Stockholm (HedgeNordic.com) – September saw strong gains for Nordic hedge funds, especially those managers focusing on equity markets while Managed Futures managers took yet another beating to finish the quarterly and the YTD numbers in deep red. A more in depth review of the regions CTAs was published earlier and can be viewed here: Nordic CTAs Q3.

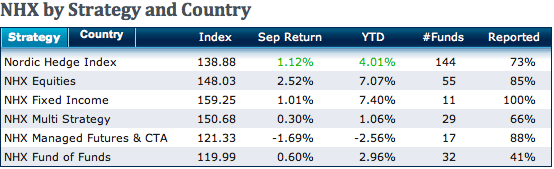

The Nordic Hedge Index Composite, NHX, gained 1,12% for the month (4,01% YTD). Strong equity markets lifted NHX equities to 148,03 index points, a gain of 2,52% for the month (7,07% YTD). The average Nordic fixed income hedge fund appreciated by 1,01%. NHX Fixed Income continues to be the strongest sub category for the year, up 7,4%. NHX Multi Strat gained 0,3% and Fund of Funds 0,6%, up 2,96% for the year. Late reportings mean NHX FoF is only supported by less than half oft he 32 funds in the category. CTAs still cant find the right environment to get their systems to produce positive returns and lost 1,7% in September, now clocking in a decline of over 2,5% for the year; thus the only strategy loosing money.

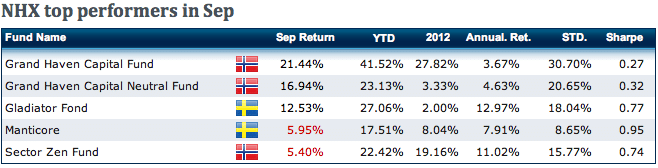

Best performing funds in September across all 144 managers in the HedgeNordic database were Grand Haven Capital Fund up 21,44% fort he month (41,52% YTD) followed by Grand Haven Capital Neutral Fund rising by 16,94% (23,13% YTD), Max Mittereggers Gladiator Fund 12,53% (27% YTD) and Sector Asset Managements Japan focused Zen Fund. Fort he first time this year, this puts three Norwegian funds in the top five.

Consequently, looking at NHX country sub indices NHX Norway is well ahead for the year, up 11,33% ahead of Sweden (3,68%). NHX DK is sticking to its patriotic red color and despite gaining 0,64% in September is still down 0,67% for year. NHX Finland falls behind and is down 2,91%. Just as Nokia had a dominat role in the HEX, weak performance by Estlander & Partners CTAs pulled the country index down to -2,91%, despite all other Finish hedge funds being positive both in September, as for the year.

With the books closed for the third quarter, the top performing funds year to date are all to be found among the equity strategies: Adding another 4,38% in September, Rhenman Healthcare Equity L/S is still in pole position, up 46,9% in 2013 followed by Grand Havens two funds catapulted up after Septembers performance, and Swedens Gladiator and Madrague Equity L/S fund, up 22,42%.

Bild: (c) shutterstock Ioannis Pantzi