By Jussi Tanninen and Matias Hauru – Mandatum Asset Management: Mandatum Asset Management (MAM) takes a diversified approach to its Private Debt programme. With over fifteen years of private debt experience, we believe that diversification is particularly critical as the asset class is so complex. Historically, our Private Debt programme allocation is split almost evenly between direct lending strategies and opportunistic strategies, with further diversification by sub-segments and geographies.

The different risk/return and cash flow profiles of direct lending and opportunistic strategies balance the programme in different market situations. For example, direct lending strategies, including large cap, sponsor-backed and non-sponsor transactions, provide a steady cash flow and return profile from coupons and arrangement fees. On the other hand, opportunistic strategies, including primary short-term loans and secondary loans from banks’ balance sheets, can take advantage of downturns and thus provide outsized returns.

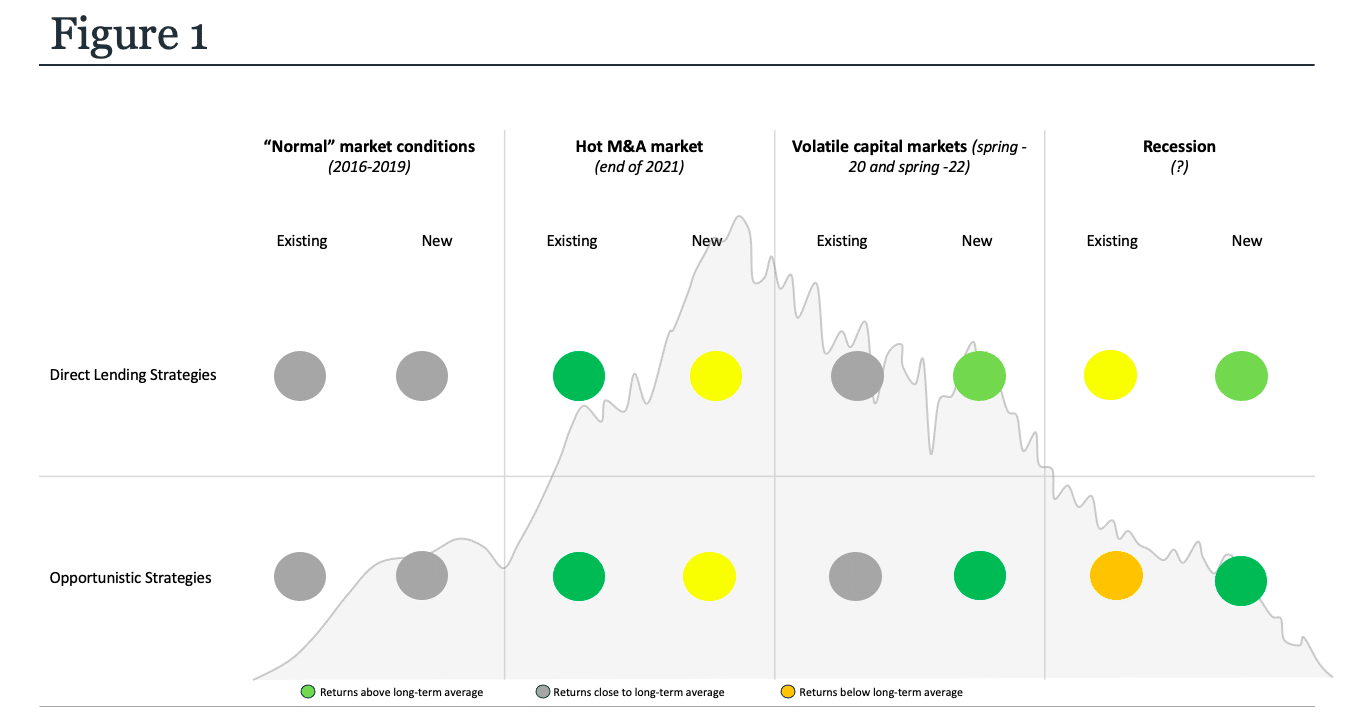

We advocate allocating to a programme with both direct lending and opportunistic strategies on a rolling basis. A systematic vintage allocation will ensure a diversified portfolio of existing investments along with a constant level of dry powder. While existing investments behave in different market conditions predominantly like investments in other asset classes, a programme with dry powder benefits from volatility. For example, deploying capital in an active M&A market may not result in as strong performance given increased competition; however, committing capital in a volatile, but not recessionary, environment can lead to attractive investments for the programme. As a result, we believe it is necessary to understand how both existing and new investments perform across strategies and markets.

Existing Investments Behave Predominantly Like Other Asset Classes in Different Market Conditions

Normal Market Conditions

In normal market conditions, as in 2016-2019, both direct lending and opportunistic strategies perform in line with expectations.

- Direct lending strategies – Strategies generate stable and predictable returns with low default rates

- Opportunistic strategies – Similarly, returns for opportunistic strategies are in-line with long-term averages, but return generation is dependent on the underlying company rather than the market

Hot Market

In a hot market, similar to the end of 2021, the M&A market was very active and asset valuations were high. Existing investments generally demonstrate strong outperformance, but due to different underlying reasons.

- Direct lending strategies – In particular, IRR increases in large cap and sponsor-backed transactions due to pre-payment fees and shorter holding periods, while credit losses remain minimal. In non-sponsor direct lending, outperformance remains strong as well, however, not as significant as compared to large cap and sponsor-backed given their higher correlation to the M&A markets

- Opportunistic strategies – Returns in primary transactions tend to increase due to equity upside, for example, and secondaries have a similar uptick due to increased company profitability and the potential for early exits given market dynamics

Volatility

The springs of 2020 and 2022 were characterized by volatile capital markets and lower M&A activity as the markets reacted to COVID-19 and the war in Ukraine, respectively. Existing investments perform in line with averages despite the market volatility.

- Direct lending strategies – Returns may decrease during volatility, as compared to a “hot” market environment, but are still generally in line with long-term averages. IRRs tend to decrease marginally as holding periods increase, and credit losses remain small. Quarterly valuations tend to be affected by capital market movements

- Opportunistic strategies – Credit losses remain small, although the value of equity upside components and early exits are decreasing. The profitability of companies remains strong

Recession

Heading into a potential recession or period of increasing credit risk, existing investments will struggle as expected given the market conditions.

- Direct lending strategies – During a recession, we see that the number of defaults is increasing, particularly in smaller and non-sponsored deals, but recovery rates continue to be higher due to better loan documentation and lower entry leverage. The asset class remains relatively strong (compared to other asset classes) due to the defensive nature of investments, but portfolio construction and selecting strong managers remains crucial to navigating challenging market conditions

- Opportunistic strategies – Similarly, credit losses increase although opportunistic early investments with strong profits provide buffer for potential credit losses. Opportunistic secondaries are most significantly affected as investments are typically made in challenged businesses as a starting point

New Investments Can Benefit From Market Volatility

Normal Market Conditions

In normal market conditions, as in 2016-2019, both direct lending and opportunistic strategies perform in line with expectations.

- Direct lending strategies – Strategies generate stable and predictable returns with low default rates

- Opportunistic strategies – Similarly, returns for opportunistic strategies are in-line with long-term averages, but return generation is dependent on the underlying company rather than the market

Hot Market

In a hot market, similar to e.g. the end of 2021, the M&A market was very active and asset valuations were high. New investments are made in line with or below averages given increased competition in the capital markets.

- Direct lending strategies – Deploying capital into large-cap direct lending can lead to muted returns given significant competition and weaker documentation. Sponsor-backed, or mid-cap, transactions may perform slightly better as direct lending funds are more competitive against banks

- Opportunistic strategies – Return expectations for new investments are unchanged but the types of deals are different; generally, there are limited secondary opportunities from liquid markets with the possibility for deal flow from bank balance sheets

Volatility

The springs of 2020 and 2022 were characterized by volatile capital markets and lower M&A activity when the markets reacted to COVID-19 and the war in Ukraine, respectively. Significant opportunities can be found when making new investments in opportunistic strategies.

- Direct lending strategies – Strategies closer to the capital markets, like large cap direct lending, benefit from market volatility, but deployment becomes slower in sponsor-backed and non-sponsor direct lending due to less activity in the M&A market

- Opportunistic strategies – Significant opportunities across primaries to fix problems but also offer capital for offensive plays. Forced sellers and liquid credit markets also provide significant opportunities

Recession

Heading into a potential recession or period of increasing credit risk, the access to dry powder has the potential to lead to significant outperformance.

- Direct lending strategies – Banks decrease their supply of debt financing, leading to more opportunity for strong direct lending funds to invest in large-cap and sponsor-backed direct lending. The best opportunities in a challenging environment come from smaller and non-sponsored businesses where debt financing is even more difficult to get from traditional sources

- Opportunistic strategies – Significant and attractive opportunities across both primaries and secondaries, including senior secured debtor-in-possession financing and debt-for-equity

CONCLUSION

Private debt offers attractive opportunities across markets as existing and new investments, along with underlying private debt strategies, perform differently depending on market conditions. A systematic commitment to a diversified programme allows an investor to essentially put their private debt allocation on “autopilot”. Commitments can thus be allocated to and pivoted between direct lending and opportunistic strategies based on market conditions, without further action from the investor, to create a balanced programme that provides attractive risk-adjusted returns across market cycles.

This approach to private debt investing was critical during the pandemic in the spring of 2020. With many forced sellers and limited M&A activity for our direct lending funds, we deployed our clients’ commitments into opportunistic strategies. You can read more about it here. As a result, our programme was meaningfully invested during a period of volatility, generating strong returns, steady cash flows and predictable capital calls.

Disclaimer

This document is being provided to you for marketing and informational purposes only and does not constitute investment advice or a solicitation to invest or to participate in any trading or investment strategy. Any investors should make their own assessment as to the suitability of investing in any of the discussed strategies and, if necessary, consult their own legal and tax advisors. The presented information is based on the information available at the time the article was created as well as on the views and estimates of Mandatum Group at that time.