By Anna Svahn, Antiloop Hedge: Two years have passed since I wrote this memo about the uranium sector. Since then, it’s safe to say a lot has happened to even further strengthen the bull case for uranium.

While the previous memo primarily emphasized the imperative shift from fossil fuels to sustainable energy sources, addressing the stigma and prevailing misconceptions regarding the safety of nuclear power plants. This memo will delve deeper into the compelling reasons supporting the rising price of uranium. Despite the recent uptick in uranium mining companies, the secular bull market for uranium has just begun.

The Complex Landscape of Global Uranium Supply

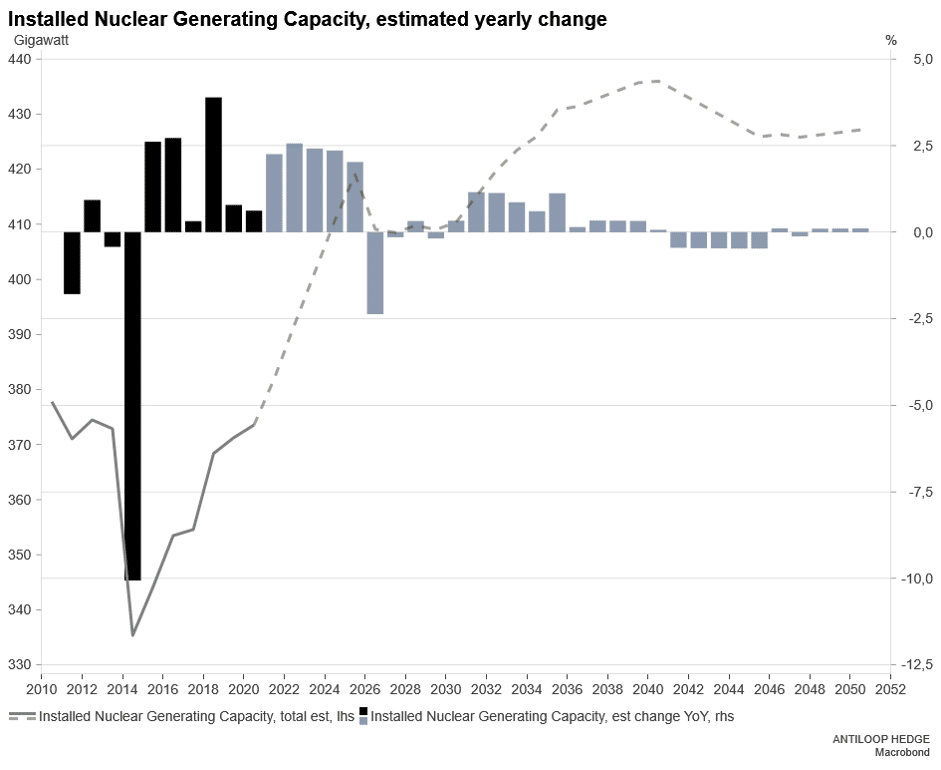

There are 440 operational reactors in the world today, 60 under construction, and another additional 300 projects proposed waiting for approval. By 2050, the total global capacity is expected to have grown by over 40 percent, accounting for 8.5 percent of global energy consumption (compared to 3.7 percent in 2022).

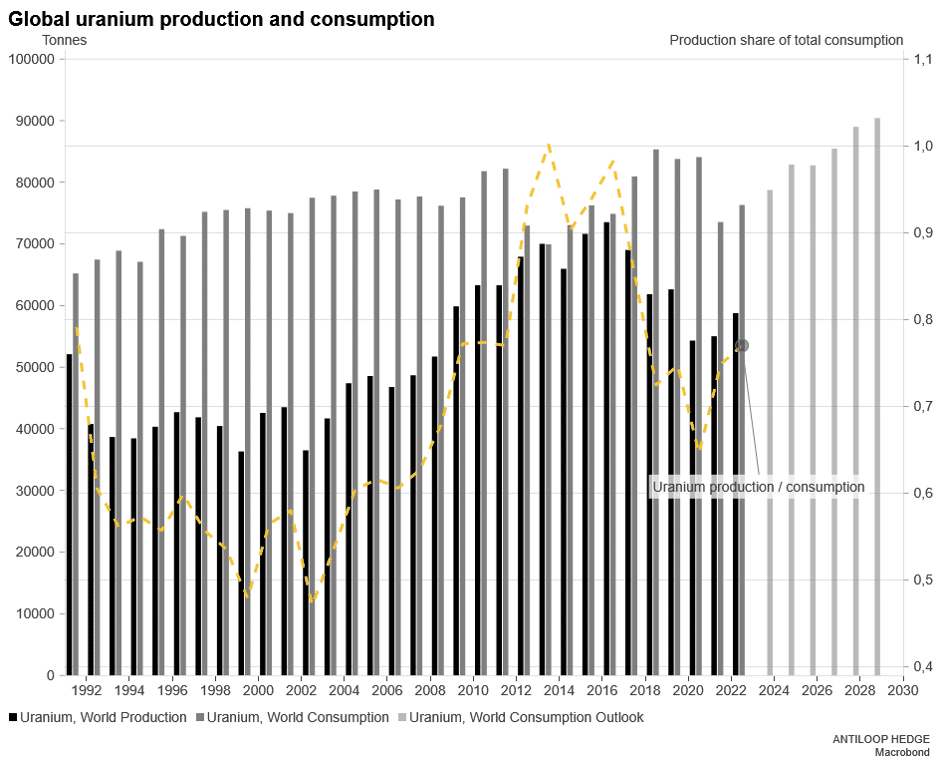

We’re on the brink of witnessing a nuclear renaissance, a resurgence not seen since the pre-Fukushima era. As the global capacity from nuclear reactors for the first time since before the Fukushima catastrophe is expected to grow, so will the demand for uranium. However, since 2016, when global mines peaked production at 73 526tU, global production has slumped due to unfavorable market conditions as the demand for uranium fell as reactors were shut down as a reaction to Fukushima. In 2022, mines only produced 58 769tU, which can be compared to the global consumption of 76 321tU the same year.

Several factors are pointing in favor of a further rising uranium price. Between 1987 and 2013, the uranium supply had a unique contributor in the form of recycled nuclear materials as surplus fuel from decommissioned nuclear weapons was repurposed to fuel reactors. This practice, primarily involving the conversion of military high-enriched uranium, had been responsible for satisfying approximately 15 percent of the global reactor requirements. However, that surplus is now gone, and with growing demand and current mines already only producing three-quarters of the yearly consumption, prices are set to surge.

In addition to this, the decade-long bear market has led to several mines closing down and no new ones opening. It’s only now that the economics of uranium mining are shifting. Until recently, the uranium spot price has been too low to justify the significant investment required to open new mines. This unfavorable economic environment discouraged companies from investing in new projects. By January 2021, there were over 29 400 tons of unused production capacity from mines that were ready to operate but weren’t due to market conditions. While these are relatively easy to re-open, the current production capacity, including these mines, will not be enough to meet the growing demand, meaning both the shorter and longer-term outlook for the uranium price continues to be bullish.