When strictly looking at the domicile of the management company, Sweden has been seen as home to Europe’s second-largest hedge fund hub by assets under management, following the UK. The city of Stockholm, in particular, has historically served as the beating heart of hedge fund activity in the Nordic region, both in terms of AUM and concentration of managers. The city remains a bustling center for the industry, housing firms such as Lynx Asset Management – one of the Nordics’ largest hedge fund managers, now celebrating its 25th anniversary – and Brummer & Partners, widely credited with laying the foundation for Sweden’s hedge fund scene.

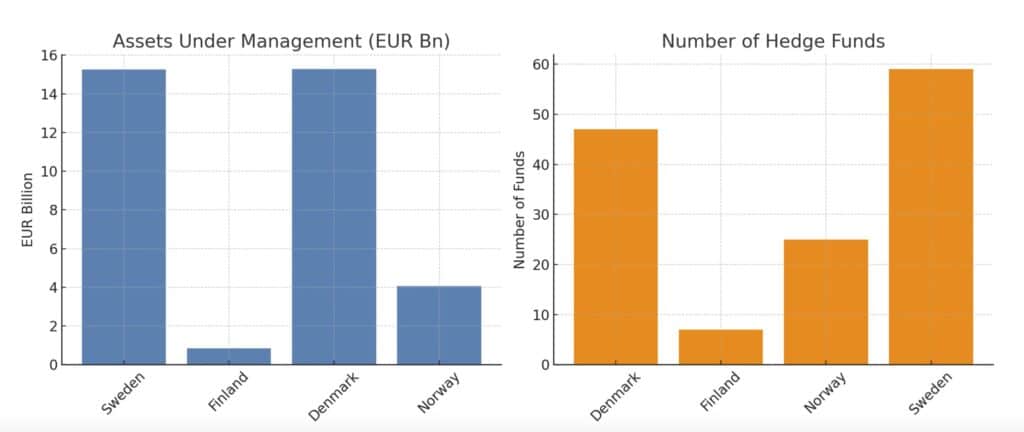

In terms of the number of active hedge funds, Sweden continues to lead, although Denmark and Norway are narrowing the gap. However, when it comes to assets under management, the picture is changing. HedgeNordic’s data indicates that Denmark has just overtaken Sweden, with Danish hedge funds managing €15.27 billion as of March 2025 – just edging out Sweden’s €15.26 billion. This growth has been driven by heavyweights: Nordea Asset Management, which oversees €6.3 billion across its multi-asset alpha and fixed-income hedge funds, Danske Bank Asset Management with €4.5 billion in fixed-income and quant-based strategies, and Asgard Asset Management managing €1.7 billion. As a result, Denmark may now lay claim to having the largest hedge fund industry among the Nordic countries.

Looking at the broader Nordic hedge fund sector, the industry has been growing steadily in terms of assets under management – a key barometer for overall health. Following one of its strongest performance years on record in 2024, the industry has continued to attract capital. As of the end of March 2025, Nordic hedge funds collectively oversee at least €35.4 billion in assets, up from €31.8 billion at the end of 2023. The true figure is likely higher, as this estimate does not fully account for certain firm mandates, missing data from funds, or newly launched hedge funds not yet included in the Nordic Hedge Index.

However, the Nordic hedge fund industry has the potential to manage significantly more capital. Take the Finnish pension insurance sector as an example: just five institutional investors collectively allocate €25.7 billion to hedge funds. Yet almost none of that money is invested in Nordic managers. This is partly due to a preference for more established firms with large teams, long track records, and multi-strategy platforms. But that may be starting to shift. While some Nordic managers may grow to rival global hedge fund giants, some industry experts argue that Nordic hedge funds should instead focus on niche, specialized strategies to remain competitive.

And there is strength in that approach: Svelland Global Trading Fund, for example, has become one of the fastest-growing and best-performing Nordic hedge funds in recent years by focusing exclusively on the commodities space. Rhenman & Partners is another such example that grew to a billion-dollar fund focusing on its healthcare niche. And there are others, too.

While Sweden remains a vital hub and the undisputed leader in the number of hedge funds across the Nordics, it may no longer hold the top spot in assets under management – a title now narrowly claimed by Denmark. This shift underscores the evolving dynamics within the Nordic hedge fund landscape, where scale is increasingly driven by a handful of heavyweight institutions. Yet, the broader industry continues to expand. Going forward, the Nordic region’s hedge fund sector may not compete on size alone, but its strength lies in specialization.