By Jussi Tanninen (pictured) and Matias Hauru – Mandatum Asset Management: Our approach to responsible investing ensures that we not only account for financial results, but also recognize and consider the environmental or societal impact. As a result, many of our investments and operations are committed to promoting economic, social and ecological sustainability.

Mandatum Asset Management (MAM)’s private debt program takes a unique and differentiated approach to ESG implementation steeped in the firm’s deep history and experience in sustainability and private debt manager selection. We focus on understanding how a manager’s strategy, geographical location and size can impact its ESG position in order to build a truly diversified portfolio and provide our investors with strong risk-adjusted returns.

Portfolio Diversification Influences ESG Analysis

MAM believes that diversification across asset class subsegments is critical to building a balanced private debt program across market cycles.

Historically, MAM has focused on direct lending and opportunistic strategies and maintained an even split between the two strategies. The direct lending strategies provide more stable coupon payments and return profile, while opportunistic strategies provide differentiated risk-return drivers and have the potential for outsized returns in periods of dislocation. As a result of its diversified approach, MAM’s private debt program has generated strong performance and clear alpha compared to its most relevant public market equivalent, the Euro High Yield Index.

The beneficial result of strategy diversification affects our approach to ESG analysis. We evaluate ESG programs and policies with a number of other factors in mind, including strategy or location, similar to how direct lending or opportunistic strategies each play a different role in our portfolio.

Differentiated Approach to ESG Staffing

MAM believes that ESG implementation requires the support of the entire organization, including its investment, ESG and legal professionals. However, MAM takes a differentiated approach to ESG staffing, focusing on building a team with prior investment and operational expertise as opposed to recruiting ESG professionals who then need to learn about our investment strategies or the legal framework of alternative funds.

MAM’s dedicated ESG team has previous and direct experience in private markets, legal matters, credit portfolio management and reporting, along with significant expertise in ESG policies and procedures. Although the starting point for ESG implementation is with the portfolio management team, we believe that this approach allows our ESG team to truly evaluate the sustainability factors of a potential investment in the context of the full portfolio’s strategy and risk-return targets.

For the private debt program, the ESG team actively works with portfolio managers to review each target fund from an ESG standpoint. With their added investment experience and perspective, the ESG team can provide their analysis of a target manager and fund’s ESG program as compared to other managers within a subsegment and with an understanding of how the target fund also affects the program’s portfolio construction.

In addition to the ESG team, the portfolio management team looks at each deal from an ESG angle, beginning from the first meeting with the target manager and fund. The portfolio managers work closely with the ESG team throughout the due diligence process to create an informed decision on each potential investment based on financial and sustainability factors. Finally, the legal team is also critical to the legal review and negotiation of each target investment to ensure the implementation of responsible investing principles.

Rigorous Investment Process and Monitoring

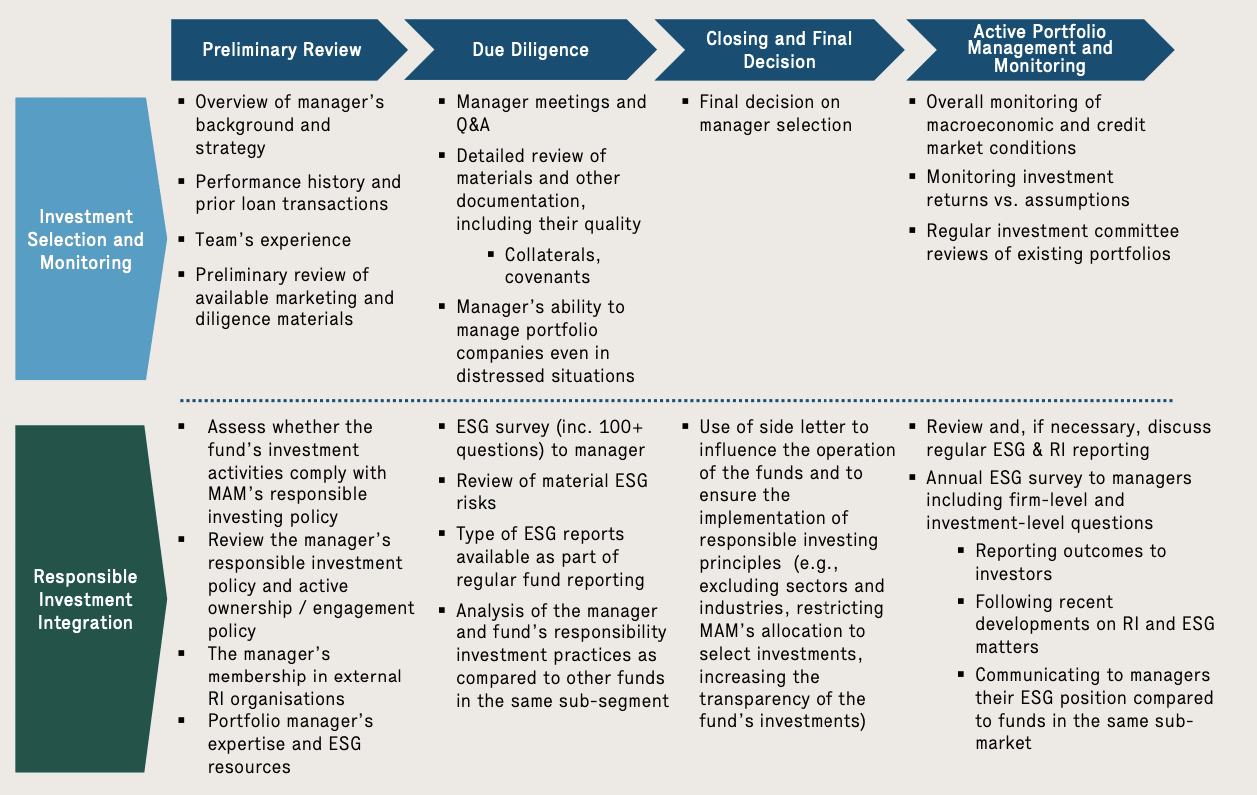

An ESG analysis is fully incorporated into the due diligence process and the continued monitoring of our managers and their funds, as demonstrated in Figure 1. In a fund of funds program like our private debt program, MAM believes the due diligence process and legal negotiations are the most important times to influence ESG matters. The ESG team leads the sustainability-related diligence and monitoring while working closely with the portfolio managers, who lead the investment diligence and monitoring.

Preliminary Review

During an introductory meeting with a manager, the team will review the target manager’s responsible investing policy, membership to RI organisations and its ESG team and resources. MAM will also analyse whether the fund’s investment activities comply with our responsible investing policy. Based on the preliminary review of the manager’s investment experience and track record along with its ESG policies and practices, MAM will either pass on the opportunity or move into due diligence.

Due Diligence and Proprietary Survey

A key part of MAM’s ESG due diligence is its proprietary 100+ question survey. Each target manager is required to answer the survey during the due diligence process, as well as annually over the course of the manager’s partnership with MAM.

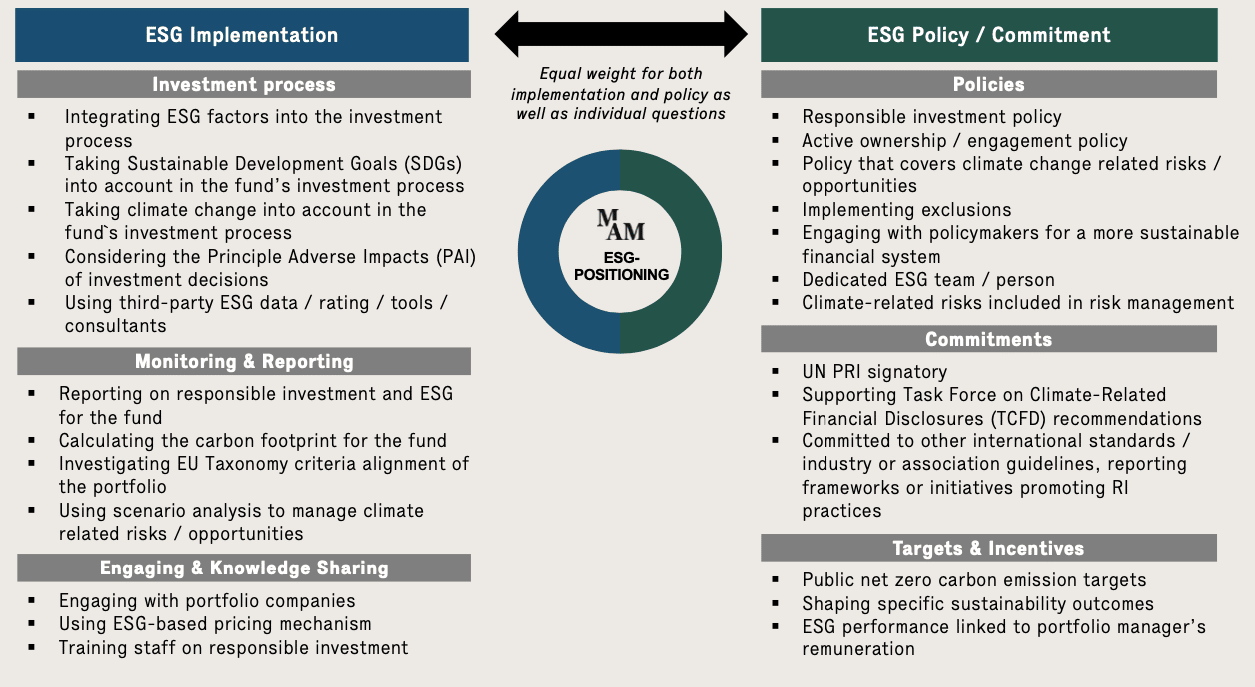

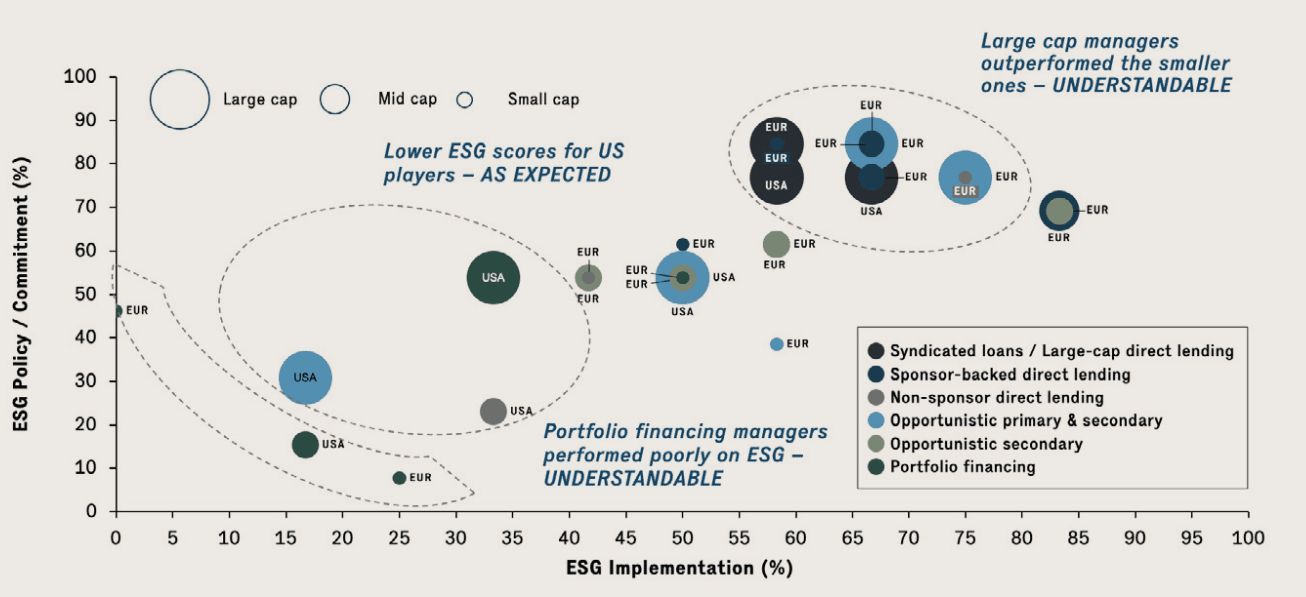

As demonstrated in Figure 2, the survey consists of firm-specific and portfolio-specific questions, which relate to policies and principles, governance, risk management, ESG integration and engagement, along with ESG reporting and resources. Based on survey responses, the managers and funds are classified in a chart (see Figure 3) and compared to other managers and funds within their subsegment. The survey responses and chart allow MAM to review any potential relevant ESG risks and issues and discuss these in further detail with the manager prior to making an investment decision. A copy of the chart is also included in the materials for the Investment Committee to demonstrate how each target manager and fund compares to the program’s existing investments.

The analysis from the survey serves as one tool to evaluate managers and funds’ ESG practices during due diligence. In addition, the ESG team, alongside the portfolio management team, meets with each target manager to discuss the results from the ESG survey in more detail. At this stage, we can also promote the ESG matters that we consider important to the firm and the private debt program.

Legal Review and Closing

Once both the investment and ESG diligence is complete, a final decision will be made whether MAM will invest in the target fund. During legal negotiations, the portfolio management and ESG teams leverage MAM’s legal team and external advisors to influence and ensure the implementation of responsible investing principles, including the exclusion of select industries or increasing transparency into underlying fund investments.

Active Monitoring

Responses to the ESG survey during due diligence allow for active monitoring of the managers’ management of sustainability and development of various ESG matters during the partnership. As referenced, all current managers receive the same questionnaire to answer on an annual basis, and meetings are also held with each manager to conduct a deep dive of their ESG integration and development. In the future, the ESG development of each manager and fund will be compared to other funds within each subsegment. Additionally, investments are monitored by reviewing regular ESG reporting, if available, and managers are strongly encouraged to report on ESG for the fund on a regular basis.

Proprietary ESG Framework Informs Investment Decisions

As discussed, the survey results are a critical part of the due diligence process and ongoing monitoring of active managers. However, the survey results have also shown a number of interesting conclusions regarding the ESG position of our 22 active managers, as shown in Figure 3, that influence our investment selection. Particularly, we see that there are different levels of ESG implementation and commitment based on strategy and geography.

Portfolio Financing Managers

Portfolio financing managers generally have lower ESG scores given the number and types of investments made. On the whole, portfolio financing managers tend to lend to a large number of underlying companies, including small, family-owned businesses, making it hard to manage and review each company’s ESG policy. However, it is important to understand the types of underlying companies that portfolio financing supports. For example, loans by portfolio financing managers to small, family-owned businesses aid local economies, especially during the COVID-19 pandemic, and you cannot expect the same level of reporting from an SME as compared to a large cap PE-owned company.

Small vs. Large Cap Managers

Our large cap managers outperform the smaller managers in the portfolio. On one hand, these managers usually have more resources to develop and build out ESG programs, principles and resources as compared to their smaller counterparts. Additionally, many of the large cap managers we track are focused on private equity and invest in more ESG-focused industries, like healthcare. Similarly, the underlying companies of the small and large cap managers have different levels of ESG implementation. Specifically, small cap companies tend to have more nascent ESG programs and fewer ESG resources as compared to their larger cap counterparts.

United States vs. Europe

As expected, European managers have better ESG scores as compared to their US peers. Historically, implementation and regulation related to ESG has been much more prominent in Europe, leading to more developed and larger ESG resources and capabilities. In the United States, ESG implementation has only recently become a focus for managers, although we are seeing good progress and initiatives, albeit overdue, from these managers.

Primary vs. Secondary Managers

We have also seen a difference in ESG scores between our primary and secondary managers. Overall, our primary managers have scored better given their ability to influence ESG matters during investment and legal diligence. On the other hand, when buying an existing loan on the secondary market, many of the ESG terms in the loan documentation had already been agreed to a number of years ago, which may now be outdated, and challenging to amend or correct.

Influencing Investment Selection

We believe that a target manager and fund’s ESG score from our survey should not ultimately be the only tool to determine whether the investment is attractive based on its sustainability factors. Instead, as seen in Figure 3, we should review the manager and fund’s ESG capabilities in the context of its subsegment and investment strategy. Given their investment background and experience, our ESG professionals are able to complete a comprehensive review of a target fund that accounts for these factors, in addition to the ESG score from the survey.

For example, a portfolio financing manager’s low ESG score could impact declining an investment opportunity. However, comparing the ESG score to other similar managers within the sub-segment provides additional detail on the manager’s ESG position. Additionally, diving deeper into the fund’s intended strategy and understanding that it may improve the local economy through its loans to local small, family-owned businesses offers a completely different ESG perspective of the investment.

Conclusion

MAM takes a dynamic approach to the ESG review and monitoring of our private debt program’s managers and funds. Based on our diversified approach to portfolio construction, we take a wholistic view on the ESG position of our target funds based on its ESG scoring and investment strategy. With our proprietary survey as a base, we have a framework to compare and analyse the ESG program and capabilities of our managers within a subsegment of the private debt market. However, our ability to take a more informed view of our managers’ ESG capabilities is dependent on our ESG professionals, who also have prior private markets and portfolio management experience. We believe that these dedicated professionals are a key differentiator and, alongside our portfolio managers, can help to build a diversified private debt program that reflects both financial and sustainability factors.

This article features in HedgeNordic’s “Private Markets” publication. The article was originally published here.