Stockholm (HedgeNordic) – Every crash, crisis and recovery is different in terms of its origins, duration, path, and pattern. This means that some crisis offset strategies may work in certain crises but fail to protect capital – or even lose money – in others. Some of the simplest approaches are akin to a “one trick pony”, which may only deliver under a narrowly defined scenario. LGT’s Dynamic Protection strategy is more like an eight-armed Buddha: it contains eight strategies that are explicitly, or implicitly, long of volatility; it also dynamically varies its risk budget.

It comes under the umbrella of LGT’s Alpha Generix range, which includes systematic alternative risk premia/style premia strategies harvesting carry, value, momentum, trend, quality and size premia. LGT Dynamic Protection is also entirely systematic, but it is “the antithesis of risk premia”, says Pascal Spielmann (pictured right), Head of Alpha Generix Investment Team at LGT Capital Partners. “The objective is not tail risk protection per se, but rather to generate positive returns during an extended equity market drawdown, while producing flat or only slightly negative numbers during flat or rising equity markets”, he says.

“The objective is not tail risk protection per se, but rather to generate positive returns during an extended equity market drawdown, while producing flat or only slightly negative numbers during flat or rising equity markets.”

Volatility Instruments

The most obvious portfolio protection strategy – being directly long of equity market volatility – is one of the eight LGT Dynamic Protection strategies, but LGT’s execution of the idea differs from many other popular approaches in terms of the instruments used, and the trading strategy.

Spielmann argues that, “buying put options can work well for big gap or tail risk moves, but the time decay is expensive in terms of the cost of carry, and the payoff is also sensitive to timing entry points and monetization times”. Variance swaps are also widely used in volatility strategies, but he argues that, “we do not want to be at the mercy of OTC counterparties who may widen out bid/offer spreads when we want to exit the trade”. Counterparty failure was another risk in 2008, though this may now be mitigated through clearing. LGT prefer VIX futures, for their liquidity and low transaction costs.

Across various volatility instruments, a widely employed method of reducing time decay costs is to construct a calendar spread, owning long-term volatility and shorting near term volatility. “This approach is however sensitive to sizing the ratio between the two legs, and it does not always protect from crises when front month volatility jumps faster than more distant volatilities”, says Jean-Francois Bacmann (pictured left), Portfolio Manager and Co-Head of Research, who previously worked for Man Group.

LGT Dynamic Protection can trade different maturities of the VIX but only from the long side, and they dynamically resize exposure, not only for the VIX but also for the other asset classes.

Other Volatility Related Strategies

The debate over different volatility instruments and strategies is anyway of limited relevance to the LGT strategy, since the VIX only makes up a maximum of 12.5% of the risk budget. The three other “long volatility” strategies are tactical short equity indices, contrarian short-biased equity indices, and crisis-sensitive commodities, all based on multi-factor signals. There are also four other “safe haven” strategies that are implicitly long of volatility: Gold, Government Bonds, Money Markets and FX, also driven by a range of mainly fundamental signals.

This diversification can profit under different crisis scenarios. For instance, gold could gain from an inflationary shock and, despite very low yields, government bonds could provide further upside under a deflationary shock.

Gold and government bonds are longs, but the asset classes include a mix of long, short and long/ short exposures. For instance, the commodity hedge strategies can trade long or short positions in other precious metals such as palladium and platinum, base metals and energies, partly based on a correlation filter to screen out high equity market correlations.

Dynamic Risk Budgeting and Costs of Carry

The eight long volatility and safe haven strategies are equally weighted with daily rebalancing. “This provides an equal chance to perform and mitigates model risk”, says Bacmann.

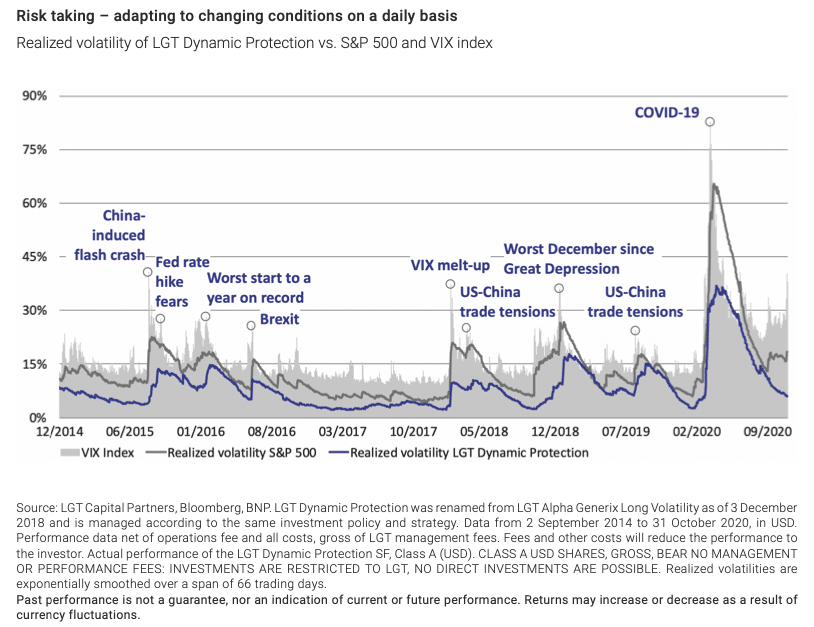

But overall risk exposure is not fixed; dynamically varying the risk budget is central to the strategy, and is designed to opportunistically capitalize on higher volatility periods while avoiding or minimizing costs of carry in calmer markets. Fund exposure is sized in proportion to S&P 500 volatility, and other signals such as volatility of volatility and the term structure. This has worked well: the fund’s own volatility has tracked that of the S&P 500 very closely, as shown below.

The beta of the strategy has also fluctuated. It has been close to -2 in the most negative periods of the S&P 500 index (losing 3% or more) and fluctuating around 0 in more benign periods.

Just as the overall exposure and risk budget is variable, so too is the overall cost of carry. “We cannot define in advance how high the costs would be in the way that we could for an option buying strategy. Costs of carry vary over time and between the strategies. For instance, the VIX futures have the highest cost of carry, but also the greatest convexity. US Treasury bonds still have small positive carry”, explains Bacmann.

Costs of carry can also be mitigated by the ninth strategy, a dynamic equity overlay, which is the “odd one out” for two reasons: goes tactically long of equities (up to a maximum of 30%) in order to reduce the fund’s carry costs, and it sizes positions inversely to S&P 500 index volatility.

Dimensions of Diversification

“The strategy is diversified from many angles: asset classes, term structures for some markets, trading time periods, and signal types: a blend of backward-looking, coincident and forward-looking indicators are used. Signal types also range from breakout, to concordant and digital types. The strategy has been designed to avoid over-optimising or over-fitting. We would rather be approximately right than precisely wrong”, says Bacmann.

“The strategy is diversified from many angles: asset classes, term structures for some markets, trading time periods, and signal types.”

Performance Under Different Market Regimes and Scenarios

The suite of strategies have, thus far, generated a high hit rate. The fund then had its best ever month in March 2020, making 19%, and in the generally low volatility bull market regime between launch in 2014 and early 2020, it maintained positive returns for several reasons. “There were some opportunities to monetise volatility spikes before scaling back exposures to reduce bleed during calmer markets, and the long holdings in government bonds and gold were also profitable”, says Spielmann.

During substantial equity market corrections since 2014, at least five of the eight strategies have been profitable and there have been episodes – such as the fourth quarter of 2018 – when all eight strategies benefitted from market turbulence.

Equally, there could be adverse market scenarios under which the strategy might not make much or any profit, such as a “bolt out of the blue” market correction. “An event such as the September 11th 2001 terrorist attacks, may be difficult for a systematic strategy to capture”, says Spielmann. The LGT strategy would probably have had relatively low exposure immediately before the attacks. Somewhat similarly, the VIX spike in February 2018 came without much warning, so returns from the strategy were rather subdued. An endogenous market event, such as the technology stock swoon on September 3rd 2020 can also be challenging because this originated from mega cap tech stocks rather than being foreshadowed by any uptick in overall market volatility.

“An event such as the September 11th 2001 terrorist attacks, may be difficult for a systematic strategy to capture.”

Therefore, the strategy is not a perfect hedge for every possible equity market correction, but given its daily rebalancing in response to various signals, it is likely to protect against most of those that become multi-day, multi-week or multi-month pullbacks.

It has also preserved capital during market conditions that could be very challenging for some short-biased or long volatility strategies. The summer of 2020 has seen a relatively unusual combination of a “melt up” in equities combined with high implied volatility, possibly related to large volumes of call option buying. This would have been an expensive time to either be short of equities or to own options. Over this period the LGT strategy has been roughly flat, making money in some months and losing in others.

The strategy has clearly performed far better than buying puts or a long VIX strategy. It has also outperformed other liquid volatility strategies: both the flagship AIF version of the strategy as well as the UCITS version of the strategy won two renowned industry awards, including the HFM European Quant Performance Awards 2020 and The Hedge Fund Journal’s “UCITS Hedge” award 2019 in the tail risk and volatility categories respectively.

The strategy looks more like a systematic macro approach engineered for negative equity correlation, than a traditional volatility strategy, but it has delivered better equity drawdown mitigation over the past 6 years than have many more typical approaches that are labelled as “tail risk” or “crisis risk” hedges.

This article featured in HedgeNordic’s report “True Diversifiers.”