By Dan Rizzuto, CFA and Linus Nilsson, CFA: Prior to Covid, Commodity Hedge Funds and the non-financial exposures of more diversified Global Macro portfolios may have been seen as a lost cause to many. Assets allocated to Commodity Trading Advisors and Hedge Funds specialized in these markets dwindled, while fully diversified managers reconsidered their weightings at the expense of Commodities in an effort to replace the hollow returns of the sector. Several high-profile managers, old and new, closed as the interest in Commodity strategies shrunk due to lackluster performance. Surging interest in public and private equity, alternative credit, and cryptocurrencies readily filled the void for risk-seeking capital as Commodities fell out of favor during this time.

Much of this changed though during and following the 2020 Pandemic. Commodity markets were suddenly back to their old selves, and then some. Almost forgotten volatility, sustained trends, and a renewed focus on tight supply and uncertain demand brought the Commodity sector’s favored idiosyncratic fundamentals roaring back into focus.

Following the lockdowns and historic fiscal and monetary accommodation, inflation was back in the limelight too, with both retail and institutional interest generating inflows and higher prices for broad Commodity indices and specific Commodities. An asset class with a debated risk premium was back in vogue, and seemingly “back to normal”.

Beyond the “good old days” factor, newer elements to the Commodity sector introduced other opportunities. Energy transition, a re-start of regulatory, voluntary carbon emission investments, an assertive Global South, de-globalization, and the green transition each added to a re-invigorated and shifting Commodity sector.

Commodity investing has historically been pursued primarily for its absolute returns and its lack of correlation, offering better risk-adjusted results when included in a portfolio of financial investments like stocks and bonds. While long-biased Commodity indices created investment opportunities for asset allocators, the Commodity sector has also given rise to an associated interesting and uncorrelated opportunity set for long/short Commodity strategies that try to arbitrage dislocations and temporary anomalies.

Though history shows that investor appetite in these markets can be fickle, and enthusiasm can wax and wane, a global transition economy and all its concomitant frictions suggest a fundamental tailwind for sector specialists and other opportunistic strategies trading Commodities.

The Resurgence of the Active Commodity Trader

Since 2019, specialized active traders in the Agricultural, Metals, Energy, and related markets have been able to capitalize on the volatility, trends, and forced trading in this niche CTA space.

While Commodities have always been a macro market, driven by broad global phenomena plus sector-specific supply and demand, in more recent years it became evident that the micro-structure of these markets can matter a lot! Knowing the differences between seemingly similar markets, the interconnectivity of physical and derivative markets, and the real logistics/commercial considerations of the underlying industries turned out to be crucial.

The unprecedented circumstances around the negative pricing of the WTI Crude Oil contract during the panicky markets in March 2020 are the prime example. Awareness of contract specifications and that WTI is only delivered at a particularly constrained delivery point, while the almost equivalent Brent Crude Oil contract offers much more optionality when it comes to delivery was pivotal.

Similarly, the supply side of the market has created previously unseen volatility levels. And, the near implosion of the LME on the back of the Nickel price surge in March 2022 is an example that some exchanges offered better or worse transparency when it comes to arrangements specific producers had with their banks.

Perhaps most importantly, a decade-plus of monetary accommodation across the globe, and in particular Western economies, has finally come to an end, with a five-fold increase in interest rates in the United States in about a year with other Central Banks following suit. Similarly, the coordinated Central Bank efforts to manage capital market valuations and to keep interest rates low shifted rapidly to inflation fighting and attempts to centrally manage domestic economies.

And finally, as a bonus, post the crash in 2020, retail and institutional buyers started to accumulate long positions in listed Commodity ETFs. These were predominately price-insensitive buyers and cared little for (and understood less about) the micro-structure of the market. These “Commodity Tourists” have only a fleeting interest in the underlying mechanics of the market but rather seek exposure for fear of missing out. This “FOMO”, while costly for many, can be a bonanza for professional managers that seek to arbitrage curve prices, temporary supply and demand imbalances, and flow-driven anomalies. (As the inflation theme and Commodity prices have moderated in 2022/23 these investors have predictably started to reduce their exposures.)

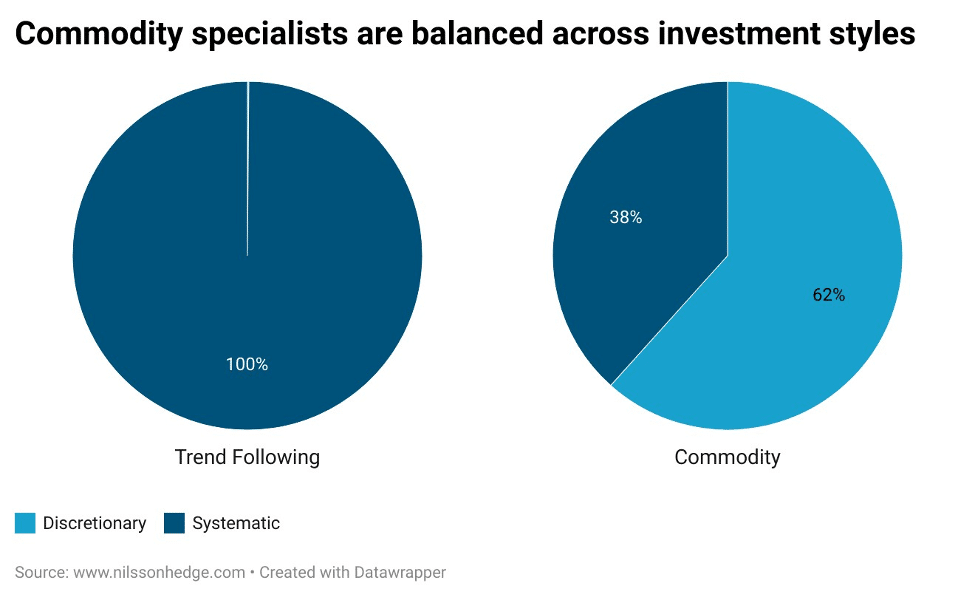

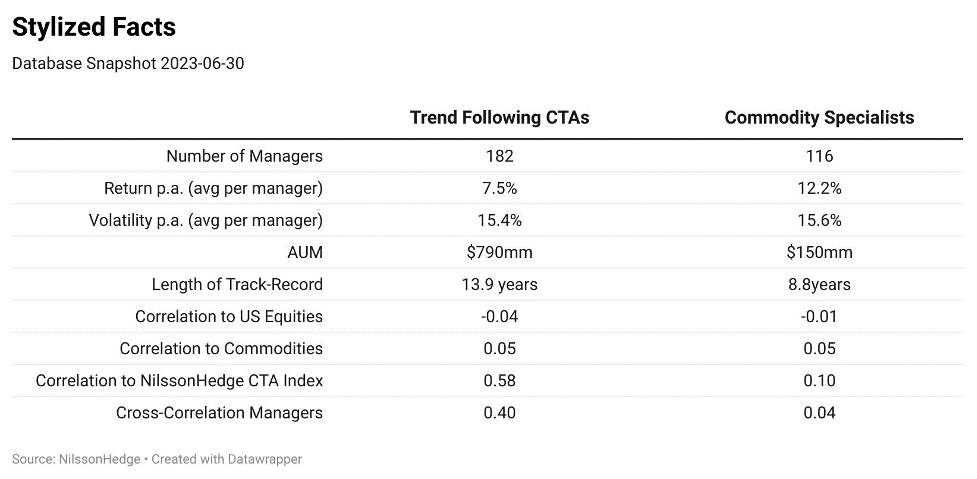

When we are looking at the most well-known CTA strategy, globally diversified trend following, they are overwhelmingly dominated by Systematic strategies, almost 100% of managers are using a trading approach that is focused on trying to extract value from opportunities that are persistent and can be formulated as an algorithm.

The Commodity Specialist peer group exhibits a much more balanced mix of Discretionary and Systematic trading approaches. Discretionary managers often have a background on the physical side of the business and come with deep specialized experience. Systematic Commodity specialists are commonly deploying highly specific models that try to capture the dynamic nature of a handful of markets.

The Trend Following manager is on average five times larger than their specialized Commodity peers. Commodity managers have slightly better risk-adjusted returns, which may be offset by less strong performance during equity market stress periods or lower skew. Commodity alpha managers also tend to be uncorrelated to each other, whereas Trend Following managers are relatively highly correlated to each other.

A diversified basket of strategies

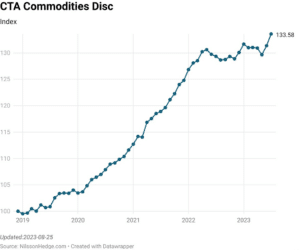

All of these opportunities created a favorable situation for funds that had a specialized skill set to analyze and trade Commodities. Across all the different Hedge Fund indices that we calculate, the Discretionary Commodity Index had by far the most efficient returns (closely followed by a mix of Systematic and Discretionary Commodity strategies).

Since 2019, the Sharpe Ratio for a combined portfolio consisting of a diversified basket of active long/short Commodity specialists is above two, whereas the other indices within liquid alternatives typically have a Sharpe ratio of one or lower. The Discretionary managers is a subset of the CTA universe, that is structurally different from the pre-dominantly diversified and Systematic programs that have come to be the main investment strategy for institutional investors seeking tail protection and trend exposure.

Considerations for Investors

While helping, a Commodity “super cycle” is likely not enough rationale for re-entering or increasing exposure to the sector through a long-biased approach. Fortunately, there does appear to be a resurgence of conditions (e.g. trends, mean reversion, volatility) to allow the premias offered by actively trading the sector to deliver upside and diversification for several years to come. Most notably, we suggest de-globalization and the retreat of coordinated Central Bank manipulation will play out to the advantage of active Commodity exposure.

Active Commodity trading is a specialized sub-strategy with comparatively limited scalability. Most managers have limited capacity and operate on a smaller AUM basis. Investors committed to the sector will most likely need to be more diversified across portfolio managers and perhaps use smaller managers. On the plus side, the specialization required of newer markets including environmental and rare earth elements will likely give active management, and perhaps Discretionary specialists in particular, a leg up on their Systematic and globally diversified peers. Newer markets can offer opportunities (and risk) to the nimbler trading methods.

Across this backdrop of enthusiasm are some warning signs though. We point to the limited capacity of some of these markets, strategies, and managers. Though diversification and enhanced returns may be present, is there enough market depth to support full institutional allocations?

We conclude with the opportunistic view that today’s capacity for technological innovation is unprecedented and that capital markets innovation has throughout history offered elegant solutions to constraints that were seemingly insurmountable only a few years prior. And with that, we believe active Commodity trading may indeed renew its tenured position as an uncorrelated investment with attractive risk/reward trade-offs too attractive to ignore.