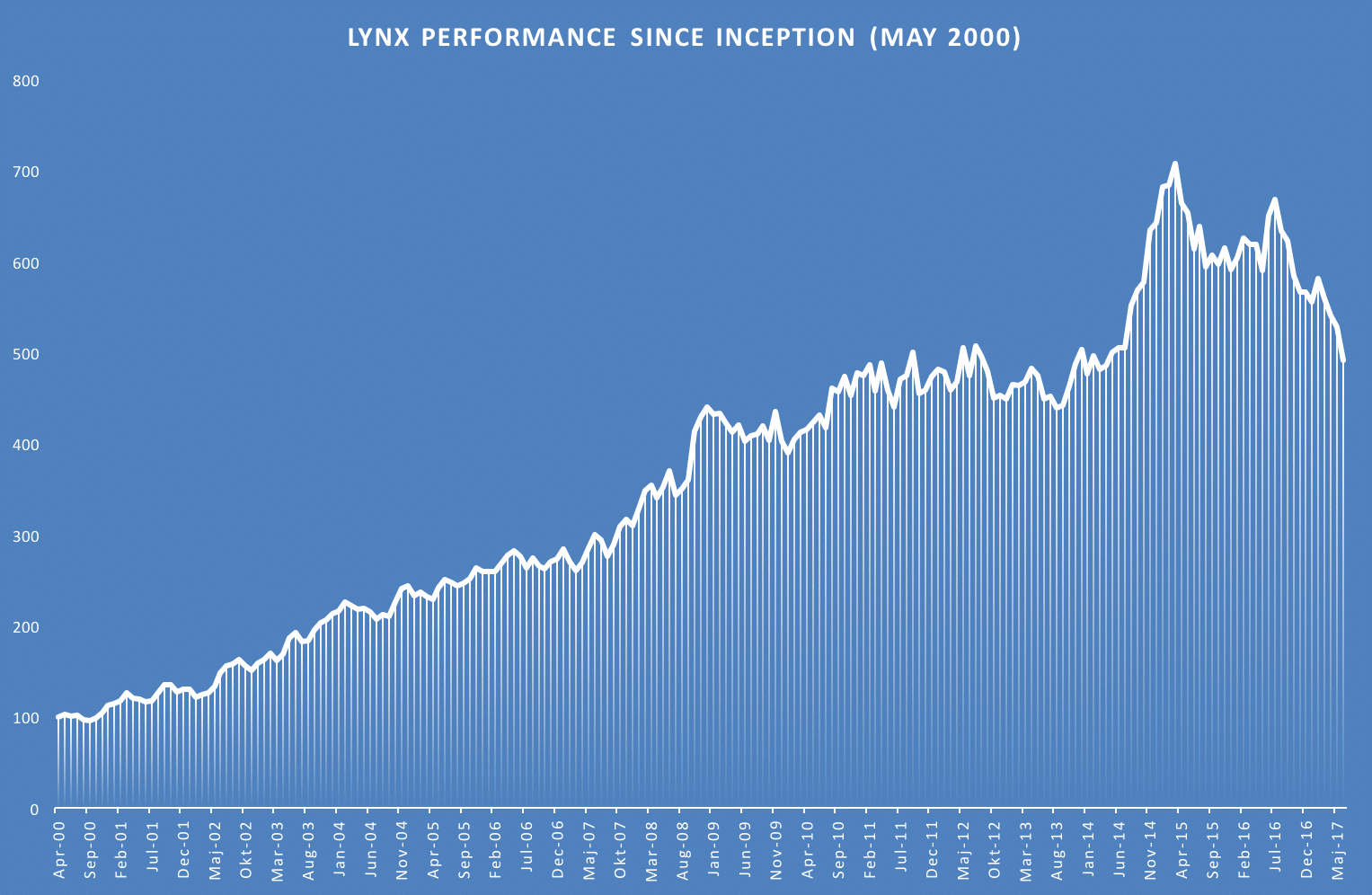

Stockholm (HedgeNordic) – Swedish CTA giant Lynx, headed by CEO and founding partner Svante Bergström (pictured), posted one of its worst monthly losses since inception in June (only 5 months have been worse according to HedgeNordic data) as the high profiled trend follower gave back 6.9%, bringing year-to-date performance to -13.2% for its flagship fund. This means that the fund is on track for its worst year since the fund launched in May 2000.

In comparison, HedgeNordic’s Index of Nordic CTA managers, NHX CTA, posted a net loss of 3.1% in June, ending the first half of 2017 down 5.9%. The SG CTA Index, a leading global benchmark for the CTA industry, lost 3.4% during the month and is down 3.5% for the year.

In a comment, Lynx writes that a large part of the losses occurred during the second half of the month as markets turned against the fund’s positions in equities (long), bonds (long), commodities (long) and the US dollar (long). Trend models suffered the most and were down 5.6% by the end of the month. Diversifying strategies also suffered, albeit to a lesser extent being down 1.4%.

The recent negative run for Lynx has erased the gains made by the manager in 2014 when the program had a very strong showing adding approximately 27%, leading the Lynx fund to peak in March 2015. Since then, performance has been depressed by a generally difficult trading environment for quantitative trend following strategies.

Source: HedgeNordic

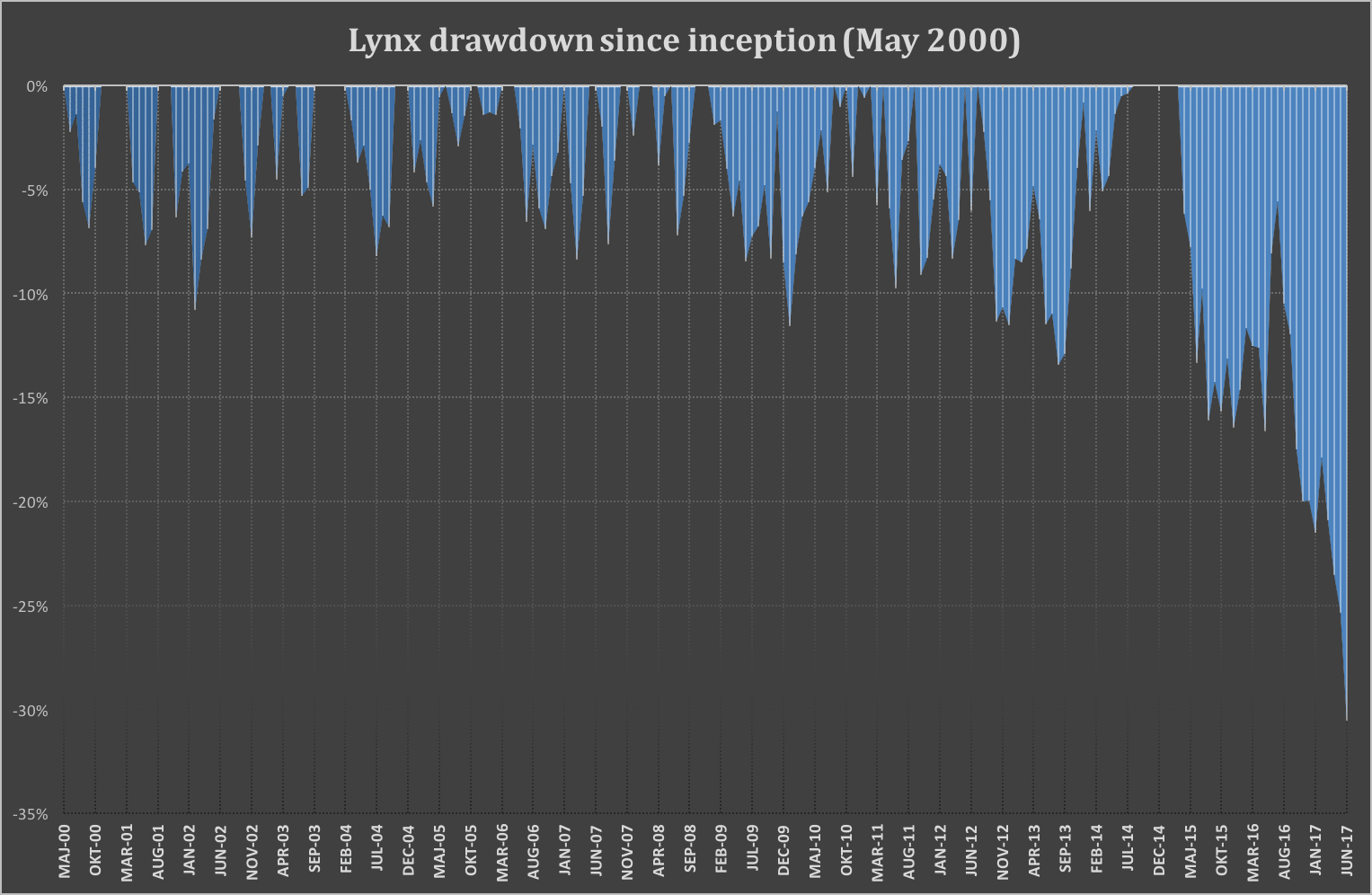

The recent weak performance has made Lynx enter into its worst period on record considering drawdown characteristics (see chart below). Since the peak in March 2015, the Lynx fund has lost approximately 30%. A mid-month estimate however suggests that the fund has recovered 0.67% so far in July (as of July 14).

Source: Calculation based on HedgeNordic data

Prior to the June performance setback, Lynx managed above 50 billion SEK in total client assets. This marks a significant increase in recent years as the quantitative asset manager managed 32 billion SEK by the end of 2013. Lynx’s assets under management stood at 45.2 billion SEK by the end of June 2017.