London (HedgeNordic) – The first half of 2022 will be remembered as an exceptional environment for systematic managers who specialize in trend-following, commonly known as CTAs. During that time, many CTAs captured the bull market in commodities and the bear market in government bonds, both of which are related to inflation at 40-year highs. Commodities have been boosted by supply chain issues that were somewhat predictable after Covid, and geopolitics that has come as a shock.

Most CTA managers have had no recent experience of trading this sort of environment, but their open-minded models have adapted to the new paradigm much more nimbly and adroitly than most discretionary investors. “We had no real inflation or interest rate shocks in the prior 20 years, but the models have performed well,” says Nicolas Mirjolet, CEO of Quantica Capital AG, based in Zurich, Switzerland.

“We had no real inflation or interest rate shocks in the prior 20 years, but the models have performed well.”

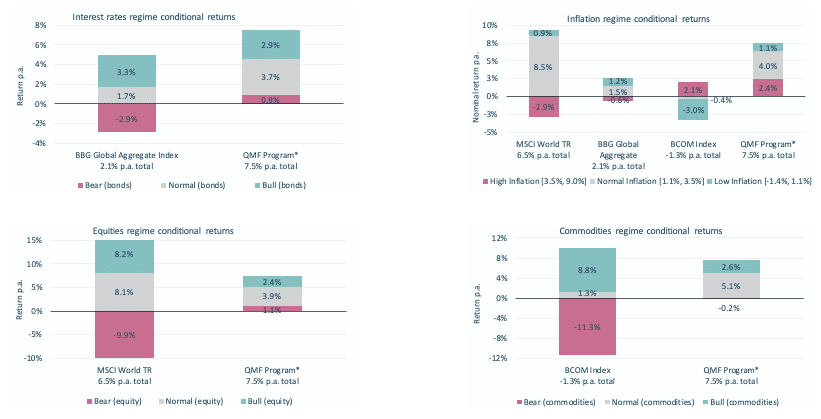

This year has been a cocktail of extreme left tail events for bonds with extreme right tail events for commodities and inflation, but a thorough analysis of CTA performance shows return generation across asset classes – and through bullish, bearish and neutral regimes. Quantica’s analysis of trend following regime resilience breaks down asset class performance into bullish and bearish markets each 16% of the time, with the other 68% being defined as neutral. Using Quantica’s trend models shows that CTAs have, on average, profited under all of these regimes for equities, commodities and bonds – and the distribution of CTA returns per asset class is clustered in a more stable and tighter range than a long only investor would obtain. “This shows there is no long-term link between the macro climate and returns. CTAs offer macro-agnostic returns,” asserts Mirjolet.

”Bear market regime”: when quarterly returns of the market risk-factor are below their 16% percentile >>

“Bull market regime”: when quarterly returns of the market risk-factor are above their 84% percentile >>

“Normal market regime”: when quarterly returns are in-between the 16% and the 84% percentile

*QMF: Net realized returns of the Quantica Managed Futures Program,

** Inflation: Year-on-year change in the headline US Consumer Price Index (CPI) – Source: US Bureau of Statistics

Source: Quantica Capital, Bloomberg. Analysis period: Jan. 2005 – June 2022

Past performance is not necessarily an indication for future results.

Why have trend models stood the test of time so robustly? One market inefficiency being exploited is that financial markets can take time to recognize regime changes. “Markets are slow to react to news and inefficient at incorporating it,” observes Mirjolet. The explanations for this include behavioural finance biases: investors are anchored to the past, and extrapolate from what they feel comfortable with. When a market regime first starts to change, many investors, politicians and policymakers are “in denial”, a psychological state of mind first identified by the Austrian father of psychoanalysis, Sigmund Freud. For example, over many months in 2021 and early 2022, many politicians, central bankers, economists and investors insisted that inflation was only “transitory”, even though each monthly data point kept coming in ahead of estimates. Rather like a naughty child who has to be scolded many times, they needed to repeat the behavioural pattern of being wrong repeatedly before admitting their mistake – and acknowledging that inflation was high, accelerating and potentially persistent.

Now in August 2022, the behavioural biases might work in the opposite direction – the US CPI number for July was just shy of consensus estimates. Recency bias might now lead investors to have blind faith in the “commodity super cycle” narrative – even though many commodities in August 2022 are now below their levels prior to Russia’s invasion of Ukraine.

In contrast, CTA managers have no a priori view on whether inflation has peaked or will continue to rise, but are agnostic about all regimes including the inflation climate. “If inflation comes down, that in itself will generate a new suite of trends to follow. Some trend following CTAs could already be short of wheat, which was a big winner on the long side earlier this year. We do not need faith in the inflation story,” says Mirjolet.

Thus “smart diversification” can profit from positive inflation beta in an inflationary climate, and negative inflation beta in a deflationary climate – and the same logic applies to other risk factors and asset classes.

It is however true that bear phases for some asset classes can, on average, be less profitable than bull phases. Shorting equities is a tough game that needs to navigate violent bear market rallies, but short equity positioning in CTAs does make a positive contribution to their overall risk adjusted returns. Shorting bonds entails negative carry whereas owning bonds in a bull market can capture three sources of return: coupon income, yield curve roll down and capital appreciation. All of these variables can be factored into models, and the shifting dynamics of positive or negative carry feed into CTA positioning.

For many traditional long only investors in 2022, a long allocation to commodities has been the only place to hide with bonds and equities both down. However, a static buy and hold approach to commodities is not necessarily a profitable longer-term strategy.

Investible long only commodity returns have averaged near zero over the past 30 years. The reason for this lies partly in the dynamics of the commodity term structure and negative costs of carry: investible commodity indices have underperformed spot commodity prices by an average of 6% per year, due to negative roll yields, mainly in energy and agriculture. A more flexible approach that sometimes has short exposure, and might blend a mix of longs and shorts, can opportunistically profit from the roll yield.

“Our only hypothesis is that trends exist and can appear in any market at any time. We do not know when or where.”

There is a certain degree of humility in the trend following mindset: “our only hypothesis is that trends exist and can appear in any market at any time. We do not know when or where. We may start trading new markets that would not have been profitable for the past 10 or 15 years, because we cannot predict when trend following will start working for an individual market,” points out Mirjolet.

CTAs can provide particularly powerful diversification benefits for some large institutional investors who are subject to artificial constraints on their investment freedom. “For instance, many pension funds do not have the flexibility to go short and cannot invest directly into commodities,” says Lukasz Wojtowicz, Director of Business Development.

Quantica has been applying its distinctive style of trend following for over 20 years and has delivered returns independent of risk factors.

This article features in HedgeNordic’s “Systematic Strategies” publication.