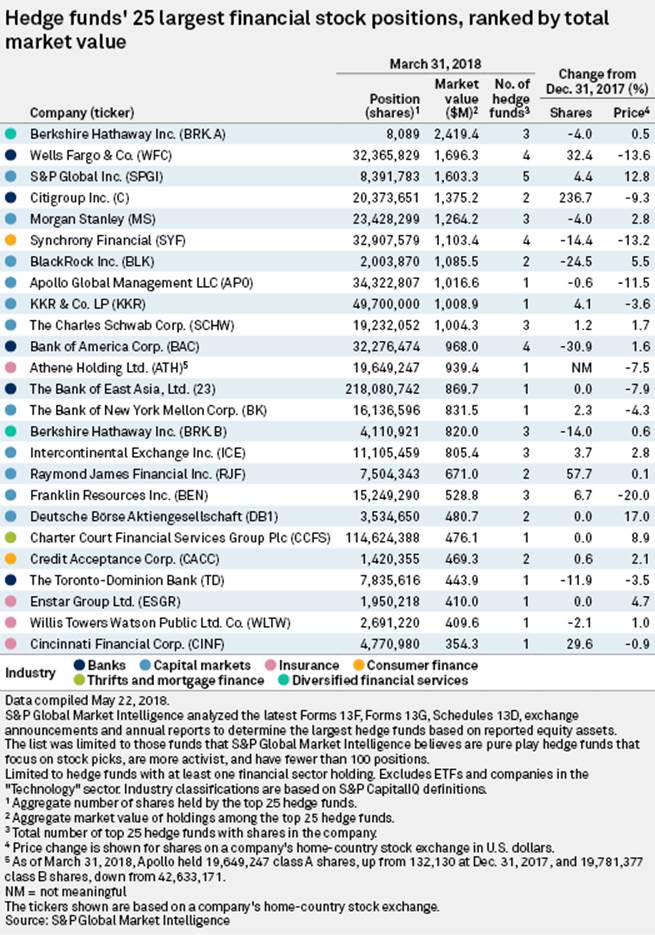

(S&P Global Market Intelligence) – The world’s largest hedge funds were bullish on Wells Fargo & Co. and Citigroup Inc. in the first quarter even as both banks’ stocks lost ground.

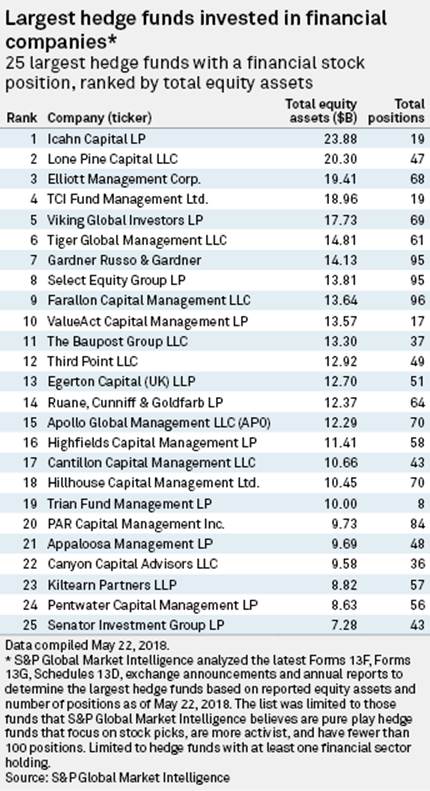

S&P Global Market Intelligence looked at the 25 biggest global hedge funds in terms of equity assets that had at least one position in a financial stock. The analysis showed that four of these big hedge funds held a position in Wells Fargo worth a combined $1.70 billion as of March 31.

During the first quarter, Viking Global Investors LP more than doubled its position in the bank to $672.6 million, while Appaloosa Management LP initiated a $154.0 million stake. At the same time, both Gardner Russo & Gardner LLC and Ruane Cunniff & Goldfarb LP trimmed their exposure to the bank during the quarter.

At U.S. megabank Citigroup Inc., two of the top 25 hedge funds held a position worth a combined $1.38 billion. ValueAct Capital Management LP significantly increased its investment in Citi to $1.09 billion as of March 31, up from $81.9 million at the end of 2017.

Kiltearn Partners LLP also added to its Citi stake during the first quarter, but the decline in the bank’s share price knocked the market value of the firm’s total position down to $281.7 million as of March 31, from $308.7 million a quarter earlier.

Among the top 25 hedge funds, Kiltearn Partners was the most concentrated in financial stocks, with 12 of its 57 holdings allocated to the industry.

Gardner Russo and Ruane Cunniff both reported investments in Berkshire A-shares and B-shares, while Hillhouse Capital Management Ltd. reported an A-share stake and Select Equity Group LP disclosed a B-share stake.

Berkshire Hathaway Inc. was easily the largest investment among the top 25 hedge funds, which held a collective $2.42 billion stake in Berkshire A-shares and an $820.0 million investment in Berkshire B-shares as of March 31.

Carl Icahn’s Icahn Capital LP completely sold out of insurer American International Group Inc. during the first quarter. At the end of 2017, the hedge fund’s stake was worth $2.56 billion, which was the largest investment among the top 25 hedge funds at year-end 2017.

Picture: (c)by Peter Kirchhoff — pixelio.de.jpg