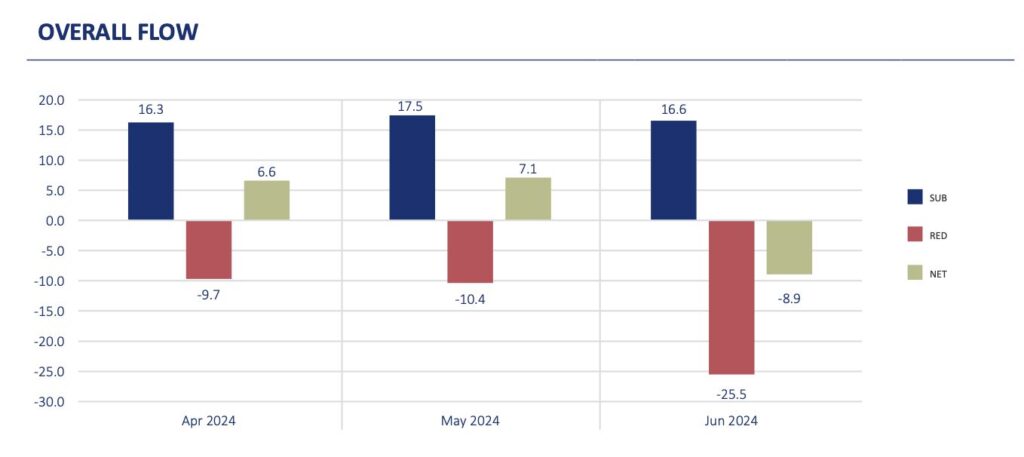

Stockholm (HedgeNordic) – The global hedge fund industry has experienced robust asset growth for seven consecutive quarters ending in June, primarily fueled by performance-based gains, as highlighted in a recent report by HFR. Fund administrator Citco corroborates this trend, noting that the second quarter of 2024 marked the seventh consecutive quarter of positive returns for hedge funds. More notably, Citco’s findings indicate that this quarter was the first to witness net inflows since the first quarter of 2022.

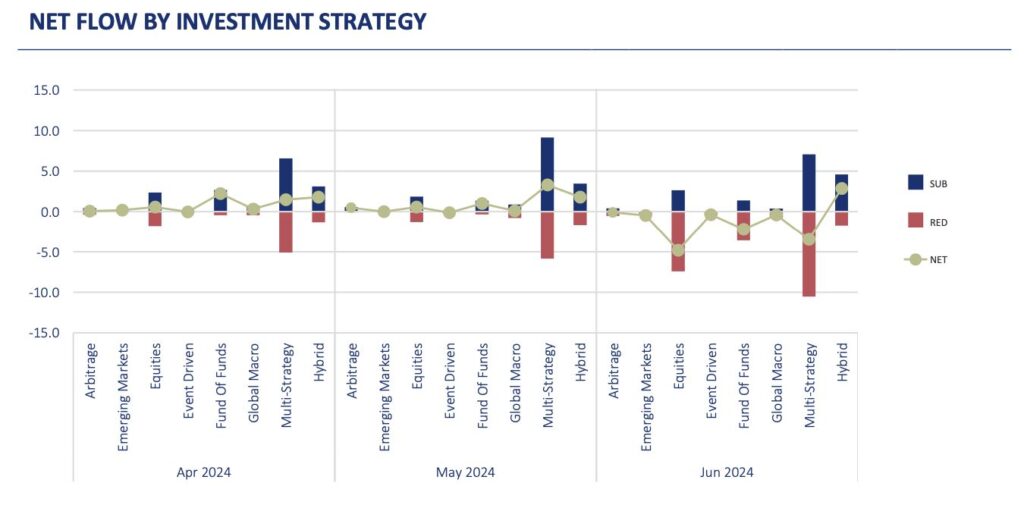

In the second quarter, hedge funds administered by the Citco group of companies saw net inflows totaling $4.7 billion, primarily driven by net inflows in April and May. This marks the first quarter of net inflows since the first quarter of 2022. A wider range of strategies benefited from inflows, with hybrid funds leading the way, experiencing net inflows each month in the second quarter. Hybrid funds, which combine public and private market assets, recorded net inflows of $6.5 billion in the second quarter, following net inflows of $1.1 billion in the first quarter.

Multi-strategy funds also enjoyed net inflows of $1.3 billion in the second quarter, despite outflows in June. Funds of funds attracted net inflows of $1 billion, followed by fixed-income arbitrage strategies. In contrast, equity strategies faced another quarter of net outflows in the second quarter, totaling $3.6 billion. Emerging markets and event-driven funds also reported small net outflows of $0.3 billion and 0.5 billion, respectively.

Funds managing between $5 and $10 billion recorded the highest net inflows in the second quarter, totaling $2.4 billion. The largest funds with assets exceeding $10 billion received combined net inflows of $1.9 billion. Meanwhile, funds overseeing between $1 and $5 billion received net inflows of $1.3 billion, whereas the smallest funds with below $1 billion under management experienced net outflows of $0.7 billion.