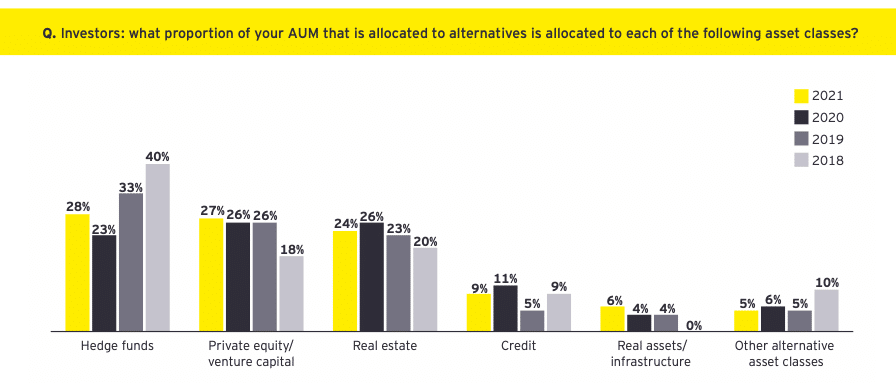

Stockholm (HedgeNordic) – Allocations to hedge funds reversed a multi-year downward trend, with allocations to hedge funds (28 percent) and private equity (27 percent) almost on par after the proportion of investors’ assets invested in private equity exceeded hedge fund allocations in 2020. According to Ernst & Young’s 2021 EY Global Alternative Fund Survey, allocations to hedge funds decreased from 40 percent in 2018 – which outpaced private equity by a two to one margin – to 33 percent in 2019 and 23 percent in 2020, but the allocation increased to 28 percent this year “reflecting improved perceptions of performance and their ability to take advantage of opportunities as they arise.”

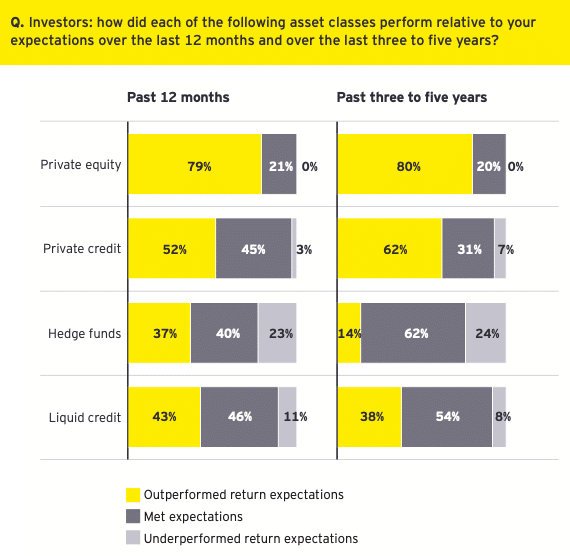

According to the survey, which involved 54 institutional investors representing about $1 trillion in assets under management, investors are increasingly satisfied with the performance of their hedge fund investments. The proportion of investors surveyed stating that hedge funds outperformed return expectations over the past 12 months reached 37 percent, compared to only 14 percent over the past three to five years. An additional 40 percent of respondents stated that hedge funds met their return expectations.

The EY survey also finds that hedge funds are increasingly making private company investments to enhance returns and attract investor demand. According to EY, “private investment opportunities have been significant contributors to performance during 2021 while also providing a diversified return profile against public market investing.” About 40 percent of the 105 surveyed hedge funds (representing over $1.2 trillion in assets under management) can and do make private equity and venture capital investments within their co-mingled hedge fund products. However, almost all managers interviewed reported limits on the proportion of assets that can be invested in private equity and venture capital investments, with almost half saying the upper limit was ten percent.

The Broader Alternatives Universe

The 2021 EY Global Alternative Fund Survey, which seeks to offer an overview of the perspectives from alternative fund managers and the institutional investors who allocate to these asset classes, shed light on topics that can transform the industry for years to come. Some of these topics include improved investor perception of alternative funds; the growing importance of ESG and diversity, equity and inclusion (DEI) considerations; and the industry’s view on product and strategy expansion into areas such as digital assets and an increased desire for exposure to private markets.

“Beyond reflecting on how alternative fund managers and their investors addressed the ongoing challenges posed by COVID-19, this research highlights the resilience of our industry and the key transformations that managers and investors are partnering to affect,” says Natalie Deak Jaros, EY Global Hedge Fund Co-leader and Americas Wealth & Asset Management Co-leader. “2021 was a year in which the industry invested to build significant momentum around various initiatives that will pay dividends for years to come.”

The 2021 EY Global Alternative Fund Survey can be found here.

Photo by Elena Mozhvilo on Unsplash