Stockholm (HedgeNordic) – Secured loans, also known as leveraged loans, represent an attractive asset class to diversify one’s high-yield credit portfolio, fixed-income portfolio, and broader investment portfolio. As compared to high-yield or fixed-rate bonds, for instance, secured leveraged loans exhibit limited interest rate risk due to floating rates and offer downside protection due to seniority. In light of growing investor demand and awareness of ESG, Helsinki-headquartered Mandatum Asset Management has launched an SFDR Article 9 secured loans vehicle that complements the attractive features of secured loans by having sustainable investment as its objective.

“There are several features we like about the asset class, including downside protection and the floating rate nature,” says Alexander Gallotti, Head of Leveraged Finance at Mandatum Asset Management (MAM). “The loans offer downside protection as they are 1st lien senior secured, which is the highest rank in the capital structure,” explains Gallotti. The loans also exhibit limited interest rate risk or duration risk due to floating rates. “The market also typically consists of a large number of high-quality companies that are large, profitable and growing businesses with strong market positions and good diversification in terms of products, geographies, end-markets, and customers.”

“There are several features we like about the asset class, including downside protection and the floating rate nature.”

Although senior secured loans are backed by the borrower’s assets, the biggest risk associated with investing in this space remains credit risk. “The biggest risk is the same as for any credit investing in the higher yielding space, be it high yield, leveraged loans, or any other segment. The largest threat to the investment that matters at the end of the day is the risk of default and the associated recovery rate,” explains Gallotti.

There is also some risk associated with mark-to-market price volatility when liquidity dries up in the secondary syndicated loan market during times of turmoil, acknowledges Gallotti. “For long-term investors, this volatility should not be the main risk on their minds,” he argues. “Investors should view mark-to-market volatility as an opportunity to add at discounted levels and hence boost the long-term overall performance. At the end of the day, the biggest concern is that you don’t get back the money you’d lent in the first place.” After 15 years of experience in this asset class, the team behind the asset management arm of Finnish insurance group Sampo has shaped its approach to assessing and mitigating credit risk.

Assessing and Mitigating Credit Risk

Mandatum Asset Management’s investment strategy in the secured loans space has historically been overweight high-quality issuers in defensive sectors, which are often preferred by private equity funds. These include areas such as healthcare, pharma, software, services, and consumer staples. The majority of loan deals across its portfolios are issuers run and backed by reputable private equity sponsors, who have the financial strength in times of stress. “We build a defensive base for the investment portfolio. The defensiveness comes from the senior security in the credit spectrum, the allocation towards the more defensive and non-cyclical sectors, and the hand-picking of the stronger credits,” explains Gallotti. “Although our entire product range has a European focus, our Nordic tilt brings some additional defensiveness to the portfolio.”

A strong focus on incorporating ESG risks and factors in the investment process and credit selection process further helps to understand and mitigate credit risk. “Our portfolios have an overweight in resilient and typically ESG-friendly industries,” says Gallotti. “These ESG-friendly industries also improve the credit quality of the companies and the financial performance in the long run,” he continues. “We hence take ESG factors into consideration in our credit analysis process. The analysis of ESG concerns goes in parallel with the credit selection process. As part of this analysis, we are trying to identify potential ESG-related risks for the company in particular and the industry as a whole that could also pose a financial problem for the company at some point.”

“The analysis of ESG concerns goes in parallel with the credit selection process.”

The competitive edge that helps Mandatum Asset Management take a step further in its loan selection due diligence stems from its co-investment structure and philosophy. “Mandatum Asset Management is the asset management arm of insurance group Sampo, and our philosophy of managing clients’ assets is characterized by jointly investing in products with Sampo Group’s balance sheet assets,” explains Gallotti. “When we invest our clients’ money, we often also invest Sampo Group funds in the same assets; our integrated investment process aims to identify the best possible opportunities and aligns us with our customers,” he emphasizes. While that does not necessarily mean Mandatum Asset Management would have performed a less detailed and careful due diligence if it were not investing Sampo Group’s assets, there’s empirical proof showing that having skin in the game leads to outperformance. After all, Sampo Group and MAM are eating their own cooking via this co-partnership philosophy.

Product Range, and Article 9 Version

Mandatum Asset Management manages three strategies investing in the leveraged loans space, one closed-ended, opportunistic fund and two open-ended senior secured loan funds. “We manage close to €700 million across these three funds, with an additional €1 billion+ of Sampo Group’s balance sheet assets invested in the same underlying investments,” says Gallotti. The most recently-launched vehicle in the secured loans space is an SFDR Article 9 fund with a sustainable investment objective that invests across the European leveraged buyout space. The fund is an alternative investment fund (AIF) for (semi-) professional European clients and focuses on European and Nordic syndicated, as well as club-style leveraged loans.

“With the Article 9 fund, we not only focus on quantifying the positive outcomes the company achieves, but also measure the possible negative impacts to achieve those outcomes.”

In addition to having a traditional ESG assessment incorporated into the credit analysis process, Mandatum’s Article 9 Senior Secured Loan Fund also quantifies the sustainability objective for each particular investment. “We validate our assessment of the sustainability objective of each investment through a third-party company that helps us in quantifying the net impact of that company’s products and services to society,” explains Gallotti. “In the other senior secured loan funds, we aim to identify potential ESG risks and then try to understand how likely those are to be headwinds for the company in addition to firm-wide exclusion and ESG policies,” he elaborates. “With the Article 9 fund, we not only focus on quantifying the positive outcomes the company achieves, but also measure the possible negative impacts to achieve those outcomes.”

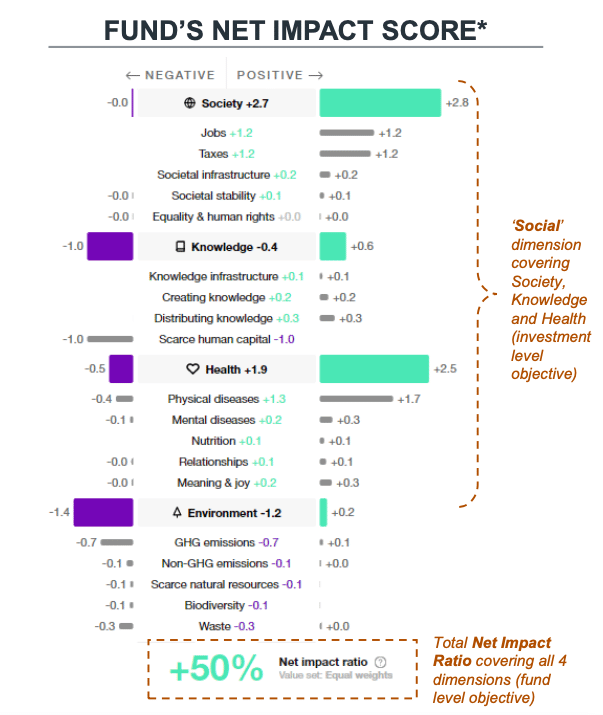

The Article 9 Senior Secured Loan Fund assesses and measures each investment’s net impact on society across four main aspects: environment, health, society, and knowledge. “On a high level, we first assess the negative impact of a company’s resources that are used to create a product or service,” explains Gallotti. “Then we also assess the positive impact of the product or service across these four categories. On a fund level, we target a net positive impact on all of these four dimensions. Although we focus more on the social dimension covering society, health, and knowledge, we do not neglect the environmental part. It is integrated into the whole loan selection process on top of our credit assessment and other ESG streams we run while assessing an investment opportunity,” Gallotti explains.

Expectations

Loans have outperformed bonds amid a difficult 2022 for fixed-income investors as a result of central banks’ aggressive policy pivot to address rising inflation and the uncertainty of the war in Ukraine. And yet, the current yield to maturity in the loans space is still above the yields offered by high-yield bonds. “The current environment in the secured loans market is very attractive in our view as a result of rising rates and the sell-off in the credit market in general,” says Gallotti. “The loan market is offering a yield in excess of 8 percent. If rates continue to rise, that will feed in positively into the returns,” he elaborates. However, successful investing in the secured loans space is “all about credit picking where we try to minimize and avoid pitfalls.” Even so, “current yield levels are well above to compensate even for extremely gloomy default and credit loss outcomes, which is not our base case in the first place.”

This article features in HedgeNordic’s “ESG & Alternative Investments” publication.