By Oddbjørn Dybvad, CIO – REQ Capital: As an investor you entrust senior management in an organization with your capital. Finding exceptional management teams is perhaps the most important aspect of being an investor, but this is no easy task, being more of an art than a science. Warren Buffett put it this way: “It is almost impossible to overpay for the truly extraordinary CEO…but the species is rare.”

William N. Thorndike has written a brilliant book on the theme of extraordinary CEOs. When we combine the insights from the book with our own experience as investors we find some similarities among those CEOs who deliver extraordinary results.

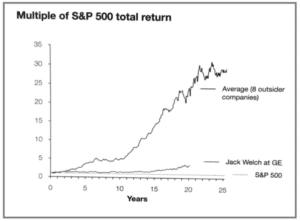

The 8 truly extraordinary CEOs featured in “The Outsiders” share many common traits. What is extraordinary about these CEOs is that they managed their respective companies for decades, not years, and generated total shareholder returns that really stand out from the crowd. The figure below compares the average stock performance of the companies managed by these individuals with the S&P 500 and that of “rockstar” CEO Jack Welch at GE over a 25 year period.

Over time, many of the stocks of the companies run by the “Outsiders” went on to be so-called “100-baggers” – stocks that multiply the original investment 100 times. Apart from Warren Buffett, one of the 8 CEOs featured in the book, these individuals are less well known to the public. We should study these highly successful CEOs, just as we study highly successful athletes. As an investor we like to learn about their commonalities and use those traits in our search for new outstanding investments.

What is the correct way to measure the success of a CEO? It is not size of the company or the number of employees, or the number of headlines in the business press. The role of the CEO is to manage people and capital, in a way that gets the most out of these two vital resources.

As shareholders, the most important criteria to judge a CEO is by the total return on the stock over very long horizons, and to compare these returns with those from the market as a whole and returns from a relevant peer group. Where the senior management team has been in place for many years, and has generated total shareholder returns far in excess of the market index and peers, you know the management team has done something right, and has maximized value per share. Looking for common traits among extraordinary CEOs is therefore not just interesting, but might also increase the chances of finding new extraordinary investments where the right kind of top management in place.

It is easy to be mesmerized by an outgoing and well-articulated CEO that always shows up at equity conferences and trade shows, and speaks with great conviction on strategy and market opportunities. Busy CEOs traveling constantly in their private jets while speaking to journalists and analysts seem to be the norm for most CEOs. Wall Street loves these CEOs.

The extraordinary “Outsiders” in the book by Thorndike could not be more different. They do not cater to Wall Street. They view Wall Street as a distraction. They give customers and employees top priority. If customers and employees are happy, shareholders will be happy also. These outstanding CEOs plan and execute for the long-term, and let their performance do the talking. Of course, they know that being a public company exposes them to a great deal of short-term noise, but they choose not to pay attention to it. They build dominant companies with enduring cultures.

Thorndike uses Jack Welch as an example of a charismatic and outgoing CEO who has long been looked upon as the perfect blueprint for a CEO. Welch was CEO at GE from 1981 to 2001 and generated 20.9% CAGR on the stock during his tenure. That is a very impressive return, even during one of the longest bull markets in history. But the truly extraordinary CEOs in Thorndike’s book generate even higher returns for longer time periods.

The extraordinary CEOs in “The Outsiders” differed from other CEOs in three different areas.

- They were masters at capital allocation

- They ran very decentralized organizations

- They were independent-minded and humble

Truly extraordinary CEOs do most things differently than their top-management peers which helps explain their performance.

Capital allocation

The truly extraordinary CEOs in the book chose capital allocation as their most important task. These CEOs were investors more than managers.

Every CEO has a toolkit when it comes to capital allocation. There are 3 sources of capital and 5 ways a CEO can use capital as illustrated below. The extraordinary Outsider CEOs were masters at using the right capital source at the right time and investing the capital where it generated the best returns for shareholders.

Most senior people in an organization are promoted to the CEO role through strong performance leading functions such as production, marketing, etc, over many years with an organization. Many managers are promoted to the CEO role because they are effective at corporate politics. On your first day as CEO you have sole responsibility for allocating the firm’s capital. That is a skillset, one that very few individuals have experience of prior to becoming a CEO.

Most of the CEOs in the book by Thorndike made huge share buybacks during their time as CEO. Sometimes the best investment opportunity is your own stock. These were not ordinary share buyback programs conducted by most companies. The Outsider CEOs undertook large tender offers when the share price was undervalued, and used equity as currency in acquisitions when the stock was richly valued. Many Outsiders bought back up to 90% of shares outstanding during their tenure as CEO. Most companies today announce share buyback programs for a certain amount and carry this through over several years. That is not how the Outsiders operated.

These CEOs very seldom paid dividends, even at times when dividends were “popular” among investors. Instead they focused on maximizing cash flow per share rather than earnings per share.

Many of these highly successful CEOs made many acquisitions of private companies during their tenure. Acquisitions were often sourced through direct contact with sellers. By avoiding auctions, they were able to secure assets at attractive prices. They showed patience and acted with occasional boldness.

Organization

All the Outsider CEOs ran extremely decentralized organizations. They were not afraid to push responsibility down in the organization. Staff-functions were reduced to a minimum and top management’s main focus was capital allocation. They were master delegators.

By pursuing a decentralized approach they were able to release entrepreneural energy in the organization. It is also a good way to keep costs down. They avoided “office politics” by paying for performance.

They often combined this decentralized approach with good incentive systems that focused on maximizing cash flow per share. A pushback many of these kind of organizations get is the fact that managers down in the organization who perform well are richly rewarded.

They all set up small headquarters and clearly understood that the head office does not have the answers required to solve customers’ problems. These CEOs hired the best people and left these people alone. They had a deep understanding for human behavior and motivation.

These extraordinary CEOs had no time for investor relations. They offered no guidance to Wall Street. They were owners of the business and acted as owners instead of agents. Henry Singelton owned 13% of the company. Warren Buffett holds about 30% of Berkshire Hathaway.

Personalities

These Outsider CEOs were devoted to their families and often left work to attend school events. They did not attend conferences. They set their own agenda. These were not the CEOs who, after retiring, wrote books on management advice. These are not the rockstars of the business world, but people who chose to operate in the background. They did not seek fame. All these CEOs were new to the industries and companies that they ran. Humility and independence were striking characteristics of these CEOs. They avoided bankers, consultants and advisors.

All 8 Outsider CEOs were new to the CEO role. That is perhaps one of the reasons why they succeeded. They looked at the companies and industries in which they operated with fresh eyes. They were highly rational and used new perspectives that resulted in great performance.

These CEOs were generalists. Most CEOs are not able to resist the “teenage pressure” to look like everyone else. “The Outsiders” did not care about conventional wisdom. They were committed to rationality and avoiding the peer pressure of the corporate world.

The bottom line

There is a lot to learn from extraordinary CEOs who perform well over many decades. As investors we can use these blueprints of success in our search for future exceptional investments. If we find investments with high integrity and top managers who first and foremost focus on capital allocation, that organize in a decentralized way and share many of the personality traits above, we may have found something very special. These potential investments can provide us with returns far in excess of the returns available from the market overall.

This article features in HedgeNordic’s In-Depth series on “Quality Investing.” The article was originally published here.