By Graham Robertson, DPhil – Man AHL: Trend-following indices, such as the SG Trend and BTOP50, have posted their best year-to-end-August returns since 2000, against a backdrop of poor performance from traditional asset classes such as equities and bonds. This should not come as a surprise, in our view. First, we are seeing the presence of strong trends in futures markets which are sensitive to macro-economic themes such as inflation. Second, trend-following has historically been observed to perform well during equity crises, and academic studies have also indicated an ability to perform well during fixed income crises too (see Bibliography for more details).

In this short article, we delve into some aspects of trend-following’s returns this year, specifically conventional futures and FX trend versus alternative markets trend, and question whether recent positive performance is just predicated on continued worries around inflation and weakness in traditional assets.

TREND-FOLLOWING: THE ALTERNATIVES STRATEGY DU JOUR

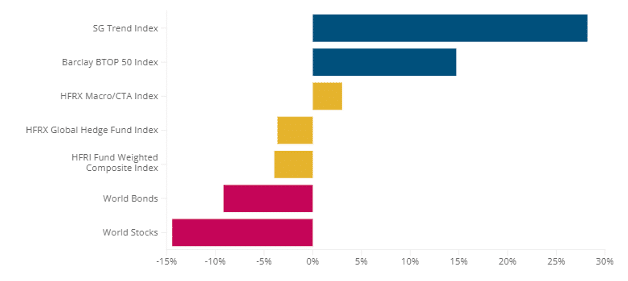

Trend-following strategies have had an outstanding 2022 so far, outperforming not only traditional asset classes like stocks and bonds, but also hedge funds in general (Figure 1).

Investments Source: Man Group, Bloomberg, MSCI, BarclayHedge, HFRI and HFRX. Date range, year-to 31 August 2022. World Bonds represented by Barclays Capital Global Aggregate Bond Index Hedged USD. World Stocks represented by MSCI World Net Total Return Index Hedged USD.

We have written extensively about trend-following’s persuasive credentials during inflationary periods (Neville et al, 2021) and equity crises (Harvey et al, 2019, Hamill et al, 2017). The difference in performance between the BTOP50 and SG Trend indices, consisting of 20 and 10 constituents respectively, suggests there is considerable dispersion between trend-following managers in 2022. This could be down to various factors – risk targets, market allocations, models and trading speed, etc – which are hard to quantify without detailed knowledge of how managers trade. At Man AHL, however, we are fortunate to be running multiple trend-following programmes, spanning the full spectrum of markets, models and risk budgets, so we are potentially in a good position to isolate the real drivers of performance.

TRADITIONAL TRUMPS NON-TRADITIONAL IN 2022

What we have found in 2022 is that simple is best: pure trend strategies trading the largest futures markets have been the star performers. Macro-economic themes are driving markets in our view; inflation, central bank activity, war, supply chain disruption, de-globalisation and post-pandemic recovery, to name but a few. They are all interlinked, of course, but these are macro trends which are best observed in macro-sensitive instruments such as futures on global markets, be they country-level equity indices, government bonds or the largest of the world’s commodities. What are now called ‘non-traditional’ or ‘alternative market’ trend-followers generally boast a wider range of price drivers and better diversification through trading a broad range of typically over-the-counter (‘OTC’) markets such as emerging market interest-rate swaps or European hydro-electric power markets.

When trends are concentrated in certain markets at a given point in time, it stands to reason that the more concentrated the trend-follower is in these markets, the better performance is likely to be at that time. And this is the case at the moment; traditional trend-following (futures markets) has broadly outperformed non-traditional trend-following (mostly OTC markets).

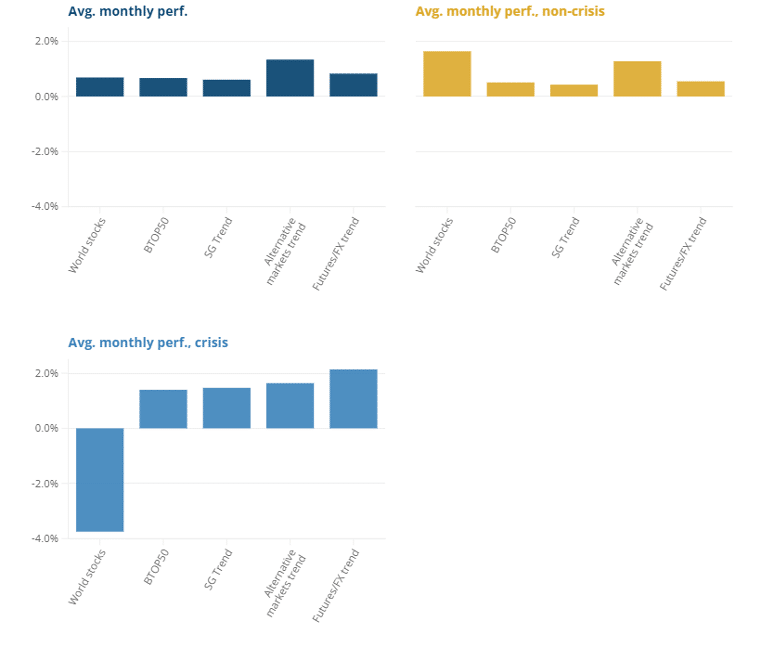

In the long term, we believe diversification is the key feature in designing robust trend-following strategies. Figure 2 shows how an alternative markets trend-following strategy – with its greater diversification – outperforms a simulated futures/FX trend one. This is particularly true in the non-crisis periods. However, it is not the case for crisis periods such as the Global Financial Crisis of 2008 and the coronacrisis of 2020.

Simulated past performance is not indicative of future results. Returns may increase or decrease as a result of currency fluctuations.

Source: Man Group, Bloomberg; between 1 September 2005 and 31 August 2022. Crisis period defined as Aug 98 to Sep 98, Sep 00 to Sep 02, Oct 07 to Feb 09, May 10 to Jun 10, May 11 to Sep 11, Oct 18 to Dec 18, Feb 20 to Mar 20, Jan 22 to Aug 22. Note: Data normalised to same volatility as world stocks (14%). World Stocks represented by MSCI World Net Total Return Index Hedged USD. Alternative trend results are from a hypothetical strategy whch trades predominantly OTC markets. Futures/FX trend results are based on hypotheical strategies trading predominantly futures/FX markets. The strategy performance data is simulated and is shown for information purposes only. The simulated data does not represent actual performance of the strategy or of a fund and it should not be used as a guide to the future. This approach has inherent limitations, including that results may not reflect the impact material economic and market factors might have had on the investment manager’s decision-making and/or the application of any trading models had the strategy been managed throughout the period over which the simulated performance is illustrated.

Can it be true that diversification is less effective in a crisis? ‘Crisis’ typically relates to developed markets, most often equities. News of a crisis in European hydro-electricity rarely makes the headlines or ripples through financial markets. In this case, we believe it stands to reason that global futures markets should be the instruments of choice for a trend-follower if an investor wishes a crisis hedge.

THE OUTLOOK FOR TREND

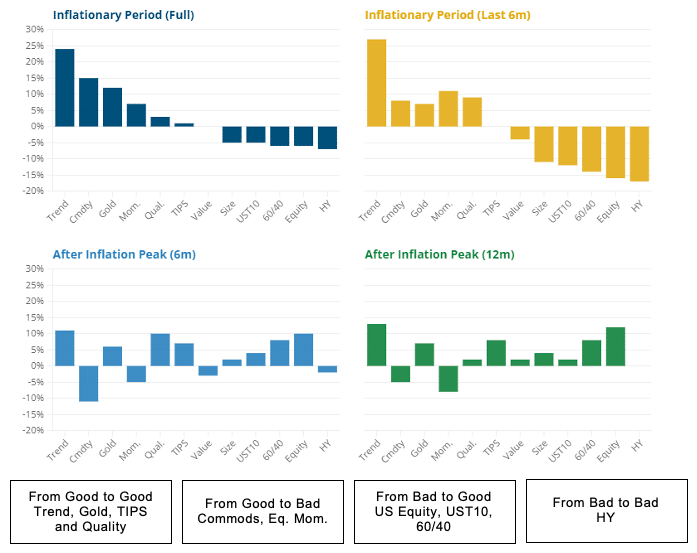

History is one thing, but to quote the first rule of Italian driving: “What’s-a behind me is not important.” What is ahead is what matters. Figure 3 reproduces a chart from Draaisma & Neville, 2022, showing that trend-following is not only a robust performer in inflationary periods in general, but also in the last six months of the episode, as well as in the 6- and 12-month timeframes following inflation’s peak.

Simulated past performance is not indicative of future results. Returns may increase or decrease as a result of currency fluctuations

Source: Equities are the S&P 500 using Professor Shiller’s data. UST10 is from GFD. 60/40 is the monthly rebalanced 60% equity, 40% bonds portfolio. Commodities are proxied by an equal weight portfolio of all futures contracts as they appear through history. From 1926 to 1946 this is based off work done by AQR. From 1946 we use returns from the Man AHL database. Styles are the Fama-French portfolios (Mom., Value (HML) and Size (SMB)), and AQR (QMJ) for Quality. TIPS prior to 1997 based off a backcast by William Marshall at Goldman Sachs, otherwise Bloomberg. HY portfolio constructed by the Man DNA team, using data provided by Morgan Stanley; as of 28 April 2022.

This is important: it tells us that by using a trend-following strategy, we do not need to be able to predict when an inflationary period may peak or end. Intuitively, this is because given sufficient time, trend-following strategies are likely to adopt the market direction, whether it be long commodities, short bonds and equities in inflationary periods or the other way around after inflationary peaks.

CONCLUDING COMMENTS

At its heart, trend-following is an intuitive strategy; it should do well when markets move a lot, as they so often do in inflationary environments. Further, if an investor wants to tune a trend-following strategy to a crisis, and that crisis is in macro-economies, we believe instruments that are sensitive to the macro-economy should be used.

Bibliography

Neville, H., T. Draaisma, B. Funnell, C. Harvey, and O. Van Hemert, “The Best Strategies For Inflationary Times”, March 2021. Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3813202

Harvey, C. R., E. Hoyle, S. Rattray, M. Sargaison, D. Taylor, and O. Van Hemert “The Best of Strategies for the Worst of Times: Can Portfolios Be Crisis Proofed?”. July 2019. Journal of Portfolio Management, Volume 45, number 5. Available at https://www.man.com/maninstitute/best-of-strategies-for-the-worst-of-times

Hamill, C., S. Rattray, and O. Van Hemert, “Trend Following: Equity and Bond Crisis Alpha” (August 30, 2016). Available at SSRN: https://ssrn.com/abstract=2831926

Draaisma, T., and H. Neville (2022); “Inflation can go down as well as up”; https://www.man.com/maninstitute/road-ahead-inflation-up-down

Important Information

This information is communicated and/or distributed by the relevant AHL or Man entity identified below (collectively the “Company”) subject to the following conditions and restriction in their respective jurisdictions.

Opinions expressed are those of the author and may not be shared by all personnel of Man Group plc (‘Man’). These opinions are subject to change without notice, are for information purposes only and do not constitute an offer or invitation to make an investment in any financial instrument or in any product to which the Company and/or its affiliates provides investment advisory or any other financial services. Any organisations, financial instrument or products described in this material are mentioned for reference purposes only which should not be considered a recommendation for their purchase or sale. Neither the Company nor the authors shall be liable to any person for any action taken on the basis of the information provided. Some statements contained in this material concerning goals, strategies, outlook or other non-historical matters may be forward-looking statements and are based on current indicators and expectations. These forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update or revise any forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those contained in the statements. The Company and/or its affiliates may or may not have a position in any financial instrument mentioned and may or may not be actively trading in any such securities. Unless stated otherwise all information is provided by the Company. Past performance is not indicative of future results.

Unless stated otherwise this information is communicated by AHL Partners LLP which is registered in England and Wales at Riverbank House, 2 Swan Lane, London, EC4R 3AD. Authorised and regulated in the UK by the Financial Conduct Authority.

European Economic Area: Unless indicated otherwise this material is communicated in the European Economic Area by Man Asset Management (Ireland) Limited (‘MAMIL’) which is registered in Ireland under company number 250493 and has its registered office at 70 Sir John Rogerson’s Quay, Grand Canal Dock, Dublin 2, Ireland. MAMIL is authorised and regulated by the Central Bank of Ireland under number C22513.

This material is proprietary information and may not be reproduced or otherwise disseminated in whole or in part without prior written consent. Any data services and information available from public sources used in the creation of this material are believed to be reliable. However accuracy is not warranted or guaranteed. © Man 2022