By Kathryn M. Kaminski and Yingshan Zhao, AlphaSimplex – As macroeconomic uncertainty and inflation created havoc on traditional assets in 2022, this resulted in a range of strong global trends and a spectacular year for trend-following strategies. These strategies can take long and/or short positions in a range of asset classes, depending on price trends in those assets; this gives the strategy the potential to provide “crisis alpha,” or positive returns even when traditional assets decline or are in a state of stress. This year’s inflation crisis was certainly no exception to that narrative.

Over 2022, trend-followers saw several key themes: 1) stellar performance across several asset classes over the year, with fixed income leading the pack; 2) heightened return dispersion across manager returns on the upside; and 3) variations in CTA style factors that may explain some of this dispersion.

A Banner Year for Trend

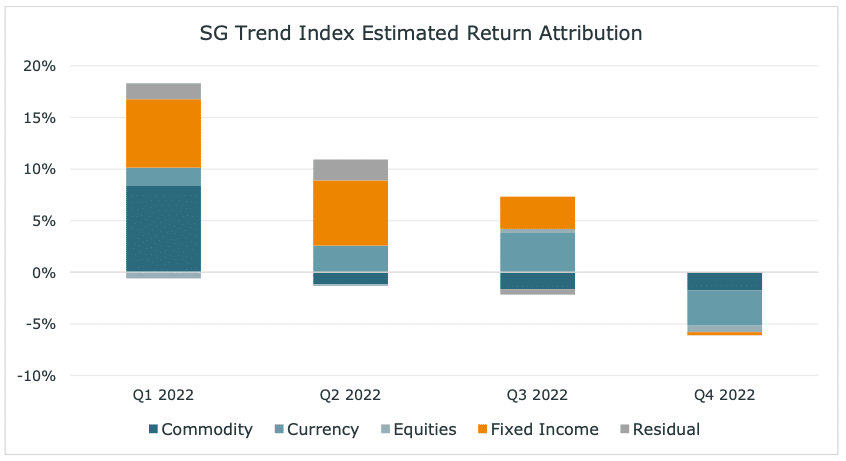

The largest theme in 2022 was rising rates and the presence of high downside volatility in fixed- income markets. This allowed trend followers to profit from the short fixed-income trade, also known as the “pigs fly” trade, which was profitable for one of the first times in roughly forty years.1 First- quarter concern over inflation was exacerbated by the Russian invasion of Ukraine beginning in late February. Despite market turbulence and geopolitical concerns, central bankers had to remain steady in their fight against inflation globally. As shown in Figure 1, this led to a phenomenal Q1 for trend following. Rate hikes disappointed fixed-income markets and led to the beginning of what would be a long decline through much of 2022. Oil prices skyrocketed and became volatile, locking in some nice gains for trend-following strategies that had been following this trend beginning in 2020. In short, commodities and fixed income contributed the lion’s share of gains in Q1.

Q2 marked the continuation of higher volatility and a highly trendy environment until June, when trends and asset-class returns began to consolidate and de-gross portfolios. Moving into Q3, markets were full of hope that central bankers would simply back off. Instead, central bankers stood steady in August, which sent markets racing back to the “fight inflation” narrative. One key difference from the first half of the year was that commodities had started to revert and show risk-off behavior in the summer and the markets shifted focus to the relative strength of the U.S. dollar and the potential for even higher rates. As a result, gains were centered on short fixed income and long the U.S. dollar in Q3.

After three straight quarters with sizable gains in trends, Q4 was a tumultuous, volatile, and reverting quarter for trend following. While October and December were months of back and forth but no sustained losses, November was the month where market hopes regained their fervor reverting many longer-term trends of the year. Trend signals wallowed through the end of a year in consolidation waiting for the next big surprises for 2023.

Quantitative Market Measurements

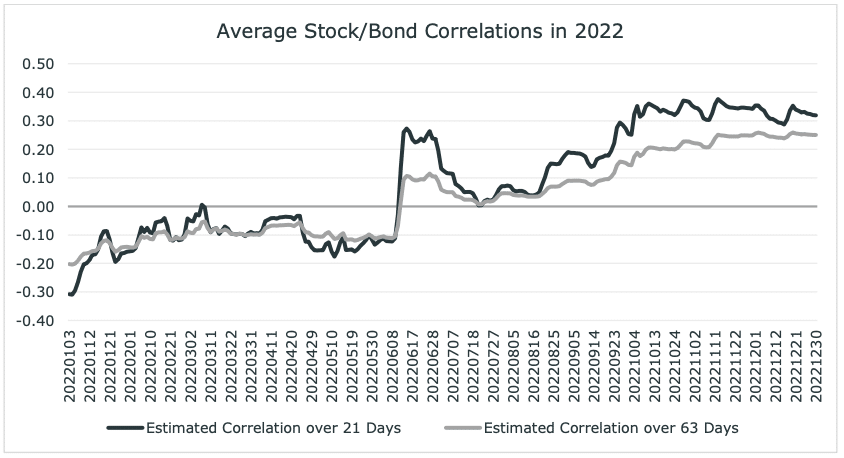

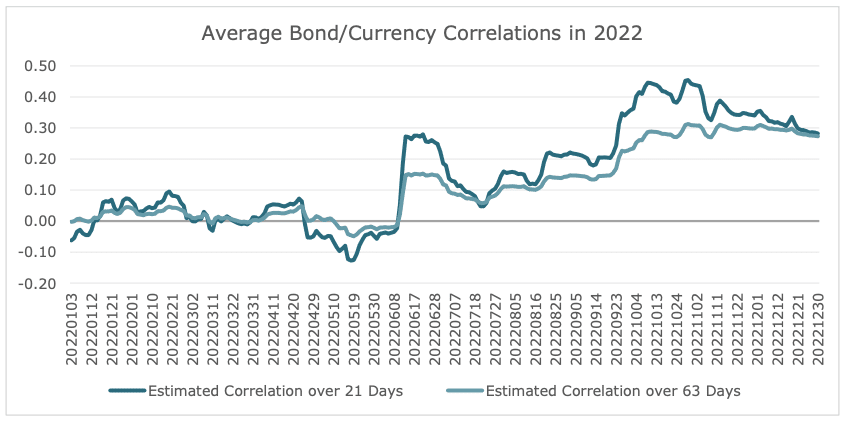

In addition to performance, there were a few other interesting quantitative themes to note in 2022. In a year with both stocks and bonds down, correlation sure didn’t help either. Stock/bond correlation began the year negative and moved to relatively positive for most the second half of the year. Figure 2 plots the correlation between stocks and bonds in 2022. Although this relationship is one that is widely followed by investors, there is another interesting quantitative theme that was quite pronounced: the correlation between fixed income and currencies, which came in markedly positive this year. Figure 3 plots the correlation between foreign currencies (short the U.S. dollar) and fixed income in 2022. (In simple terms, the U.S. dollar was positively correlated with interest rates.)

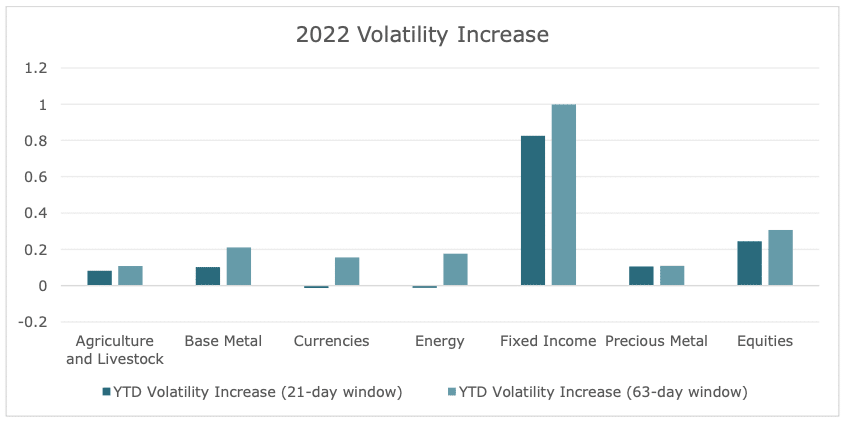

2022 demonstrated strong correlations between asset classes, but it also was a year where volatility behaved rather interestingly as well. Throughout the year, volatility estimates continued to increase, with certain risk assets peaking during the first quarter. However, the biggest volatility story is around fixed income. Figure 4 plots the relative percentage change difference as a percentage of the start level of volatility at the beginning of the year. Fixed-income volatility has roughly doubled (up almost 100%!), from 4% to 8%. Other asset classes have experienced increases in volatility but not in the same relative magnitude. 2022 is the year that investors remembered that fixed income has downside volatility.

Return Dispersion in Full Force

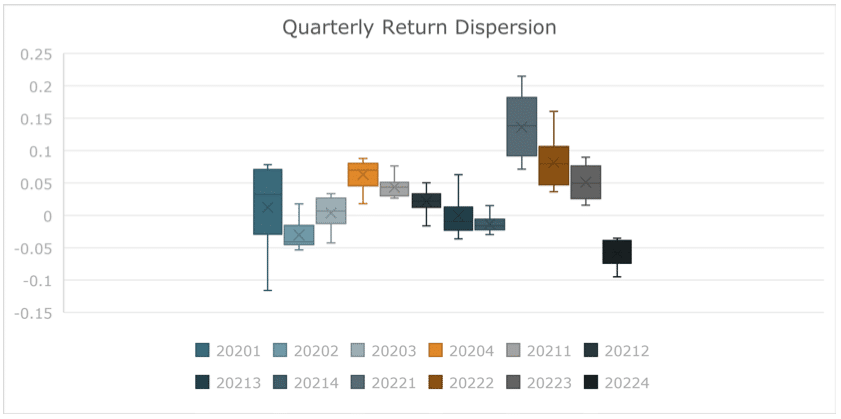

Trend followers had a stellar year overall, as demonstrated by the performance of the SG Trend Index in 2022. Despite this, the results varied substantially across managers. Figure 5 plots the quarterly return dispersion using a box plot for the 10 largest CTA trend managers in the ’40 Act space with daily liquidity. From this graph, we can clearly see that since Q1 2020 the return dispersion has remained somewhat well contained—until Q1 2022, when return dispersion spiked again on the upside. Return dispersion on the downside was somewhat consistent with previous quarters in Q4 2022. Given the range of returns in Q1 2022, it is clear that manager-by-manager performance was quite different from the index.

CTA Style Factors Tell the Tale

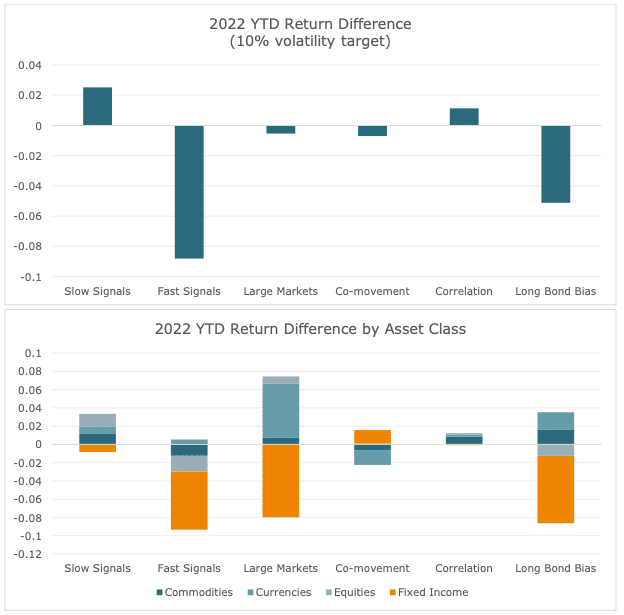

As seen from the higher return dispersion in 2022, manager returns varied across a range of interesting trends. A few themes to consider are some of the classic CTA style factors, as well as other factors such as a long bond bias.2 Figure 6 plots the cumulative return difference for trend systems with different style tilts in 2022. The asset class decomposition of each factor is detailed in the graph below.

Each trend system is run at a 10% volatility for comparison with a representative trend system. Slow and steady was better in 2022 with slow signals in commodities outperforming; slower signals also outperformed in currencies and equities. Faster signals in fixed income underperformed as these signals most likely pivoted too easily off the biggest trend of 2022. Larger markets, like the euro and Japanese yen, were more trendy in currencies, while larger markets in fixed income actually underperformed. Fixed- income markets with more residual co-movement outperformed currency markets which co-moved more. More correlated markets in commodities, notably energy markets, outperformed in 2022. Finally, adding a long bond bias to a system would result in a 4% cumulative reduction in return, which was driven by a roughly 7% loss of opportunity in fixed income with an offset gain in commodities and currencies.3 From this graph, the potential for long bond bias and speed created the largest deviations in return in 2022.

What’s Next?

Although 2022 was a great year for trend, trends change and new market trends evolve. The biggest questions for 2023 are how fast inflation will fall and if we could hit another cycle of rate hikes despite the regained hope of investors coming out of the final few weeks of 2022. The one asset class that has been quieter since the first half of 2022 is the commodity sector and equity risk has remained low all year. Perhaps the next big trend for risk assets could be a positive trend, something traditional investors would certainly welcome.

1Kaminski and Sun 2022 examined short signals in fixed income for trend following. This work was highlighted in the Bloomberg article “Quants at AlphaSimplex Explain ‘Pigs Fly’ Trade Behind 30% Gain.” (McCormick 2022).

2CTA Style Factors are described in, for example, Greyserman and Kaminski 2014, Kaminski 2019, and Kaminski and Yang 2021.

3The long bias factor is the difference between a trend system with a 50% reduction in negative trend signals versus a non-biased system. In a negatively-biased system, when fixed-income signals are discounted, risk may focus on other asset classes. The decomposition demonstrates that the reduction of trend signals might have had positive performance outside of fixed income, but the larger impact was less exposure to short positions in fixed income.

References

• Greyserman, Alex, and Kathryn M. Kaminski. 2014. Trend Following with Managed Futures: The Search for Crisis Alpha. New York: Wiley Trading.

• Kaminski, Kathryn M. 2019. “CTA Market Size Factor: Bigger was better in 2018.” AlphaSimplex Insights. https://www.alphasimplex.com/insight/cta-market-size-factor-bigger-was-better-in-2018/.

• Kaminski, Kathryn M., and Jiashu Sun. 2022. “The Short on Shorting Bonds.” AlphaSimplex Insights. https://www.alphasimplex.com/insight/the-short-on-shorting-bonds/.

• Kaminski, Kathryn M., and Ying Yang. 2021. “Crowded Trends: Safe Haven or Sour Spot in 2020?” AlphaSimplex Insights. https://www.alphasimplex.com/insight/crowded-trends-safe-haven-or-sour-spot-in-2020/

• McCormick, Liz Capo. 2022. “(BN) Quants at AlphaSimplex Explain ‘Pigs Fly’ Trade Behind 30% Gain.” Bloomberg. August 2022. https://www.bloomberg.com/news/terminal/RG03H2DWRGG0.

About the Authors

Kathryn M. Kaminski, Ph.D., CAIA® is the Chief Research Strategist at AlphaSimplex Group. As Chief Research Strategist, Dr. Kaminski conducts applied research, leads strategic research initiatives, focuses on portfolio construction and risk management, and engages in product development. She also serves as a co-portfolio manager for the AlphaSimplex Managed Futures Strategy. Dr. Kaminski’s research and industry commentary have been published in a wide range of industry publications as well as academic journals. She is the co-author of the book Trend Following with Managed Futures: The Search for Crisis Alpha (2014). Dr. Kaminski holds a B.S. in Electrical Engineering and Ph.D. in Operations Research from MIT.

Yingshan Zhao, CFA®, is a Research Scientist at AlphaSimplex Group. As a Research Scientist, Ms. Zhao focuses on applied research and supports the portfolio management teams. Ms. Zhao earned both a BSc. in Mathematics and Applied Mathematics and a B.A. in Economics from Peking University as well as an M.Fin from the MIT Sloan School of Management.

Title Pic: (c) zero-take-LRnIZoco__8-unsplash.com