Stockholm (HedgeNordic) – Nordic multi-strategy hedge funds fell 0.5 percent on average in June (89 percent reported), with the group lagging the other four categories of hedge funds within the Nordic Hedge Index (NHX). The NHX Multi-Strategy Index, the most diverse and inclusive NHX sub-category, gained 0.4 percent in the first half of 2018.

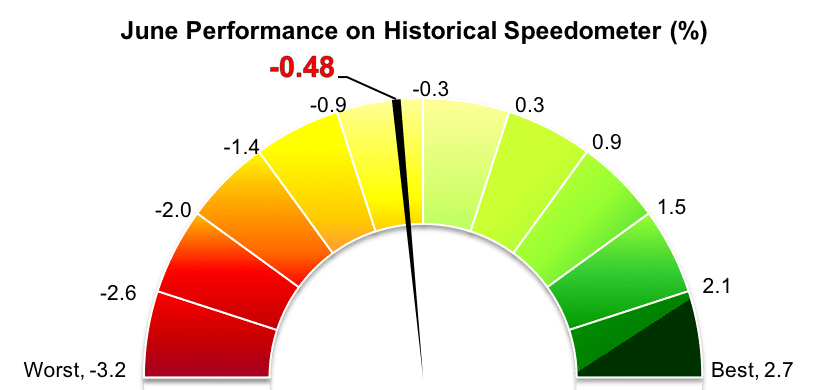

In line with the performance delivered by their Nordic peers, international multi-strategy hedge funds also struggled in June. The Eurekahedge Multi-Strategy Hedge Fund Index, which reflects the performance of a pool of 269 multi-strategy hedge funds, was down 0.3 percent last month (54 percent reported). The Eurekahedge index ended the first half of 2018 in negative territory at down 0.2 percent. The HFN Multi-Strategy Index, comprised of multi-strategy funds within eVestment’s database of hedge funds, fell 0.4 percent in June, taking the performance for the first six months of the year further into negative territory at 0.7 percent. The Barclay Multi Strategy Index, meanwhile, declined an estimated 0.5 percent in June, with the preliminary performance calculated with reported data from 59 funds. The Barclay index is down 0.4 percent year-to-date through the end of June.

Only four of the 36 members of the NHX Multi-Strategy Index produced positive returns in June. Despite being positioned for a stock market decline in a slightly rising market last month, market-neutral funds Atlant Stability Offensiv and Atlant Opportunity were June’s best performers among the multi-strategy hedge funds included in the NHX with monthly gains of 0.4 percent and 0.3 percent, respectively. Both funds are up 3.6 percent in the first half of 2018. Evli Factor Premia, which uses systematic market-neutral factor strategies within several asset classes, recovered some lost ground in June with a gain of 0.2 percent, after losses in January, February, and May. The fund is down 6.7 percent so far in 2018.

VISIO Allocator Fund, awarded the “Best Nordic Multi Strategy Hedge Fund” at our last Nordic Hedge Award, fell 2.1 percent in June, taking the performance for the year further into negative territory to -2.7 percent. Danske Invest Global Cross Asset Volatility, a freshly launched hedge fund that seeks exposure to volatility risk premia embedded in equities, fixed income, credit and currencies, booked a 1.8 percent loss in its first month of operations. Ambrosia L lost 1.7 percent in June, ending the first half of 2018 with a loss of 4.2 percent.

Picture: (c) shutterstock.com—archerix