By Harold de Boer – Transtrend: Reflation is a trending topic in the investment community this year. And the reflation trend has been the most dominant trend in the financial markets during the first half of 2021. Reflation refers to a situation where economic growth and inflation are both accelerating.

It typically follows a recession, and typically includes rising prices of commodities as well as rising stocks. In itself, rising commodities and stocks don’t really hurt most investment portfolios. However, some investors and policy makers feared that reflation could mutate into ‘just’ inflation, which potentially includes significantly rising interest rates. And that would be a regime not necessarily beneficial for investment portfolios. Certainly not for the investments that benefited the most from the low/declining interest rates during the past few decades. And, connected to that, probably also not for some of the investments that benefited the most from the massive global government support in response to the Covid-19 pandemic.

Some investors and policy makers feared that reflation could mutate into ‘just’ inflation, which potentially includes significantly rising interest rates. And that would be a regime not necessarily beneficial for investment portfolios.

The recent reflation regime started off in the first week of November 2020 fueled by optimism about the forthcoming Covid-19 vaccination programs. Dependent on the precise definition, this broad trend essentially fell apart after 10 May when industrial stocks and copper peaked, or after 10 June when energy, metals and mining stocks peaked.

These decoupling points shared a common factor as well: concerns about the spreading of the delta variant. These concerns also seemed to have carried forward the inflation concerns as well as central banks’ intentions to raise interest rates. But once the delta variant concerns fade away, inflation and rate rises will likely be back on the table.

Could investment portfolios have become explicitly or implicitly biased towards low/declining interest rates and towards no/low inflation?

We would no doubt have great commercial success if we could offer a trading program that has empirically shown its effectiveness during periods of rising rates/high inflation in recent years. The problem is, such a program cannot exist, for the simple reason that we haven’t seen strongly rising interest rates nor significant inflation for many years now. At least, not in the economies where our program is predominantly active. This cold reality raises the question: Could investment portfolios have become explicitly or implicitly biased towards low/declining interest rates and towards no/low inflation? As an investment manager we may have allowed such biases to creep into our own program. And allocators may have incurred such biases by predominantly allocating to biased trading programs.

Looking Back

There are different ways such a bias can creep into a strategy. Their common denominator is they look back. Whether we generate ideas based on what we’ve (recently) seen and experienced or explicitly run historical optimizations, whether we use robust hypothesis testing techniques or apply advanced machine learning techniques, whether we use only price data or use alternative data as well, in all cases it’s the past that guides our decisions. For a trend strategy like our own Diversified Trend Program (DTP), such a bias could enter the program along three main routes:

The selected market universe. The best tradable trends in an inflationary scenario don’t necessarily manifest themselves in the same markets as in a non-inflationary environment. For instance, in the past decade or so (though not this year so far), commodity markets generally weren’t showing the best trends. Managed futures programs trading less in commodities tended to outperform programs trading more in commodities during this period. Will that be the same in an inflationary scenario?

The applied trend indicators. The trend indicators performing best in an inflationary scenario aren’t necessarily the same trend indicators as the ones that performed best in the recent non-inflationary environment. For instance, most markets typically don’t move in a symmetrical way — uptrends in commodities and downtrends in bonds, which seem to be most promising in an inflationary scenario, aren’t necessarily comparable to downtrends in commodities and uptrends in bonds.

The risk allocation across the different markets. The largest differentiator between different trend strategies is not which trends are traded in which markets, but the sizing of the various positions in these trends. Whether done more explicitly through historical optimization or through a portfolio risk approach using correlations, the outcome will inevitably be colored by history. Will correlations between markets be the same in an inflationary scenario as in a non-inflationary scenario? That doesn’t seem very likely.

In our experience, solving the correlation issue is the hardest nut to crack when trying to successfully navigate regime shifts. Solely relying on data, often embraced as the holy grail of quantitative finance, almost certainly leads to a suboptimal solution. The way our Diversified Trend Program dealt with the down trending bonds during the first quarter of 2021 may serve as in illustration.

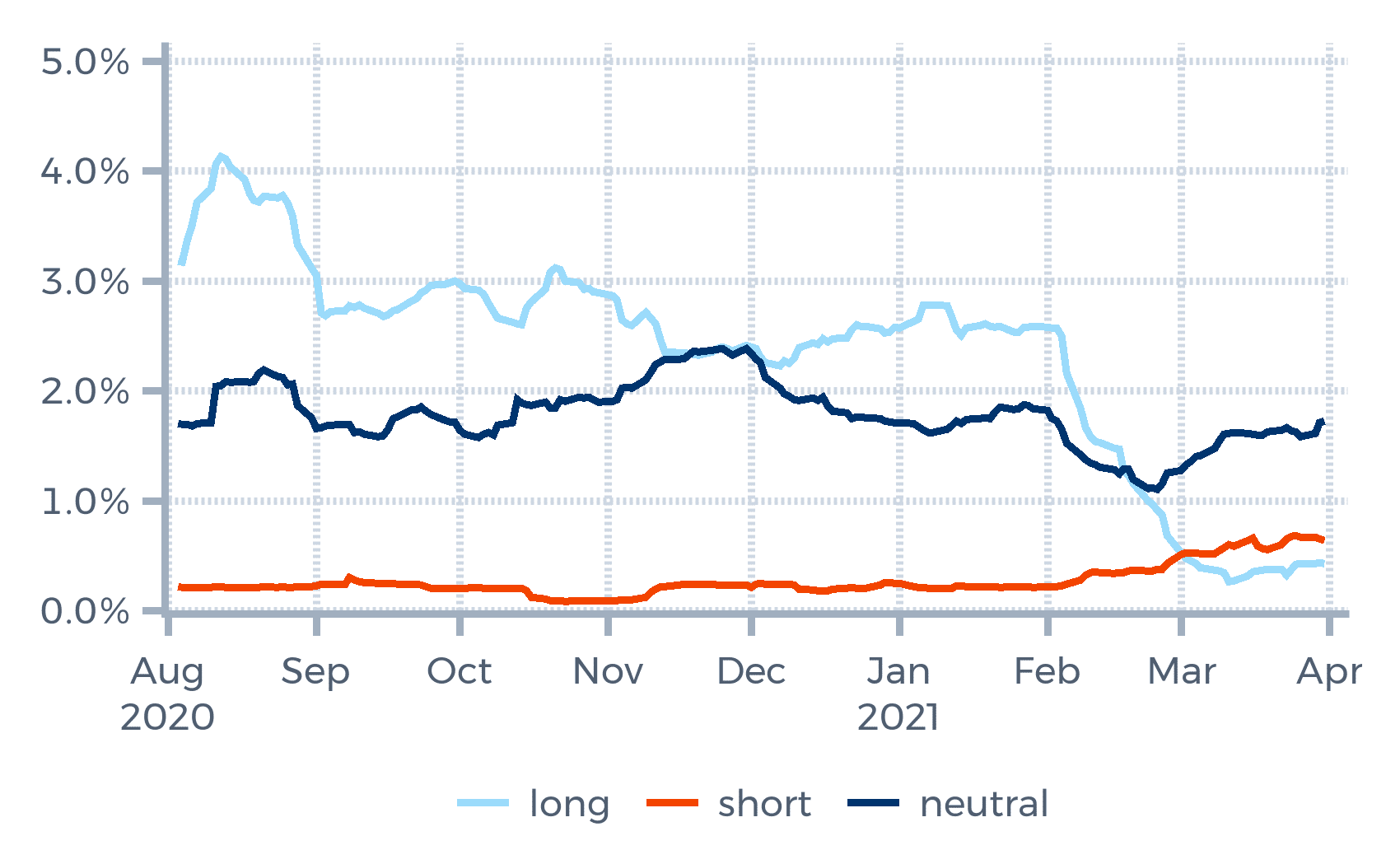

The chart below shows the program’s undiversified risk within the interest rate cluster, split up in long positions, short positions and ‘neutral positions’ (synthetic spreads between different futures contracts, such as long German bonds versus short U.S. bonds). It shows that until the first week of February, DTP was sizably net long. Only since the first week of March did the undiversified risk in short positions outsize the risk in long positions. But still not really a sizable net short position. This might seem somewhat odd and undesirable given the strong downtrend in at least the U.S. bonds since autumn 2020, as illustrated by the chart on the right. Did some form of bias prevent the program from entering into more sizable short bond positions?

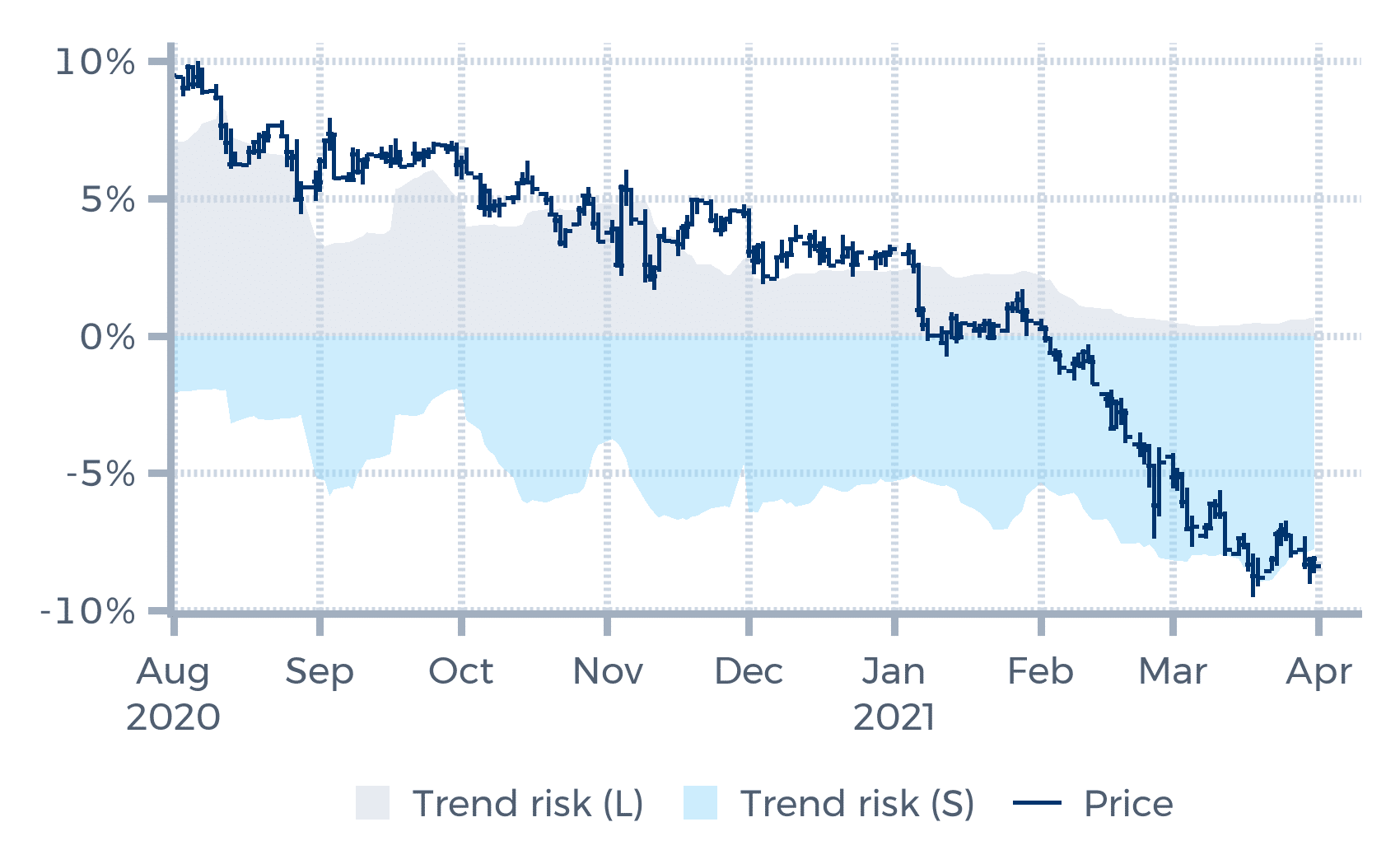

The second chart below doesn’t only show prices, but also the (diversified) trend risk around long U.S bond positions (the grey area) as well as around shorts (the blue area). In contrast to the undiversified risk statistics, this graph shows that DTP did hold a sizable short position in and around U.S. bonds. The difference between the two statistics is made up by the ‘and around’ part — positions in markets correlated with short U.S. bonds. In fact, DTP’s risk measures restricted the size of the short positions in U.S. bonds in order to prevent the trend risk around these shorts from growing too large.

This illustrates the importance of correlations. Without these highly correlated positions, the program’s short positions in bonds could and should have been much larger. So if we for instance believed our correlation measures were overestimating the actual correlations because of outdated data not representative of the current regime, the short positions in bonds should have been larger. It’s our job to make this call.

To be honest, we did believe that some of these measured correlations were outdated, as we knew their history. A part of DTP’s position in the reflation trend were long positions in stocks. As recent history was dominated by risk on/off dynamics, falling stocks were typically accompanied by rising (safe haven) bonds. This explains why correlation measures treated short bonds and long stocks as additive risks. But was this still relevant in the early 2021 environment? Inflation fears introduced the inverse dynamic: rising yields (i.e., declining bonds) triggered declining stocks. As is always the case with correlation measures, it takes some time before the measures fully capture a changed environment.

If reflation really changes into inflation, longs in commodities and shorts in bonds can still be regarded as positions in the same trend — long commodities and short bonds are two of the most popular positions for investors who fear inflation.

But for the largest part of the relevant positions the program held, it didn’t seem that the applied correlations were inflated. Already since before the start of the recent reflation regime, DTP’s largest positions had been longs in commodities. And due to their growing correlation, these positions increasingly added to the risk around short U.S. bonds as well. If reflation really changes into inflation, longs in commodities and shorts in bonds can still be regarded as positions in the same trend — long commodities and short bonds are two of the most popular positions for investors who fear inflation.

Looking Forward

Which brings us to the macro component in DTP. With our program we strive to be sizably invested in different trends. In the past, adding as many markets as possible — including synthetic markets — to the program’s market universe did the trick; the trend indicators would then effectively pick up the trends in these various markets the moment they manifested themselves. However, due to changed market dynamics, the correlation structure between markets changed in such a way that this mechanism gradually lost its effectiveness. Trends were still picked up, but it took the program longer to get sizably invested in a broader trend. Which led to the somewhat paradoxical conclusion: in order to get sizably invested in different trends (again), we needed to be more restrictive in the selection of traded markets.

But how to make that selection? The typical quant approach would be: let history decide. We could for instance backtest which markets historically have manifested the best tradable trends. But that would be the kind of historical optimization that we — among others for the reasons mentioned earlier — have always shied away from. Instead, we opted for a more forward looking approach. As part of our research, we identify and discuss the major themes that could potentially drive markets in the foreseeable future. We discuss which price trends in which markets (including synthetic markets) such a theme could trigger. Subsequently, we make sure that DTP will be able to get sizable positioned in these markets. In essence, this resembles a macro or thematic style of investing. The important difference is: we don’t strive to predict when these trends will start. We don’t even know for sure whether or not these trends will occur, and if they do, whether or not they will occur in the anticipated markets. We leave that part to the applied trend indicators.

Among the recent themes that helped shape DTP’s horizon of traded markets are Brexit, the U.S. elections, the energy transition and of course inflation. With regard to inflation, we seemed to have been somewhat too early. For a few years already, we’ve included various synthetic markets specifically developed to trade some typical inflation trends. The leading idea was that the program should be able to profit well from rising commodities in such an environment. The outstanding performance of the program in the first quarter of 2021, despite the remarkably limited positions directly in shorts bonds, is a fruit of these preparations.

Again, we don’t strive to predict when and how far yields will rise, and neither whether or not we are entering a period with persistent inflation.

Again, we don’t strive to predict when and how far yields will rise, and neither whether or not we are entering a period with persistent inflation. We know our limitations when it comes to predicting. However, what we’ve been working on and what we’ll continue to work on, is to make sure that DTP will be able to perform well also in the potential scenarios where yields do continue to rise and/or inflation does persist. This includes scenarios that didn’t manifest themselves before, so that will not show up in backtests. DTP’s healthy performance so far this year encourages us to continue further along this path.

Explanatory notes & important information

Synthetic markets

Synthetic markets are combinations of outright markets, such as spreads.

Trend risk

Trend risk is defined as the estimated aggregate impact of a major adverse price move in a particular market and the coinciding adverse price effects in all markets currently exhibiting the same trend. Trend risk can be displayed on a portfolio level, a trend level, as well as around an individual market.

Which positions add up to all of the program’s risk concentrations will change from day to day. Risk metrics are not static metrics — throughout the years the definition and the way the program utilizes these metrics have been (materially) changed, see for example our February 2019 and July 2019 Monthly Reports. Risk numbers therefore cannot always be compared over time.

Aggregate directional risk within a cluster

Within a cluster, positions can be long, short or neutral. Within the interest rates cluster, for instance, we can have long positions in interest rate instruments, short positions in interest rate instruments and neutral positions, resulting from explicit interest rate spreads. The aggregate directional risk within a cluster represents the sum of the risk in all individual positions, per side, within that cluster, irrespective of their correlations, and irrespective of associated risk in positions in other clusters.

All risk figures presented in this report are indicative for the Enhanced Risk (USD) profile of DTP.

Source of price data used in this report: Refinitiv, Bloomberg and Transtrend.

THE VALUE OF YOUR INVESTMENT CAN FLUCTUATE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

This article featured in HedgeNordic’s “Quant Strategies” publication.