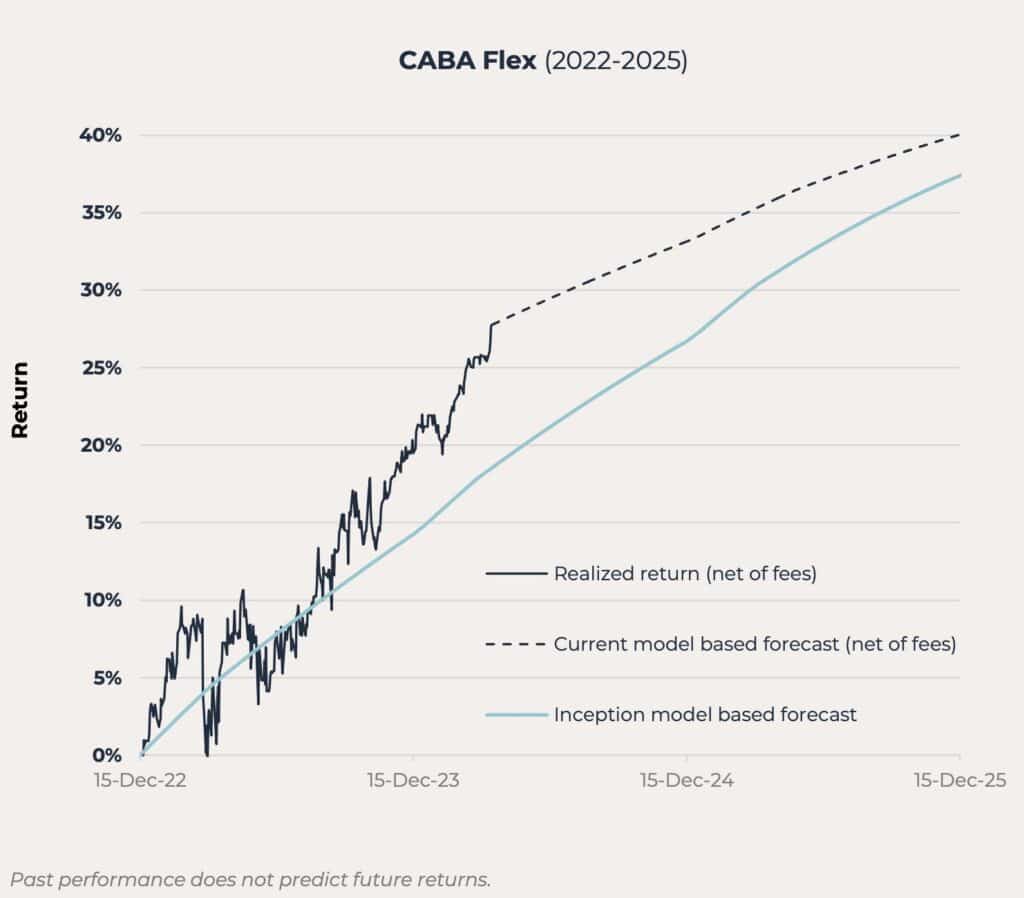

Stockholm (HedgeNordic) – In December 2022, Danish boutique CABA Capital launched a closed-end fund with a three-year lifespan to capture risk premiums in Scandinavian mortgage bonds. Halfway through its journey, CABA Flex has exceeded its predicted path by returning 28 percent to date, with 12 percentage points yet to be realized by the end of 2025. Despite the recent tightening of spreads between Danish mortgage bonds and government bonds, CABA Capital is optimistic about squeezing more returns out of Scandinavian bond markets.

This optimism prompted the launch of a second closed-end structured fund with a similar three-year term and an anticipated return target of 30-35 percent after fees. Like its predecessor, CABA Flex2 will employ extensive leverage to enhance the return potential from the yield spread between AAA-rated Scandinavian mortgage bonds and government bonds. To attract foreign investors, CABA Flex2 is domiciled in Luxembourg as a Reserved Alternative Investment Fund (RAIF), facilitated through collaboration with ISEC Services and Caseis.

“We have designed a closed-end vehicle that can generate attractive returns similar to expected equity returns with a bond-like risk profile by riding the spread curve.”

Mette Østerbye Vejen, CEO of CABA Capital

“We have designed a closed-end vehicle that can generate attractive returns similar to expected equity returns with a bond-like risk profile by riding the spread curve,” Mette Østerbye Vejen, the CEO of CABA Capital, explains the investment concept behind the fund. “As the risk in CABA Flex has declined from day one due to the bond-like risk profile, the halfway mark of its expected lifespan is a good time to offer investors the opportunity to reposition to the optimal spot on the spread curve and repeat the success from CABA Flex.”

When the yield curve slopes upward, bonds are valued with progressively lower yields and higher prices as they approach maturity. To leverage this characteristic and roll down the spread curve, CABA Flex2 will buy AAA-rated mortgage bonds with a five-year maturity and simultaneously sell maturity-matching government bonds. By magnifying the return from this spread through leverage, “most of the return is generated in the first half of the three-year period and gradually diminishes as the bonds approach maturity,” explains Østerbye.

At the halfway point of its three-year lifespan, CABA Flex has delivered a cumulative return of 28 percent, leaving 12 percentage points on the table before reaching its end-target of 40 percent at the end of December 2025. “CABA Flex has performed above the expected return path because spreads have been narrowing since inception”, explains Østerbye.

“However, spreads are still at a very attractive level, which prompts us to extend our strategy and let investors go out the spread curve once again and do another roll down,” she emphasizes. Set to debut in May this year, CABA Flex2 is expected to generate returns ranging from 30 percent to 35 percent after fees. “We believe this strategy remains compelling for investors, especially when compared to other asset classes,” notes Østerbye.

“…spreads are still at a very attractive level, which prompts us to extend our strategy and let investors go out the spread curve once again and do another roll down.”

Mette Østerbye Vejen, CEO of CABA Capital

Despite the underlying risk of spread widening, a risk magnified using extensive leverage, the purchase of AAA-rated mortgage bonds with a maturity of five years means “we have a stable anchor in the future, regardless of the fluctuations on the financial markets,” emphasizes Torben Frederiksen, Client Relations Director at CABA Capital. “We know that the underlying mortgage bonds will mature at par in five-years’ time, leading to a high level of certainty regarding the total return of CABA Flex2 over its three-year lifespan,” adds Frederiksen. “When the fund matures, the initial risk level is expected to have declined by 70 percent due to the combination of the bonds getting closer to maturity and the accrued return of 30-35 percent in the fund.”

“We know that the underlying mortgage bonds will mature at par in five-years’ time, leading to a high level of certainty regarding the total return of CABA Flex2 over its three-year lifespan.”

Torben Frederiksen, Client Relations Director at CABA Capital

Similar to the original fund, CABA Flex2 offers exposure to the Scandinavian mortgage bond market, which boasts a track record with no defaults in its over 200-year history. “The combination of default-free bonds and the fund’s three-year closed-end structure, creates a unique way of getting equity-like returns with a bond-like risk profile,” concludes Østerbye.

The Luxembourg-domiciled structure is strategically designed to attract investors beyond Denmark. “We deliberately opted for the RAIF structure in Luxembourg, because this is a structure that international investors know and are familiar with,” says Østerbye. “We believe that risk premiums in Scandinavian mortgage markets would also be of interest to professional and institutional investors outside Denmark.” CABA Flex2 will have several share classes, including DKK, SEK, and EUR, allowing investors to choose the currency of preference.