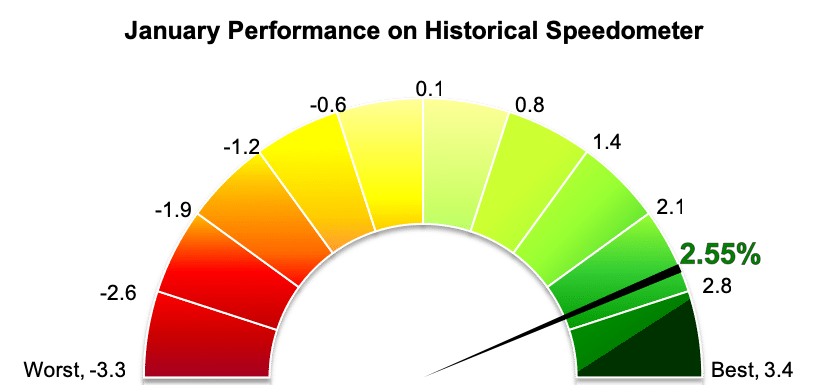

Stockholm (HedgeNordic) – Nordic equity hedge funds started 2019 on a high note after enjoying one of their best months in the past several years. The equity-focused members of the Nordic Hedge Index (NHX) gained 2.6 percent on average last month (90 percent reported), marking the second-best January on record for the group.

Despite the strong gains, Nordic equity hedge funds trailed both Nordic and international stock market indices last month. Nordic equities as measured by the VINX All-share index, for instance, delivered a net return of 5.7 percent in Euro terms in January. The index includes all firms listed on Nasdaq OMX Nordic Exchanges and Oslo Börs.

Global equity markets, as expressed by the FTSE World Index, were up 7.4 percent in Euro terms, recouping some of the heavy losses incurred in the final quarter of 2018. Eurozone equities enjoyed one of the best months in the past three years after gaining 6.3 percent last month, despite sluggish economic data, political and ongoing trade issues. North American equities, meanwhile, advanced 7.9 percent in Euro terms in January.

The entire universe of equity hedge funds performed strongly in the first month of 2019. The Eurekahedge Europe Long Short Equities Hedge Fund Index, composed of 176 index constituents, gained 2.7 percent in January. Eurekahedge Long Short Equities Hedge Fund Index, Eurekahedge’s broader index that includes 977 global long/short equity funds, was up 4.0 percent. The 118 funds from the Barclay Equity Long/Short Index that reported January return figures gained 2.8 percent on average last month.

Two in every three members of the NHX Equities posted gains for January, with long-biased equity vehicles enjoying the strongest returns. HCP Focus Fund, which maintains a concentrated portfolio of high-quality large- and mid-cap stocks, returned 16.5 percent in January after experiencing a challenging fourth quarter. The fund managed by Ernst Grönblom was up 1.7 percent in 2018 and earned a compound annual return of 19.2 percent since launching in December 2012 through the end of January.

Rhenman Healthcare Equity L/S and Accendo were up 14.3 percent and 14.0 percent last month, respectively. The healthcare-focused long/short vehicle was down 5.2 percent in 2018 after incurring sharp losses in the fourth quarter. In January, activist fund Accendo recovered some losses made during 2018, which amounted to 25.2 percent. Rhenman Global Opportunities L/S, which also experienced a difficult 2018, advanced 10.3 percent in January.

Picture © cigdem—shutterstock