Stockholm (HedgeNordic) – The year-long reflation trade – the bet that smaller, cheaper, economically-sensitive stocks will rise and traditionally safer bonds, bond-like stocks and other rate-sensitive securities will suffer – “has left stocks looking extremely expensive compared to bonds,” according to a market commentary by Man Group. The reflation has also driven short sellers away from the market, with the level of shorting activity hitting the lowest level since 2006.

“Put simply, the year-long reflation trade we’ve experienced has left stocks looking extremely expensive compared to bonds.”

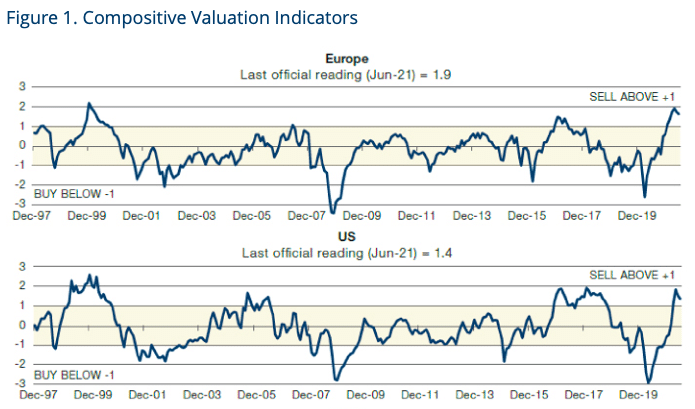

“Equities are expensive compared to bonds and vice versa,” says Man Group, based on their valuation indicator that tracks a combined Z-score of various metrics that compare bond and dividend yields to each other and to inflation. “Put simply, the year-long reflation trade we’ve experienced has left stocks looking extremely expensive compared to bonds,” write Teun Draaisma (pictured), Portfolio Manager at Man Solutions, and Dan Taylor, Man Numeric’s CIO. “This trend is not just confined to the US; Europe is the most expensive it has been since the dotcom bubble and Japan is fractionally under its highest reading in our dataset.”

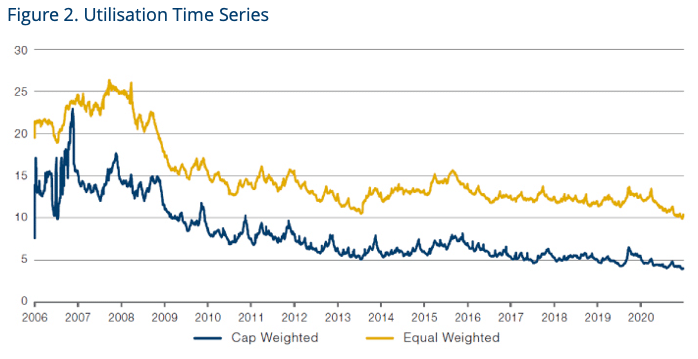

Shorting activity decreased over the course of the second quarter, “perhaps unsurprisingly given how expensive stocks have become,” according to Man Group. The London-based hedge fund group’s Utilisation factor, which describes the amount of shares borrowed for the use in short trades, fell from 4.8 percent to 4 percent, and 11.3 percent to 10.4 percent on a cap-weighted and equal-weighted basis, respectively, during the second quarter. “It seems fair to say that the reflation has driven shorts from the market; this represents the lowest level of shorting activity since the start of our dataset in 2006,” says Man Group.