Stockholm (HedgeNordic) – Quantitative asset management firm OQAM out of Sweden’s southern town of Malmö is celebrating the two-year anniversary of its first – and so far only – investment product, the multi-strategy systematic hedge fund named ia. “For us this is a large milestone and an opportunity to reflect,” says CIO Thorbjörn Wallentin, who co-founded OQAM with Andreas Olsson.

“Five years ago… we started OQAM. Two optimistic and admittingly slightly naive founders with a dream to build a successful quantitative asset management firm outside the established financial hubs,” Wallentin reflects on the beginning of their journey. “We have a lot of work to do, but this week our first product, ia, celebrates two years.”

ia employs a multi-strategy approach across different asset classes, markets, holding periods and instruments to deliver returns in both risk-on and risk-off environments. The systematic vehicle relies on about 30 different models across fixed-income, foreign exchange, equity and commodity (metals) markets. As previously explained by Wallentin, “we deploy different, purely systematic strategies that have strengths and weaknesses in different market environments.” According to Andreas Olsson, the CEO of OQAM, “we combine our human experience and knowledge with a quantitative framework to create a quantamental investment approach.”

“We combine our human experience and knowledge with a quantitative framework to create a quantamental investment approach.”

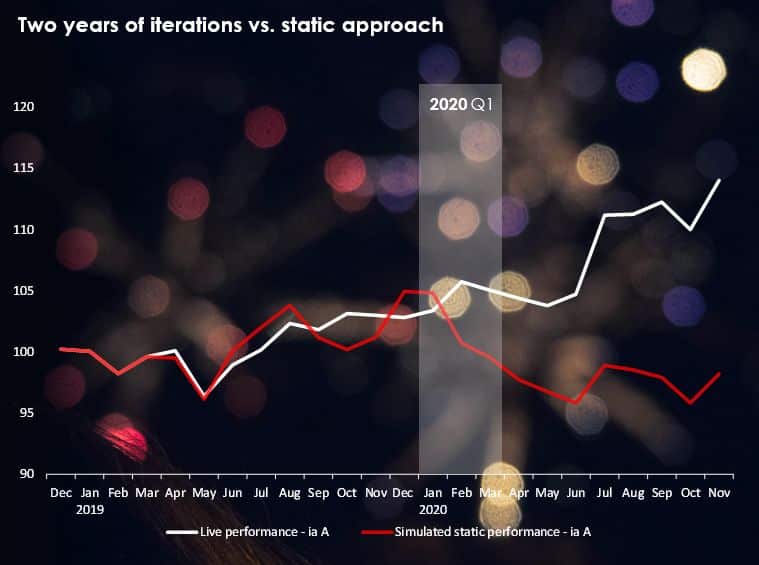

The experience and insights accumulated during the two years of running ia contributed to the evolution of the strategy powering the fund. “We did an insightful exercise recently in conjunction with the two-year celebration of our quantitative hedge fund ia,” says Wallentin. “We tried to answer one of the trickiest questions within quantitative investing – should one stick to the original investment models or should one try to adapt (running the risk of overreacting to new market conditions)?”

“We tried to answer one of the trickiest questions within quantitative investing – should one stick to the original investment models or should one try to adapt (running the risk of overreacting to new market conditions)?”

ia delivered a cumulative return of 14 percent since launching in December of 2018, reaching an inception-to-date Sharpe ratio of 1.01. Had the team not made any amendments to the investment models originally deployed at inception, the performance of ia would have been significantly lower. “The lessons learned these past two years have made it possible for us to reformulate some of our investment principles,” acknowledges Olsson.

“We believe in adaptation, failing fast (when it comes to investment models) and iteration,” Wallentin points out one of the team’s reflections on the two-year journey. “Our hedge fund, ia, is the sum of our previous experiences and knowledge combined with many iterations (new insights) made during these two years,” he continues. “All iterations, even with small short-term impact, are worth pursuing when assessed correctly as they can grow into something big in the long run.”

“Our hedge fund, ia, is the sum of our previous experiences and knowledge combined with many iterations (new insights) made during these two years.”

As previously explained by Olsson, “ia is our innovation engine.” The range of ia’s investment strategies keeps expanding through a special program called LAB, where the team deploys different models in the market more quickly. “Keep a very open mind to new approaches and insights,” says Wallentin. “We started out being a bit skeptical about machine learning and big data (regarding them as buzzwords and prone to overfitting),” he acknowledges. “Now they are a natural ingredient in our fund. Always be open to innovation.”

“Keep a very open mind to new approaches and insights.”

“We would like to thank everyone, our amazing team, our investors, everybody in our fantastic network for your faith and support and for a great 2020 (given the challenging circumstances),” says Wallentin in connection with reaching the fund’s two-year anniversary “We look forward to a truly interesting 2021 with all of you.”