By Erin Stanton of Virtu Financial: Data does not qualify as information until it can inform. To use data effectively, you must first make sense of it.

As the abundance of data proliferates, so does the challenge of managing it. The initial excitement surrounding new found abilities to extract data from internal and external sources has worn thin, as the amount of time it takes to normalize this data increases. A common adage amongst data scientists is that you spend about 80 percent of your time cleaning data and only about 20 percent of your time extracting its value. This axiom is all too familiar within the Virtu Analytics team, who ingest data from dozens of disparate systems and strive to provide meaningful output in a usable format.

“As the abundance of data proliferates, so does the challenge of managing it. The initial excitement surrounding new found abilities to extract data from internal and external sources has worn thin, as the amount of time it takes to normalize this data increases.”

Given our experience, we understand how, when faced with the steady stream of information, in-house analysis teams continue to grow in size and why, in the worst cases, these internal databases become wastelands of good intentions and discontinued projects. In our view, data analysis skills must be augmented with the right tools. Technology can help reduce data-scrubbing time—which can result in more timely data-driven decision-making and more free time to focus on alpha-generating analysis. In response, Virtu’s new Open Technology data-as-a-service platform was designed to facilitate API access and data retrieval from our global models, to provide access to normalized multi-asset datasets and to help our clients analyze their enriched broker-neutral trade data.

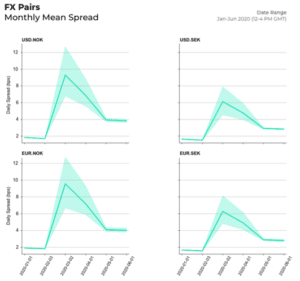

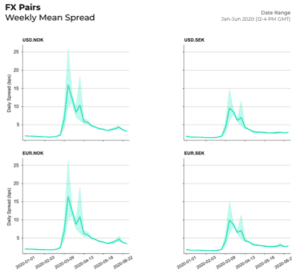

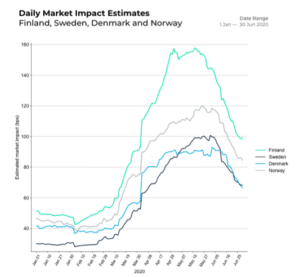

As software and basic programming literacy becomes more ubiquitous—and especially over the course of 2020—we have seen a spike in interest from clients, in non-programming type roles, eager to become fluent in programming and get up-to-speed on data analysis. Virtu’s Developer Toolkit makes it easy for programmers and non-programmers to get started. Sample code in several programming languages teaches you how to write scripts that can range from simple queries that access benchmark trade data to the analysis of historic transaction cost analysis (TCA) results. Because API data can be combined and analyzed with other data you acquire, the combinative possibilities are endless and make advanced interrogations of in-depth market data across equity, futures, fixed income and FX possible. As new data becomes available, Virtu will update the individual APIs.

Potential use cases:

- Sell side brokers Proprietary transaction cost systems, built by many sell-side brokers to service clients, are starting to age out. Calculating transaction costs correctly requires standardized market data and the ability to combine it with trade data. A reporting framework must be maintained to extract the results—forcing firms to decide whether to continue with client-customization requests or not. Increasingly, brokers are implementing solutions like Open Technology to save time and re-allocate internal resources towards improving trading strategies and serving clients.

- Replacement for legacy market data systems Several of our clients have maintained legacy market data systems to enrich in-house data. This requires skilled knowledge of market structure as well as how market data is generated. Open Technology takes care of the necessary but painstaking work such as condition code filtering, which enables user-driven parameters such as the currency a price is returned in and market-specific settings such as Thailand-foreign shares handling.

- Enhanced modeling Active management continues to become more competitive and clients are squeezing out alpha wherever possible. Virtu Analytics’ proprietary global and multi-asset models help provide more precise trading cost estimation that can be incorporated into the portfolio optimization processes. Dedicated market-on-open and market-on-close models help traders seek liquidity in a cost-efficient fashion while additional data-driven APIs supplement internal alpha generation models.

Virtu’s new Open Technology platform is the result of a multi-year infrastructure rebuild. Our TCA products are built by Virtu’s Workflow Technology and Trade Analytics & Data division which is relied upon by many buy side and sell side firms across the globe to help monitor, analyze and improve their quality of execution. Future APIs built on the Open Technology platform will enable access to data and services from other Virtu businesses including Workflow Technology and Execution Services.

This article featured in HedgeNordic’s report “Technology and Hedge Funds.”

Photo by Joshua Sortino on Unsplash