Stockholm (HedgeNordic) – Swedish asset manager Atlant Fonder is raising the performance fee – the cut from above-benchmark returns – for its largest fund, Atlant Opportunity. The performance-based fee, which is paid on returns exceeding the 90-day Swedish treasury bills, will be raised from 10 percent to 15 percent on June 1.

Atlant Opportunity, the largest fund under the umbrella of multi-fund boutique Atlant Fonder with SEK 5.4 billion under management, was launched in January 2016 with no performance fee. In September 2020, Atlant Fonder introduced a performance fee of ten percent for Atlant Opportunity and two other funds after several years of meeting their risk-return expectations. The asset manager’s other hedge funds charged an annual performance fee of 20 percent and the introduction of the ten-percent performance fee sought to harmonize the fee structures across all funds.

Atlant Opportunity is a market-neutral fund that can invest in corporate bonds, index derivatives, equity derivatives, and individual stocks, among other securities. With a goal to deliver an annual return that exceeds the 90-day Swedish treasury bills by at least five percentage points, Atlant Opportunity caters to savers interested in a fund with a low-volatility return profile. “The fund’s focus is on maintaining a steady and robust return, which it has done since it was launched on 1 January 2016,” according to the team at Atlant Fonder.

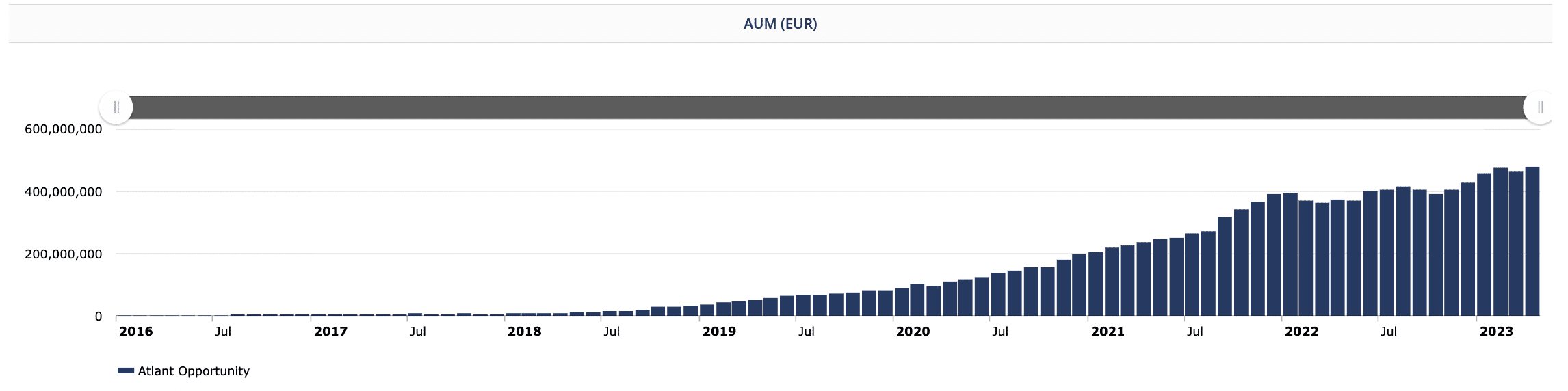

The fund enjoyed six consecutive years of positive returns before edging down 4.9 percent in 2022. Up 2.5 percent in the first four months of 2023, Atlant Opportunity has delivered an annualized return of 4.5 percent since inception with an annual volatility in returns of 4.2 percent. Atlant Opportunity has experienced a maximum drawdown of 7.9 percent, one of the lowest in the Nordic hedge fund universe. The fund has grown considerably since launching at the beginning of 2016, with the fund’s assets under management increasing from about SEK 60 million at the end of 2017 to over SEK 1 billion in early 2020, more than SEK 2 billion in late 2020, well over SEK 4 billion at the end of 2021 and to SEK 5.4 billion at the end of April 2023.