By Michael R. Marcey and Marat Molyboga, Efficient Capital Management – Institutional investors looking to add non-correlating strategies that have historically done well when markets are in turmoil often choose to invest in commodity trading adviser strategies, particularly in what is known as trend followers, because of the historic diversification benefits.

But having decided to invest in CTA strategies, it is not unusual for investors to choose to allocate to only one or two managers. It is our observation that even experienced and savvy institutional investors frequently overlook the value of diversification when it comes to investing in managed futures. Some of the reasons for this approach include:

- Performance of the largest trend-following managers must be similar since they are highly correlated.

- It is not hard to predict which managers will perform well. The best-performing large CTAs will continue to outperform because they constantly invest in research to increase their edge in strategy development and execution.

- The cost of underdiversification is low. Diversification may seem to be a good idea, but it yields little tangible benefit in the case of traditional trend followers.

- While the above explanations are very intuitive, our research indicates that the empirical data demonstrates the value of diversification, even among trend followers.

High Correlation Does Not Imply Similar Performance

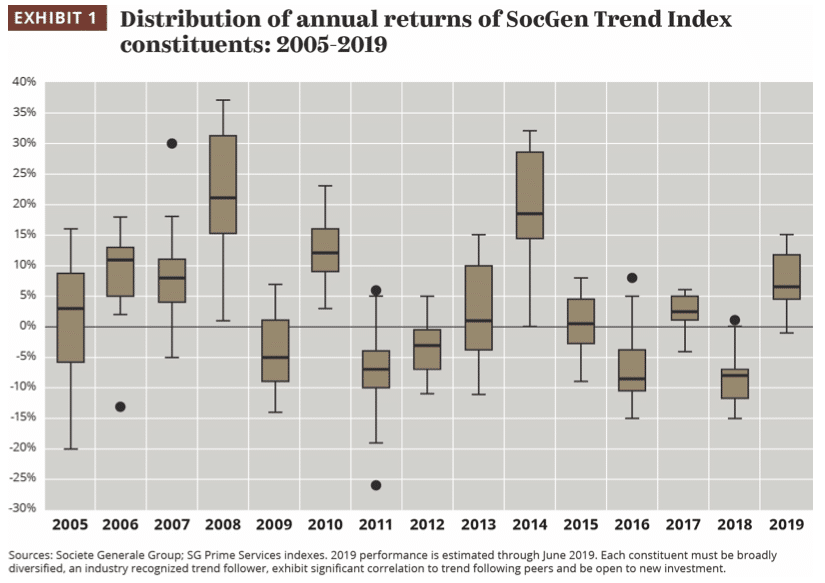

It is well known that long-term trend followers exhibit high correlation to each other. To examine the dispersion in annual returns among these managers, we considered Societe Generale’s SG Trend index constituents for the period 2005-2019. The SG Trend index is designed to track the largest trend-following CTAs and be representative of the trend followers in the managed futures space. The average correlation of these managers to each other is generally greater than 0.7. The distribution of these managers for the past 15 years is shown in Exhibit 1.

Note that these managers trade in similar ways, in similar markets, have a high correlation to each other, and are some of the largest, best known and most skilled CTAs that exist. One might assume that their returns in a given year would be very similar. In fact, as the box-and-whisker plots show, these managers have a high dispersion, with a 40% to 50% dispersion around the mean for a given year being normal. As an example, consider the year 2008, a year known for the “crisis alpha” benefits of CTAs. Although the mean return for these managers was about 20%, an investor that was “unlucky” in manager selection could have been flat for that year, a potentially disastrous outcome. In other words, the success of a “one-and-done” approach in a given year or two is highly dependent on luck rather than the skill of either the manager or the allocator.

It is Very Difficult to Predict Which Managers Will Perform Well

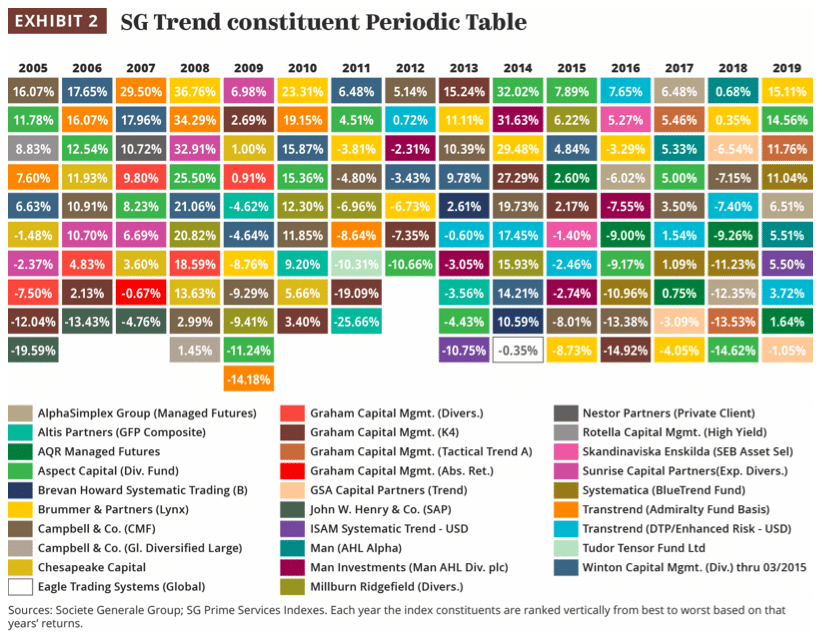

We have demonstrated that there is often large dispersion of returns in a given year among trend followers, and that it is difficult to identify which manager will outperform in a given year. But perhaps there are a handful of managers who consistently are excellent and whose performance persists from year to year. Exhibit 2 displays the SG Trend constituent rank and return for the years 2005-2018. As an example, Campbell & Co. (in dark brown) was the best performer in 2005 but the fifth in 2006; Aspect Capital (in green) was the best-performing manager in both 2014 and 2015. This “periodic chart” view makes it clear that performance does not normally persist from year to year and even large, well-performing managers can go through periods of underperformance. It is worth noting that low- performance persistence is not only limited to the largest trend followers.

High Cost of Underdiversification

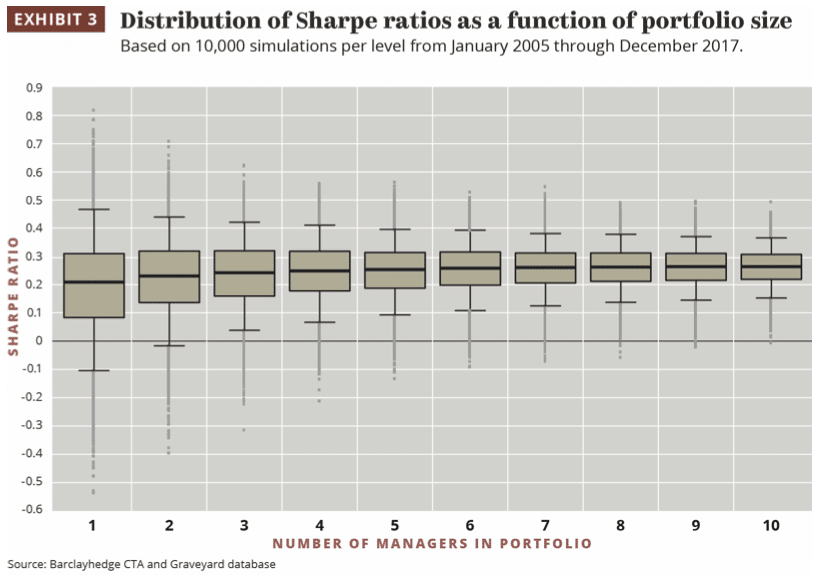

To estimate the cost of underdiversification, we measured the difference in performance of CTA portfolios that have between one and 10 managers. We rely on the simulation framework developed in collaboration with Christophe L’Ahelec from Ontario Teachers’ Pension Plan. The methodology is designed to evaluate portfolio decisions subject to the realistic constraints of institutional investors. Exhibit 3 shows the Sharpe distribution for portfolios from one to 10 managers.

In particular, note that as the number of managers increases to six from one, the Sharpe ratio increases by more than 30%, on average, and the distribution of the Sharpe ratios becomes tighter. In addition, the bottom 5% quantile changes from -0.1 for one manager to +0.1 for a six-manager portfolio, which can be seen as the chance of “getting unlucky.” Both areas of improvement are substantial. To quantify the real costs involved, for an investor that targets a portfolio volatility of 15%, the average Sharpe improvements translate into a return improvement of almost 1 percentage point per year and the cost of getting unlucky goes down by about 3 percentage points per year, which is particularly meaningful because CTA investments tend to perform well during periods of market turmoil. The cost of underdiversification is real. Diversification of CTA portfolios has tangible benefits of improving performance and reducing risk.

This article featured in HedgeNordic’s report “True Diversifiers.”