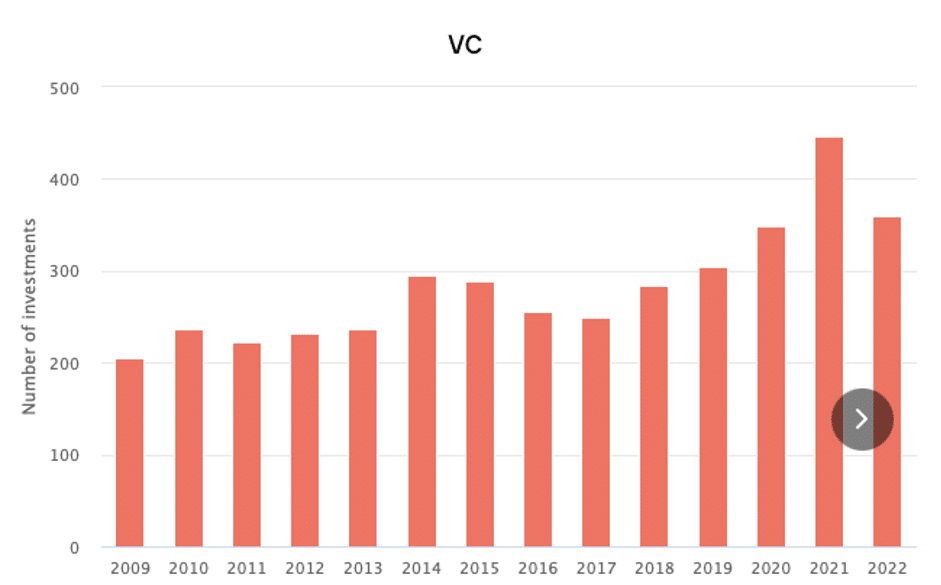

By Argentum: In 2022, 359 transactions were completed by venture funds in Nordic start-ups and growth companies. The amount invested in the segment remained high, with €2.2 billion in total. Compared to the average for 2017-2021, the invested amount was up 52 percent, but down 25 percent compared to 2021. The high activity level of 2021 continued in the first half of 2022, before slowing down in the second half of 2022.

“The Nordic venture and growth market has made impressive progress, with the number of deals exceeding 300 for the first time in 2019, and continuing to do so for four years in a row. Overall, we have seen an acceleration within the professionalisation of the venture sphere, driven by more venture firms and greater competition among them,” says Espen Langeland, CEO of Argentum.

The number of venture deals remained high in 2022, after a record-breaking number of deals in 2021. The high activity level from 2021 was maintained in the first half of 2022. However, activity was reduced in the second half of the year. The activity did not experience a hard stop in the wake of uncertainty, even though activity slowed down somewhat in the second half of 2022. The number of venture and growth deals surpassed 300 for the first time in 2019, and for the fourth straight year, the number of deals was well above 300. The number of deals fell from 447 in 2021 to 359 in 2022, but the activity remained high. Compared to the previous five years, the number of investments is up 10 percent.

“Although there was a decrease in investment activity in the latter half of 2022, the Nordic venture and growth market continues to attract significant investment. The record-breaking amount of capital raised in 2022 has put many funds in a strong position to make promising investments in the coming years,” says Espen Langeland, CEO of Argentum.

Seven of the ten largest deals involve tech companies

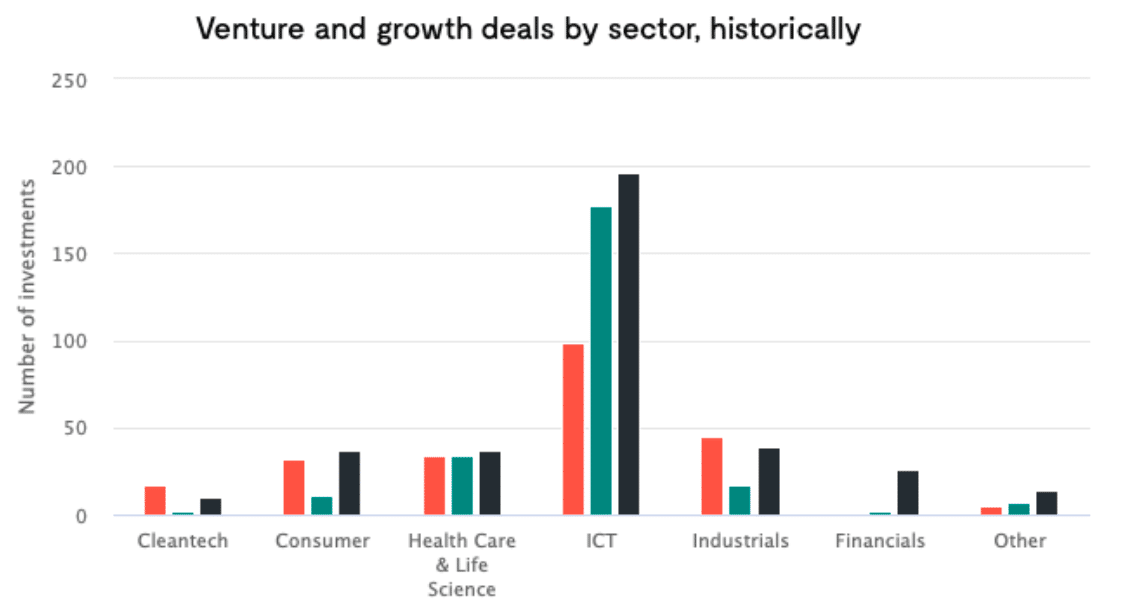

Seven of the ten most significant transactions during the year were in the ICT sector, two were within the consumer sector and one was within cleantech. Eight of the ten largest deals were completed in the first half of 2022.

The ICT sector is still attracting the most investments from venture and growth investors. The sector attracted 55 percent of investments in the segment, which is about the same share of investments as in the previous two years. The share has stabilised at around 50-55 percent, after the five-year period of 2014-2018 in which the sector attracted around 60 percent. Compared to the number of deals in the previous five years, investments increased by 4 percent, but decreased by 10 percent compared to 2021.

Growth in industrials

Industrials was the only major sector that experienced an increase in investments compared to 2021, with a record-breaking 39 deals. Industrials attracted 11 percent of venture and growth investments, compared to 8 percent in 2021. Compared to the average for the previous five years, this was an increase of 52 percent, and an increase of 11 percent compared to 2021.

Closely behind we find health care and life science and the consumer sector, each with 10 percent of investments. Both sectors attracted fewer investments than in 2021. Health care and life science investments fell by 23 percent compared to the average for the previous five years, and fell by 47 percent compared to 2021. Although investments in the consumer sector fell by 20 percent compared to 2021, investments in the sector are high compared to historical levels. Compared to the period 2017-2021, the average number of investments in the sector is up by 25 percent.

Financials is another sector that attracted a significant number of investments, attracting 7 percent of investments. This is a reduction of 42 percent from 2021, but the sector is still an important one for venture and growth deals.

Uncertainty spread in the second half of the year

Many of the GPs we have talked to referred to greater uncertainty in the market last year. Ingrid Teigland Akay, Founding Partner of Hadean Ventures, describes this as a turbulent year:

“It was a very turbulent year. A lot happened that created uncertainty in the market. We saw many of our peers slow down and become more cautious. When it came to investments, people sat on the fence to assess the situation. We were also a little cautious. Our investments last year were made at the beginning of the year, and were a result of long and thorough processes. We had a very strong deal-flow and worked on a number of processes throughout the year, but we saw that, in particular, syndication with other investors took longer than before,” says Teigland Akay.

The Norwegian market experiences growth

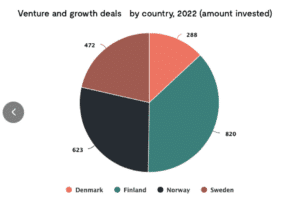

All Nordic countries experienced a decrease in the number of venture and growth deals except for the Norwegian market, which experienced a significant increase in the number of investments:

- Norwegian companies attracted 28 percent of the deals in the region, compared to an average of 17 percent in the previous five years. The number of transactions was 12 percent higher in 2022 than in the record year of 2021, and 82 percent higher than the average for the period 2017-2021.

- Swedish companies still attracted the most investments, with 125 investments in 2022. Sweden accounted for 35 percent of the market, with a decrease of 25 percent compared to 2021, but an increase of 2 percent compared to the previous five years.

- In Denmark, the number of investments fell by 46 percent in 2022, from an extraordinarily high level in 2021. Compared to the average for the previous five years, the reduction was 9 percent. Danish companies attracted only 16 percent of the venture transactions, which is lower than usual.

- Activity in Finnish VC experienced a moderate decrease of 10 percent in 2022 compared to 2021, and a 6 percent decrease compared to the average for the previous five years. The Finnish market did not experience particularly high activity in 2021, and the activity had remained quite stable for the previous five years.

If we look at the share of the invested amount, the distribution across the Nordic countries differs from the number of deals. Finland attracted the largest amount of investments, but Finland had the second lowest number of investments among the four Nordic countries. In other words, the average investment in Finnish companies was a lot larger than in the other countries. Norway is second in terms of the amount invested with 29 percent, which compares to the 28 percent when we look at Norway’s share in terms of number of investments. Sweden attracted the highest number of investments but only 21 percent of the amount invested (see graph above). Denmark only attracted 14 percent of the amount invested.

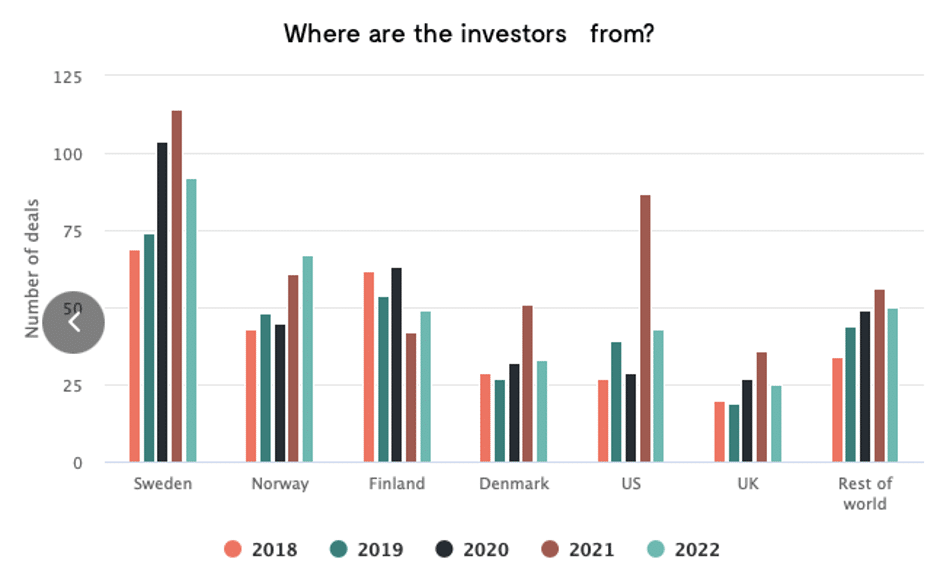

Fewer non-Nordic GPs, but more deals by Norwegian GPs

Investments from Nordic GPs remained relatively stable, falling from 268 to 243 deals. Compared to 2021, the share of non-Nordic15 GPs fell considerably, from 40 percent in 2021 to 32 percent in 2022. However, the share of non-Nordic managers remained at levels seen in the years before 2021, and was high compared to historical levels. The number of US and UK investors fell considerably from 2021. Investments from US GPs fell by 51 percent from 2021, and by 31 percent for UK GPs. Investments from GPs from the rest of the world experienced a more moderate decline of 11 percent.

Swedish fund managers were, as usual, the most active in 2022, making up 26 percent of venture investments. The number of investments remained stable, decreasing from 114 in 2021 to 92 in 2022. Compared to the average for the previous five years, the number of investments from Swedish GPs was up 5 percent.

For the first time, the Norwegian GPs were the second most active in the Nordics. Norwegian fund managers accounted for 19 percent of Nordic venture deals. Investments from Norwegian GPs increased by 10 percent from 2021 and, compared to the average for the previous five years, the number of investments was up by 38 percent.

Finnish fund managers also increased their investments in Nordic venture, up by 17 percent compared to 2021, but down by 9 percent when compared to the average for the previous five years. The number of investments from Danish GPs fell by 35 percent compared to 2021, but increased by 1 percent compared to the average for the previous five years.

The article is originally part of Argentum’s State of the Nordic Private Equity 2022. The report is based on data from Argentum, as well as publicly available data and media coverage.