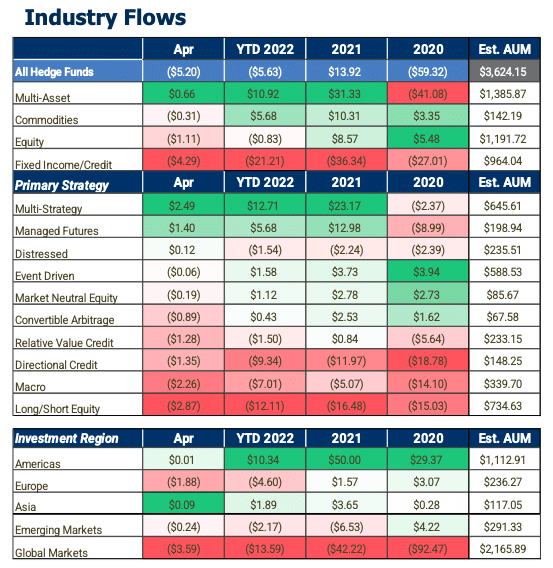

Stockholm (HedgeNordic) – Multi-strategy and managed futures hedge funds continue to attract net inflows even as investors pulled out an estimated $5.2 billion from the broader hedge fund industry in April, according to eVestment. These two strategy groups have been the drivers of net inflows into the hedge fund industry both in 2021 and so far in 2022. Their net inflows have been broadly offset by net redemptions from long/short equity and fixed-income strategies.

Investors pulled out $5.2 billion from the global hedge fund industry in April to take the year-to-date figure of net outflows to $5.6 billion. The industry’s assets under management inched higher to $3.624 trillion because of performance-based asset gains, according to eVestment’s April Hedge Fund Asset Flows Report. Multi-strategy and managed futures funds attracted a combined $3.9 billion in net inflows during April. Multi-strategy managers enjoyed net inflows of $2.5 billion to bring the group’s 2022 net inflows to $12.7 billion.

Managed futures vehicles, which appear to have fulfilled their promise of delivering ‘crisis alpha’ and non-correlated returns so far in 2022, continue to attract investor interest. Managed futures funds attracted an estimated $1.4 billion in net inflows in April to extend the year-to-date figure of net inflows to $5.7 billion. The managed futures segment of the hedge fund industry oversees an estimated $199 billion in assets under management, according to eVestment. Multi-strategy and managed futures funds have been driving most of the net inflows into the global hedge fund industry last year and year-to-date, with multi-strategy funds attracting net inflows of $23.2 billion in 2021 and managed futures funds an estimated $13 billion.

After the onset of the Covid-19 pandemic, inflows started moving back to the hedge fund industry across a broader set of products and strategies. The industry, however, has witnessed increasing concentration of net inflows towards a select group of strategies and managers. According to eVestment, the concentration of net inflows in the last two months has reached the highest levels over the entire period since the onset of the pandemic.

“In the last two months, the levels of concentration of net inflows to the highest amassing group has been higher than the entire post pandemic onset period,” says eVestment’s Global Head of Research, Peter Laurelli. “This simply means that over the last two months a small group of hedge funds have been receiving a larger proportion of new allocations. That is, in general, not a desirable trait for the broad health of the industry.”