Stockholm (HedgeNordic) – Buzz words in investments come and go, rising to the top of marketing brochures and investor communications. However, it seems that the biggest of them all, sustainability, is increasingly taking root within the very investment strategies of investors.

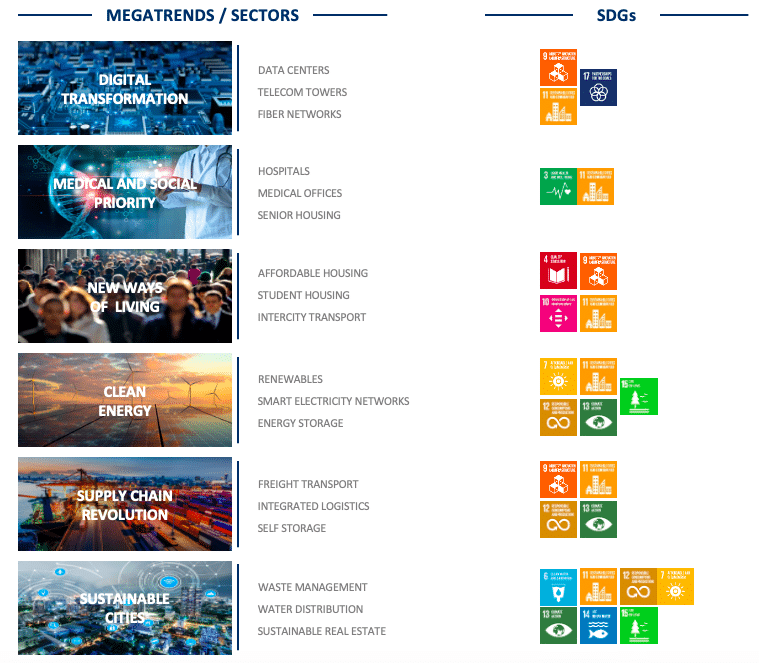

Altamar CAM Partners, the global private markets specialist, is launching its first dedicated co-investment real assets fund with a focus on sustainability. The key to their strategy is investing in previously identified sustainable Megatrends, combining strong industry tailwinds with demonstrable scope for achieving ESG goals. These Megatrends include digital transformation, healthcare, new ways of living, clean energy, supply chain revolution and sustainable cities.

Fernando Olaso is the co-head of Altamar CAM’s real assets team, which has been involved in co-investments since launching in 2004. He was quick to point out that this kind of investing is not new to the team, but the dedicated nature of the product and the top-down focus on sustainability is.

“My team has already accumulated strong investment experience in these Megatrends,” he said. “The environment remains challenging in almost all asset classes, but I believe Altamar CAM has the right mix of dealflow, relationships and team experience to identify attractive investment opportunities. It’s no great secret that a lot of capital is chasing deals in these sectors, but our track-record, experience and access to excellent opportunities alongside trusted managers across Europe and the US put us in a great position.”

Many of these strong relationships with managers come from Altamar CAM’s sizeable fund of funds business, through which Olaso’s team invests in real assets funds across the globe. “Those funds are a great source of co-investment opportunities for us. The managers know us and value us. Most of our team come from a direct investment background which gives us the ability to underwrite direct deals thoroughly and quickly,” Olaso said. “We can move swiftly and this is important because most co-investment opportunities work under tight timeframes.”

Olaso recognises that identifying assets with strong tailwinds does not guarantee success, and that the rigorous research and bottom-up analysis carried out by his team is essential to the success of the fund. “Knowing the sectors is critical,” he noted. “You can have a lousy investment in a good sector. Our outstanding success rate in co-investments is testament to the strength of our due diligence process.”

“Knowing the sectors is critical. You can have a lousy investment in a good sector.”

For the past few years institutional investors have been allocating an increasing percentage of their assets to private equity, real estate and infrastructure, but many are wary of the double layer of fees in co-investment funds. Olaso argues that the way Altamar CAM has set up this fund it is ‘very LP friendly.’ He explained that fees are similar to that of a direct investment fund. “Typically speaking the GPs with which we co-invest can offer us lower fees compared to a direct fund, on average, because we have a relationship with them,” he said.

The sectors that the fund targets, such as clean energy, healthcare or sustainable cities, are by default focused on ESG and sustainability. Interestingly, the fund will mainly target brownfield assets, with a minor allocation to greenfield. Olaso highlighted that there is a huge opportunity to upgrade existing buildings and infrastructure assets, which some sustainability-focused managers might neglect.

Recently Altamar CAM sold a portfolio of multifamily assets to Allianz, the German insurer. Altamar CAM had improved efficiency and reduced the carbon footprint of the assets by more than 60%, and Olaso is convinced that this was a crucial factor in the success of the deal. “Allianz would not have bought it had we not had such a strong sustainability focus,” he said. “Tenants want to lease and rent space that is sustainable and investors want the same.” Olaso noted that Allianz is one of the founding signatories of the UN-convened Net-Zero Insurance Allianz, committed to reaching net-zero greenhouse gas emissions across its portfolio by 2050.

Monitoring and measuring the effectiveness of ESG investments has gained a lot of attention as the popularity of impact investing grows. Olaso pointed out that the purpose of the new fund is not impact investing but ESG enhancement. He said there are several stages where the ESG criteria are checked and consistently measured. “We want to work alongside GPs who have not only strong general ESG objectives and policies in place, but also specifically defined objectives for the assets in which we co-invest. We will be tracking the ESG impact with measurable KPIs and we will produce regular reports to show the progress,” he explained.

“We want to work alongside GPs who have not only strong general ESG objectives and policies in place, but also specifically defined objectives for the assets in which we co-invest.”

Because of the layers of due diligence, the likelihood of an asset being classified as negative from an ESG perspective is extremely low. “We will simply not invest in sectors that rank low from an ESG perspective. Those sectors are banned through our screening system. We have been UNPRI signatories since 2016 – with an A+ rating in all categories – and more recently implemented a company-wide exclusion list,” Olaso added.

“An investment is not a good investment if it is not sustainable in the long run. There is no doubt that investing sustainably is critical for returns.”

The recent COP26 event gained much media attention and Olaso believes it is important to get policymakers, corporates and scientists together to send the right signals. He believes the real engine of change is with the general population and private markets, working together towards a more sustainable future. “An investment is not a good investment if it is not sustainable in the long run. There is no doubt that investing sustainably is critical for returns. We are thrilled to see more investors taking this on board, and pushing the dialogue surrounding sustainability to new levels,” he concluded. “I’m sure this is only the beginning.”

This article features in HedgeNordic’s 2021 “ESG & Alternative Investments” publication.