(Annons) – Handelshögskolan i Stockholm Executive Education ger i höst för andra gången sitt spetsprogram för kapitalförvaltare, Advanced Investment Management. Programmet leds av professor Magnus Dahlquist och syftet med det är att gå igenom betydelsefulla teoretiska koncept och modeller inom området portföljförvaltning, undersöka hur väl dessa teorier och modeller stöds av empiriska studier samt diskutera de praktiska implikationerna. Några exempel på frågeställningar som diskuteras i programmet är:

• Hur ska den långsiktiga strategiska allokeringen göras på ett optimalt sätt?

• Vilken betydelse har likviditetsrisker för den strategiska allokeringen?

• Vilken roll ska alternativa tillgångsklasser ha i portföljvalet?

• Vilka alfa- och betastrategier tillför värde?

• Hur kan man hantera osäkerhet i prognoser?

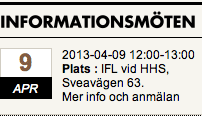

Denna advertorial är sponsrad av IFL Executive Education

Bild: (c) shutterstock-Sergej-Khakimullin