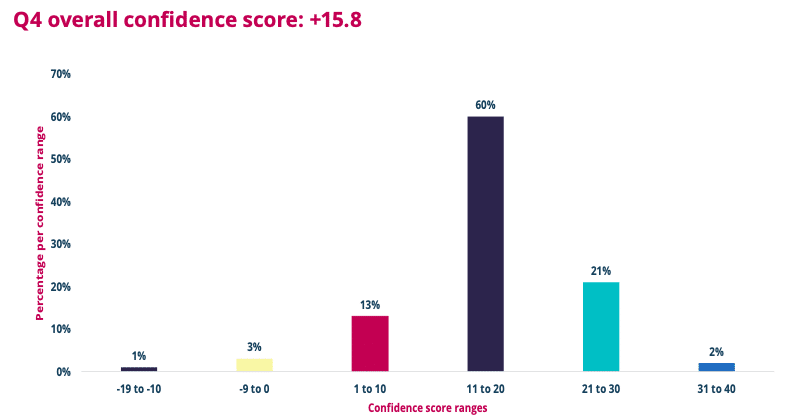

Stockholm (HedgeNordic) – Confidence across the hedge fund industry has edged down in the fourth quarter amid challenging market conditions and concerns about inflation. Based on a sample of more than 300 hedge funds accounting for around $1.7 trillion in assets, the average measure of confidence as reflected by the AIMA Hedge Fund Confidence Index (HFCI) stands at +15.81 for the fourth quarter, nearly five points lower than the score reported in the third quarter.

“The Q4 reporting period coincided with a significant market selloff and also concerns regarding inflation, and so that could be some of what we are seeing in these results,” says Nicholas Miller, Senior Associate, Investment Management at Seward & Kissel. AIMA joined forces with Seward & Kissel and Simmons & Simmons to create the new global index that measures the level of confidence among hedge funds in the economic prospects of their business over the next 12 months. The HFCI is calculated during the final two weeks of each quarter and published at the start of the subsequent quarter.

“The Q4 reporting period coincided with a significant market selloff and also concerns regarding inflation, and so that could be some of what we are seeing in these results.”

Respondents are asked to choose from a range of -50 to +50 to select the appropriate level of confidence, where +50 indicates the highest possible level of economic confidence for the firm over the next 12 months. Hedge fund respondents are asked to consider the following factors when evaluating their level of economic confidence: their firm’s ability to raise capital, their firm’s ability to generate revenue and manage costs, and the overall performance of their fund or funds.

Although the fourth-quarter score for the AIMA Hedge Fund Confidence Index (HFCI) reflects the lowest confidence score this year, more than 90 percent of all hedge funds that participated in the index are confident in the economic prospects of their business over the coming 12 months. “The results are surprising in that generally we find the market to be optimistic about the prospects of the coming year,” adds Nicholas Miller of Seward & Kissel.

“The downturn in average confidence score for this quarter reflects the intensifying market headwinds of the moment, ranging from the growing volume of regulatory scrutiny to new COVID variants and inflationary uncertainty,” argues Tom Kehoe, global head of research and communications at AIMA. “Regardless, the latest score should not distract from what has been a strong year for many hedge funds overall. The data shows that vast majority of hedge funds remain cautiously optimistic about their economic prospects for the year ahead.”

“Regardless, the latest score should not distract from what has been a strong year for many hedge funds overall.”

The November performance figures indicate that hedge funds gave back some of the gains accumulated over the past 18 months “as financial markets got spooked by renewed fears regarding the spread of the Omicron coronavirus variant and to what extent this would arrest the pandemic recovery,” according to a report accompanying the fourth-quarter results for the HFCI. “Inflationary concerns exacerbated the problem, with bond markets experiencing a difficult time resulting in some macro funds enduring a challenging end to the month.”

Photo by David Clarke on Unsplash