By David Franklin and Anders Bjorkstal, Solarstein Capital: Imagine one of the most globally recognized brokerage firms in the world saying: “We aren’t interested in half of the Nordic countries because not enough customers are interested.”

It might sound strange, but the Nordic countries are one of the best-kept secrets in the public equity market.

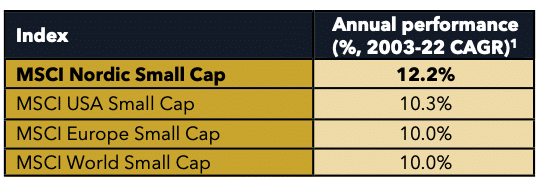

Over multiple decades, Nordic smaller companies have outperformed US, European, and Global counterparts. And by a considerable margin. Over the 20-year period to December 31 2022, the Nordic Small Cap index outperformed by 220 basis points per year.

Why are we interested in the Nordic countries? Well, it’s because of our backgrounds. Anders is from Sweden and his formative years as an investor were influenced by a natural home bias. While on the other hand, David has an academic background in human geography, which helps us understand how these countries work.

People often think the Nordic countries are all about high taxes, which stop businesses from doing well. But that’s not the real story. In fact, these countries are known for trust, stability, autonomy, exports, and innovation. All these things make it a great place for managers and companies to be trusted partners for businesses across the world and create a lot of value for people who invest in them.

This combination of qualities is more fully explained in our six-part Nordic Secret series (available on request). For the purposes of this article, we will share:

- The geographic breakdown of outperforming stocks in the global stock market;

- Five data-driven qualities behind the Nordic region’s attractiveness to investors; and

- Active management is necessary even in an attractive niche.

Geographic breakdown of outperforming stocks

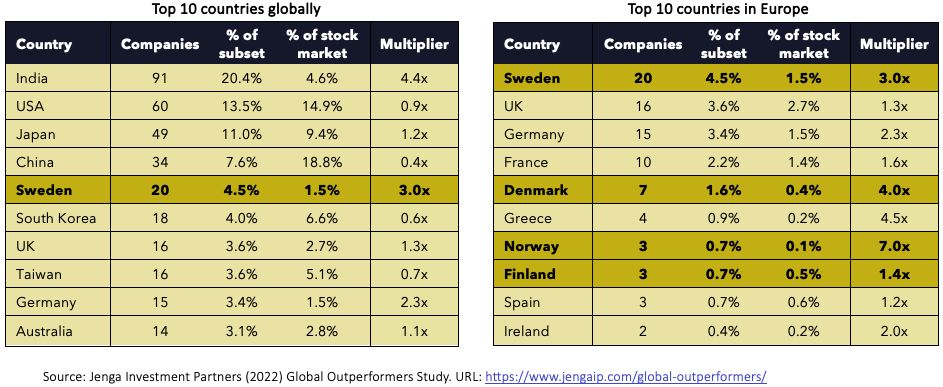

In a 2012-22 study conducted by Jenga Investment Partners on global stocks that returned 1,000% over the last decade, companies from each of Sweden, Denmark, Norway, and Finland were disproportionately represented.

Sweden had the 5th most companies represented from any country in the world, more than any other country in Europe, and had 3x the number of constituents that its representation in the global stock market would suggest. Meanwhile, Denmark and Norway are overrepresented by 4x and 7x respectively (see tables below[2]).

The outperformance of Nordic companies is no coincidence. Companies outperform over long-term horizons because of deeply embedded cultural reasons. We will now explore the five key qualities that make the region attractive to investors.

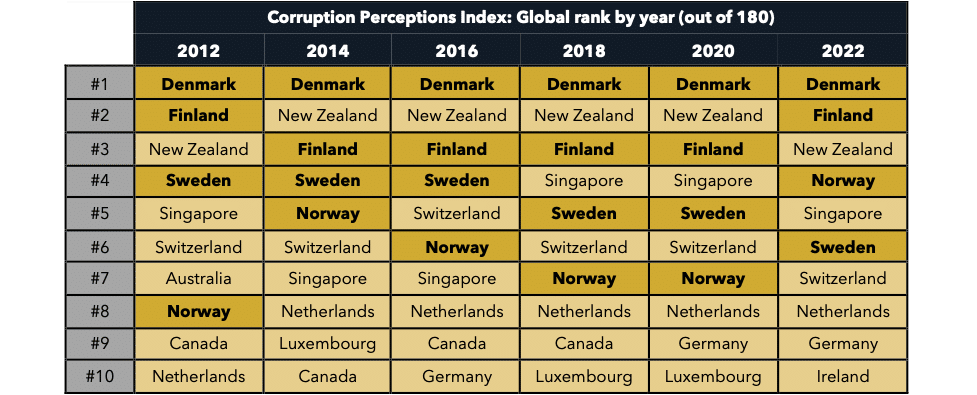

1 – Trust

The Nordic model is based on a uniquely high level of trust. In particular, the ‘voluntary associations’ formed in the 19thcentury formed the backbone of Nordic civil society. This led to a smaller class divide than other capitalist societies, which fosters trust in the government and fellow citizens. This trust results in a strong welfare state supported by high taxes and, consequently, social cohesion.

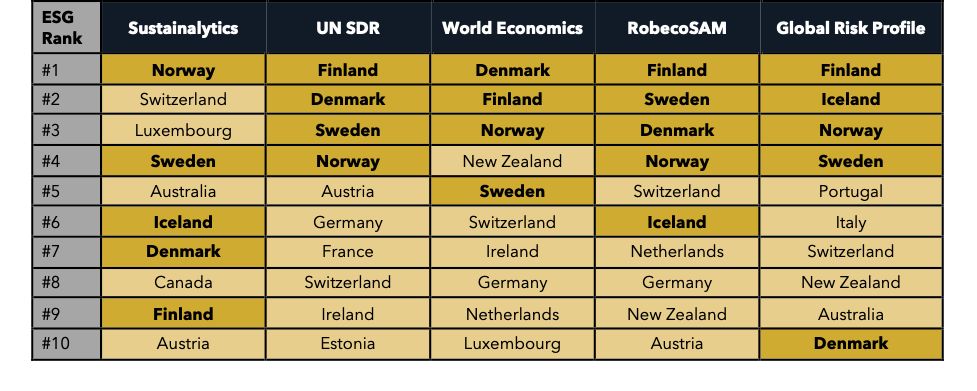

For investors, this trust translates to economic benefits, as it reduces transaction costs and promotes productivity. What’s more, the region’s commitment to ESG principles, particularly strong corporate governance, further enhances its attractiveness to investors. Multiple share class structures are common but are generally managed ethically, providing long-term value.

2 – Stability

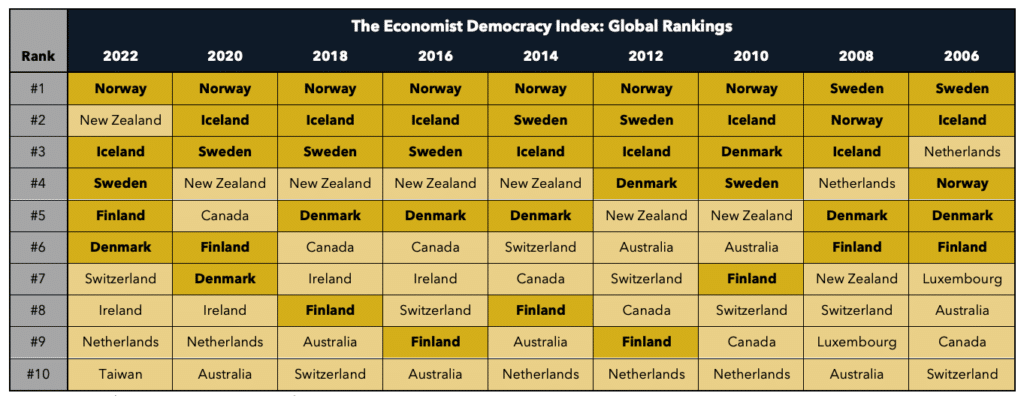

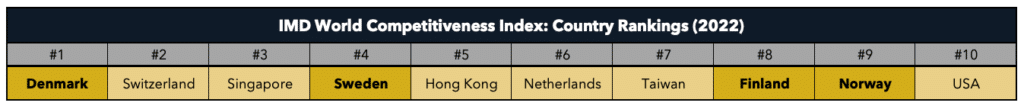

The stability of the Nordic countries gives investors more predictable outcomes. The Nordics maintain high political stability with stable democracies and a proportional representation system that engages voters.

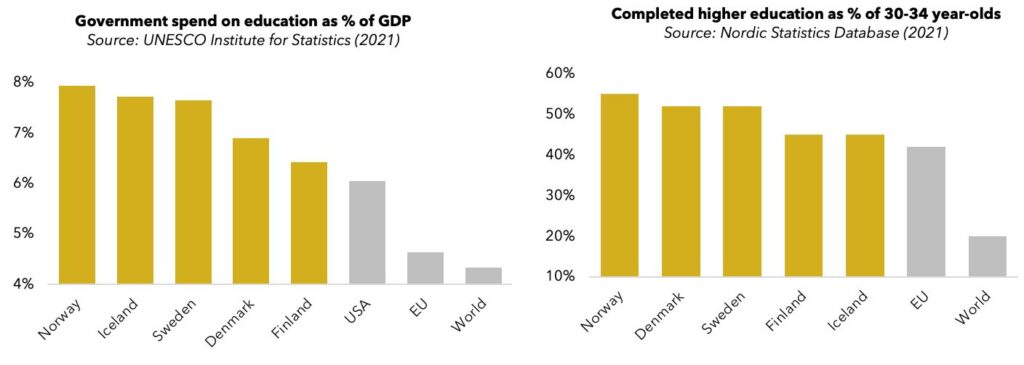

Economic stability is achieved through prudent fiscal policies and a sustainable welfare state, resulting in high labor force participation, robust GDP per capita, and sovereign credit ratings. Meanwhile, social stability is supported by substantial investments in health, education, and welfare programs, making the population well-educated and content.

This overall stability feeds through to the business culture, which explains a commitment to long-term decision making that is reflected in high rankings on the IMD World Competitiveness Ranking.

3 – Autonomy

The Nordics highly value individual autonomy, as reflected in cultural assessments like the Inglehart-Welzel cultural map and Hofstede’s Cultural Dimensions.

This autonomy culture is deeply rooted in history, where a social contract promotes productivity, education, and healthcare in return for independence. As a recent example, the Swedish government’s unique response to the COVID-19 pandemic typifies the government’s respect for individual freedoms.

This autonomy matters to investors as it promotes a management culture that empowers local decision-making and capital allocation, seen in the success of serial acquirers in Sweden, where decentralized, autonomous subsidiaries generate tremendous value.

4 – Export-driven economy

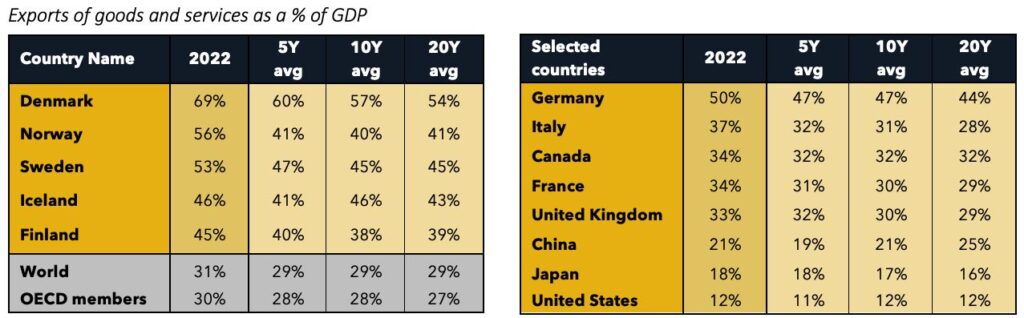

The appeal of investing in the Nordic region lies in its export-led economic model. Nordic countries heavily rely on exports, well above global and OECD averages.

This model, driven by a small domestic market, has made the Nordics highly productive and wealthy. Specific niches vary by country, such as advanced manufacturing in Sweden, medicinal products in Denmark, and natural resources in Norway and Finland.

The result is a highly productive economy with a business culture primed for international expansion. Importantly, the export-driven nature of the Nordics explains why the region has the highest standard of non-native English-speaking in the world. Therefore, Nordic companies gain competitive advantages when scaling abroad, leading to attractive investment prospects.

5 – Innovation

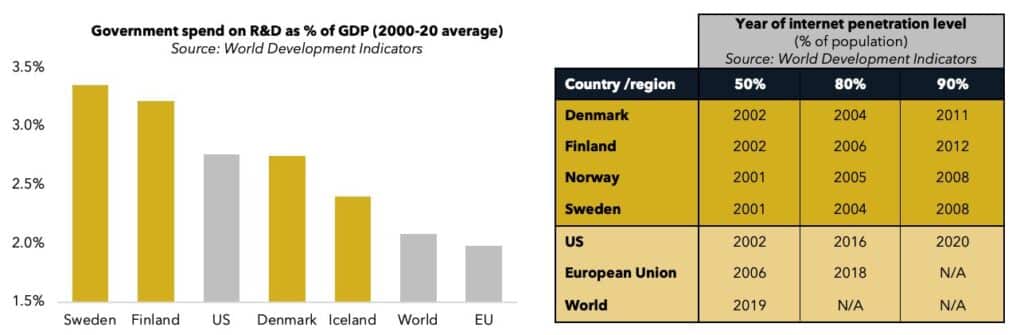

The Nordic culture of innovation is the last reason that explains the region’s appeal to investors. This culture stems from a commitment to education, substantial R&D investments, and a robust social safety net that reduces the fear of entrepreneurial failure.

Nordic innovation has led to the creation of products and technologies that range from household names like IKEA and Spotify to vital inventions such as the cardiac pacemaker and three-point seatbelt. Naturally, innovative companies with a sustainable focus are particularly attractive to investors in the region due to their long-term value and adherence to ESG principles.

The need for active management in an attractive niche

So, what’s the catch? Even in an attractive niche, you can’t just sit back and expect excellent performance. Active management is critical. Over the last 20 years, out of all the companies in the MSCI Nordic Small Cap index, just 3% of names accounted for 40% of the gains made by positive stock contributors[3].

That’s where we come in. We specialize in a unique part of the stock market. We dig deep to find companies that make for especially attractive investments. We speak with their management, competitors, customers, former employees, visit their offices, and go to industry events. It’s a lot of work, but it helps us decide if a business and its team are good enough for long-term success.

To conclude, the Nordic countries are a hidden gem for investors because of trust, stability, autonomy, talent for exporting, and their innovative spirit. But you still need to put in the work to find the best investments.

[1] Source: MSCI. Data for performance table is taken from the period 12.31.2002 to 12.31.2022. All indexes are total return, which include the reinvestment of dividends, net of withholding taxes, in USD terms.

[2] In Jenga Investment Partners’ Global Outperformance study, the stock market is defined by the number of companies with a market capitalisation above $50m as of May 31st 2022. To qualify as part of the subset, a company must have returned 1,000% between 2012 and 2022.

[3]Brannback, J. and Lahdesmaki, J. (2023) Small is beautiful: uncovering the Nordic 10-baggers. URL: https://www.schroders.com/en-lu/lu/professional/insights/small-is-beautiful-uncovering-the-nordic-10-baggers/

Disclaimer

For professional investors and advisors only. The contents of this document are communicated by, and the property of, Solarstein Capital LLP. Solarstein Capital LLP is an appointed representative of Eschler Asset Management LLP which is authorized and regulated by the Financial Conduct Authority (“FCA”) and is a registered investment adviser with the U.S Securities and Exchange Commission (“SEC”). This document is not intended as an offer or solicitation with respect to the purchase or sale of any security. The information contained herein may not be reproduced, distributed, or published by any recipient for any purpose without prior written content. The information and opinions contained in this document are subject to updating and verification and may be subject to amendment. No representation, warranty, or undertaking, express or limited, is given as to the accuracy or completeness of the information or opinions contained in this document by Solarstein Capital LLP, its directors, or its affiliates. No liability is accepted by such persons for the accuracy or completeness of any information or opinions. The value of investments and any income generated may go down as well as up and is not guaranteed.