Stockholm (HedgeFonder.nu) – 2012 proved to be another disappointing year for Nordic CTAs as well as for the industry as a whole. The lackluster performance during the fourth quarter provides a good summary of what has been a difficult trading environment for a long time. October was particularly challenging as a combination of rising bond yields and falling equity markets made most CTAs suffer significant losses. During the month of December, markets turned more “trend-friendly” again, however, CTAs in the Nordic region had a hard time benefiting from these trends and underperformed industry benchmarks during the quarter. For the year, Nordic CTAs have outperformed benchmark indices.

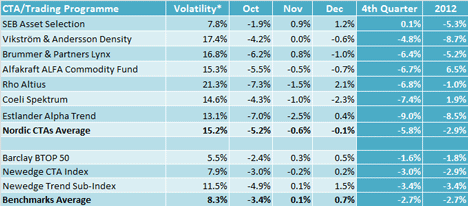

A performance overview of Trading Advisors running Managed Futures strategies in the Nordics (Figure 1) indicates how difficult the environment for these strategies has been during the quarter as well as for the past year. The average performance for the quarter was -5.8% where most of the losses were seen during the month of October. The quarter showed, once again, a great dispersion in managers’ returns. SEB Asset Selection was the best performing CTA managing to post a slight gain while Estlander’s Alpha Trend Programme recorded a net loss of -9%.

Figure 1. Overview of Nordic CTA performance during Q4 and for 2012 compared to benchmarks (not risk-adjusted)

* Volatility measured on a rolling 24-month lookback period

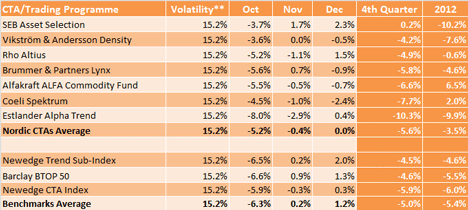

A risk adjusted comparison (Figure 2) reveals that Nordic CTAs underperformed benchmarks during the quarter (-5.6% vs. -5.0%).

Figure 2. Overview of Nordic CTA performance during Q4 and for 2012 compared to benchmarks (risk-adjusted)

** All Trading Programmes adjusted to the average volatility of Nordic CTAs

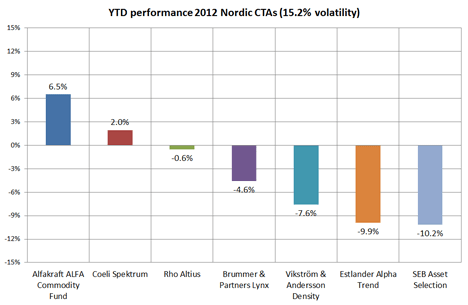

A risk adjusted ranking of year-to-date performance numbers shows that managers with large assets under management (AuM) have underperformed their smaller counterparts. The two largest trading programmes (Lynx and SEB Asset Selection) were clearly in negative territory by the end of the year. Up and coming managers like Alfakraft and Coeli Spektrum were however positive on the year. Rho were slightly negative but outperformed larger competitors on a risk adjusted basis.

Figure 3. Year-to-date performance 2012 – Nordic CTAs adjusted to 15.2% volatility

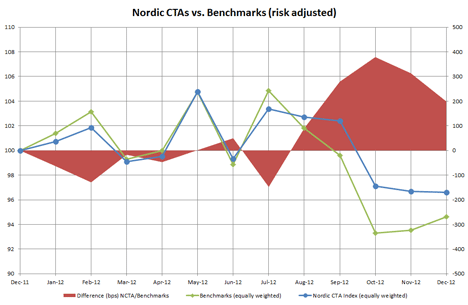

An equal weighted index of Nordic CTAs (NCTA) has, on a risk adjusted basis, had a compelling return to relevant benchmarks in 2012. Despite underperforming the industry during the last two months of the year, NCTA still managed to deliver above benchmark returns of approximately two percent on the year.

Figure 4. Nordic CTAs vs. Benchmarks (risk adjusted)

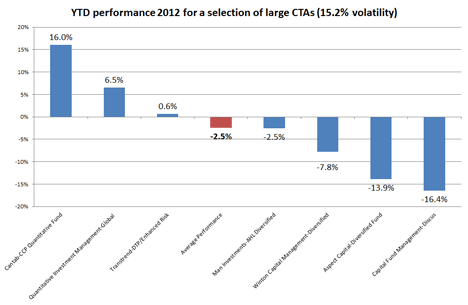

Looking at the performance of the world’s largest CTA programmes in 2012, one can once again conclude that the dispersion of returns was significant during the year. In the below graph, I have picked out a number of programmes that together account for a majority of the underlying industry AuM. I have also adjusted performance numbers to the average volatility of Nordic CTAs (15.2%).

Among trend following strategies, Winton and Aspect had a hard time coping with the directionless market environment. MAN AHL also suffered losses while Transtrend managed to end the year in positive territory. CTAs using shorter holding periods such as QIM and CFM showed very different return patterns. QIM had a positive year while CFM posted signficant losses. The big winner in the large-cap CTA space was Cantab who are using a multi-strategy approach blending trend following systems with fundamental and short-term algorithms.

Figure 5. Year-to-date returns for a selection of large CTAs (15.2% volatility)

Looking ahead, one can say that CTAs are at a “make it or brake it” point. It is time to prove that the strong returns of 2008 was not only a one-off event and that the strategy can continue delivering attractive returns even in extreme low-yield environments surrounded by a lot of uncertainty. Judging from the estimates I have seen for January, 2013 has started on a positive note, let us see if this results in positive first quarter to start with…

To view this article in in its Swedish original, please click here.

Picture: (c) shutterstock-Sebastian-Kaulitzki