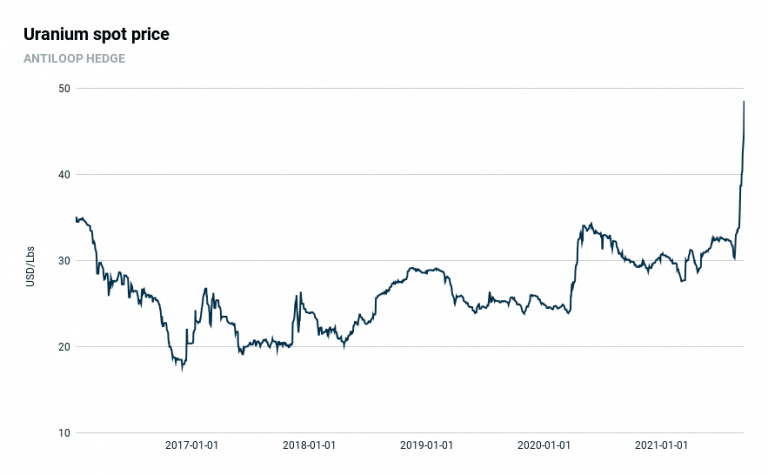

By Anna Svahn, Antiloop Hedge – When I started to write this memo, the uranium spot price was trading around 31 USD/Lbs. Since then, the price has soared over 40 percent in just a few weeks. But why is this? And will future demand for uranium continue to go up as the world tries to shift from fossil fuels to low-carbon energy sources?

Energy access is one of the fundamental driving forces of development today. Ever since the industrial revolution, when we discovered how the energy from fossil fuels could make our work more productive, we have been focused on finding better and cheaper energy sources. But although more than two centuries have passed, 13 percent of the global population still live in energy poverty, and the majority of the energy we use today comes from high carbon emission sources like oil, coal, and gas.

On the 21st of March 1994, the United Nations Framework Convention on Climate Change entered into force to prevent “dangerous” human interference with the climate system. Today, almost 30 years later, it is a near-universal membership with 197 parties all trying to act in favor of the climate.

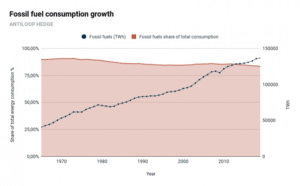

Although the majority of the parties in UNFCCC have signed both the Kyoto Protocol, committing to limit and reduce greenhouse gas emissions, and later the Paris Agreement, which goal is to limit global warming to well below 2 degrees Celsius, compared to pre-industrial levels, the consumption of fossil fuels has since 1994 gone up by 60 percent and still makes out 84 percent of the global energy consumption (2019).

After the Paris Agreement was signed in 2015 and parties started to submit their nationally determined contributions (NDCs), it became clear that even if they were to be fully implemented, it would only be enough to limit global warming to 3 degrees, high above the target of “well below 2 degrees” (United Nations, 2021). This realization led to countries revisiting their original NDCs to take an even stronger grip to cut carbon emissions and reach net zero by 2050.

But how is it really going? And what are the chances we will be able to reach net-zero carbon emissions in less than 30 years from now?

Energy Consumption

Since 1965, global energy consumption has been growing by about 2 percent every year, and this consumption growth is not expected to fall anytime soon. Over that same period, the share of fossil fuels has fallen from its peak of 93 percent to about 84 percent, as mentioned above in 2019, but the total volume is still on the rise.

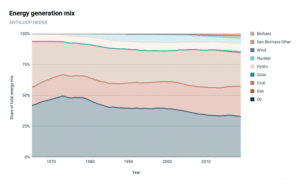

As the world is trying to shift from fossil fuels to low-carbon emission sources, renewable energy sources are growing fast. But, with total consumption still on the rise, we are far from reaching the net-zero emission goal in 2050. Fortunately, politicians have started to realize that solar, wind, and hydropower won’t be enough to answer the growing energy demand, we need something else that is efficient and clean.

A Controversial Option

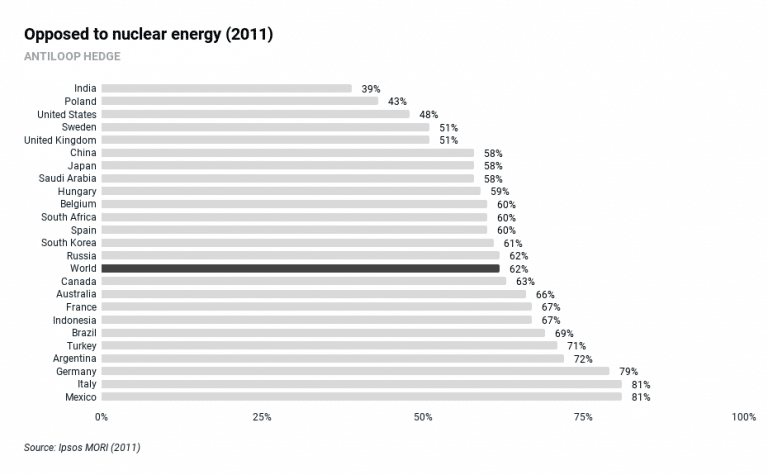

There is only one thing environmental organizations despise more than fossil fuels, and that is nuclear power. After the catastrophes in Chernobyl 1986 and Fukushima in 2011, people have turned against this type of low-carbon emission energy source.

When people are asked about their preferred power generation options from a list of fossil fuels, hydro, nuclear, solar, and wind power, their first choice is usually solar, followed by wind hydro and then coal. In the last place, we find nuclear power. It does not matter that nuclear power today provides the most efficient option for power generation.

Right after Fukushima, IPSOS did a global survey to find out what the global sentiment was regarding using nuclear power, and the answer was clear – most people did not want it in their backyard.

Rational or Irrational Fear

The general fear of nuclear power is far from rational. And even if we have no guarantee against future nuclear accidents, the right way to assess nuclear power is to compare it objectively with other power sources. As an example, did you know that coal power stations expose the public to more nuclear radiation than nuclear power plants?

In 1978, J. P. McBride and his colleagues at Oak Ridge National Laboratory (ORNL) looked at the uranium and thorium content of fly ash from coal-fired power plants in Tennessee and Alabama to see how harmful leaching (the loss/extraction of certain materials from a carrier into a liquid) could be, only to find that the radiation doses ingested by people living near the coal plants were equal to or higher than doses of people living around the nuclear facilities.

However, most are not worried about nuclear power plants as long as they are functional. What we are afraid of, is the potential risk of an accident leading to catastrophes like Chernobyl and Fukushima. But how high is this risk really?

After the catastrophe in Fukushima 2011, Zdenko Šimić et al (2011). did a study on risks related to nuclear power plants. When doing a risk assessment for nuclear power plants, we measure something called core damage frequency (CDF).

The nuclear reactor core is melt to some extent (partially or completely) in the case when generated heat is not sufficiently removed during operation or shutdown mode. This frequency is within the range of 10⁻⁶ to 10⁻³ per year for the fleet of reactors in operation, while the frequency for the ones in construction is estimated to be within a range of 10⁻⁸ and 10⁻⁶.

In clear English, this means, that a fuel meltdown might be expected once in 20 000 years of reactor operation and that in 2 out of 3 meltdowns, there would be no deaths, in 1 out of 5 there would be over 1 000 deaths, and in 1 out of 100 000, there would be 50 000 deaths.

…Or that on average 400 people will die every 20 000 years of reactor operation. Compare that to the 8,7 million people who died as a consequence of air pollution in 2018 alone (Vohra et al. 2019).

What About the Waste?

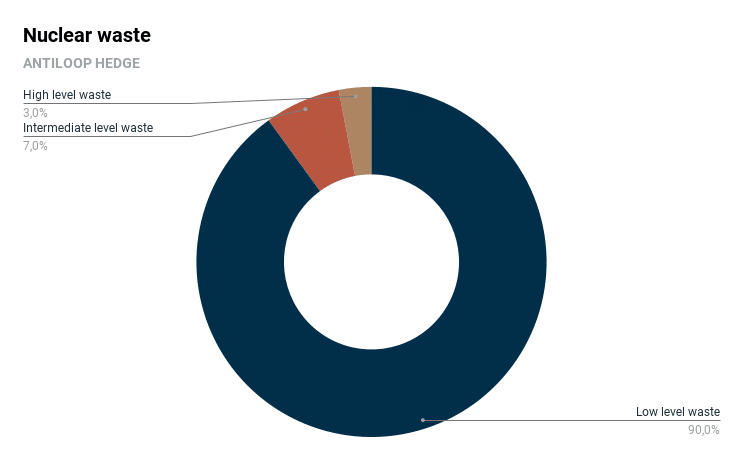

This is probably, after the risk of potential accidents like discussed above, the biggest concern regarding the problems with nuclear power and of course needs to be addressed as well.

Like all industries, the thermal generation of electricity produces waste and must be managed in a way that safeguards human and environmental health. Since the first nuclear power plant came into operation in the 1950s, all of the fuel ever produced by the commercial nuclear industry in the US would only cover a whole football field to a height of about 9 meters. While this might sound like a lot, coal plants generate that same amount of waste every hour.

Second, nuclear waste is divided into three categories: low-level waste (LLW), intermediate-level waste (IWL), and high-level waste (HLW). Categorized as LLW, we have lightly-contaminated items like work clothes or tools, that carry around 1 percent of the radioactivity. IWL refers to filters, steel components from within the reactor, containing about 4 percent of the radioactivity while HLW is the used fuel and contains 95 percent of the radioactivity (World Nuclear Association, 2021).

When people refer to nuclear waste, they often mean the latter, which only accounts for 3 percent of the total nuclear waste. But in countries like France, where fuel is reprocessed and used again, only 0.2 percent of the total waste is classified as HLW. And, not to forget, the nuclear power plants under development right now will be built to run on used fuel (Nuclear Energy Institute, 2021).

But I never intended to write this memo to convince you of the safety of nuclear power plants but to lay out the case for uranium.

What is Going on with the Uranium Price?

I started to write shortly before the uranium spot price soared 40 percent. I am, in other words, far from alone in being positive toward the nuclear sector.

The biggest contributor to the price development is the new commodity-focused Canadian asset manager Sprott, that through its Physical Uranium fund is buying large amounts of physical uranium every day since they share mine and many other investor’s beliefs that nuclear power will be a key part of moving from fossil fuels.

The uranium bubble burst in 2007 when the price in only a couple of years had more than quadrupled. The upward trend could be seen already in 2003, leading to more mining activity. When the price peaked and turned downwards again in 2007, it was due to high oversupply and the price fell quickly from 140 USD/lbs to 41 USD in May when the price turned up again only to fall after the catastrophe in Fukushima. The price continued to fall until mid 2016 to around 17 USD and was trading between 30 to 35 USD just up until one month ago.

What arguments are there for a continuation of this price surge, maybe it’s just a temporary spike?

I’m glad you asked.

Nuclear Activity

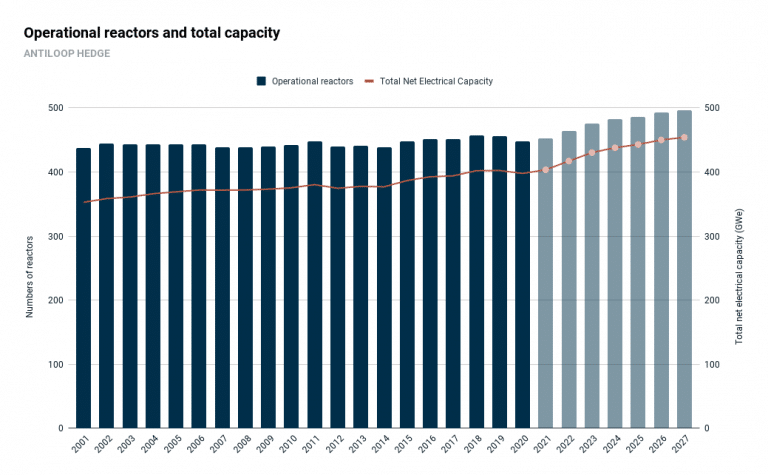

There are 442 nuclear power reactors operating in the world today with a capacity of 398 GWe, with about 50 more in construction. The operational plants can be found in 32 countries today, but in reality, they are providing far more countries with power as countries without power plants are importing nuclear power. As an example, Denmark and Italy get 10 percent of their electricity from imported nuclear power (World Nuclear Association, 2021).

In 2040, 8.5 percent of all the energy is expected to come from nuclear power (compared to about 3.9 percent today). If the energy consumption continued to grow by about 2 percent every year, that would mean that we have to produce 20 895 TWh from nuclear power, compared to 6 923 TWh in 2019, meaning the total production would have to more than triple in less than 20 years.

Today, the US is the world’s largest producer of nuclear power and accounts for more than 30 percent of the worldwide nuclear generation of electricity, but it won’t be the west driving the development forward.

China leads the world in total energy production and produces twice as much electricity as the US does. Since 2012, China has been the country with the largest power capacity and has since then increased its capacity by 85 percent to over 2000 GWe in 2019, or about 25 percent of the global capacity.

As China is moving away from fossil fuels, building nuclear power plants is playing an important role in providing the country with its growing energy demand. China has 51 reactors in operation, and an additional 18 under construction, and is looking to build even more in the future.

But China is far from alone in its plans on letting nuclear power take a larger part of the energy generation mix. In countries like India, where the energy demand is also seeing rapid growth, there are currently 7 reactors under construction that will increase the power capacity by over 75 percent. And these are only two of many examples.

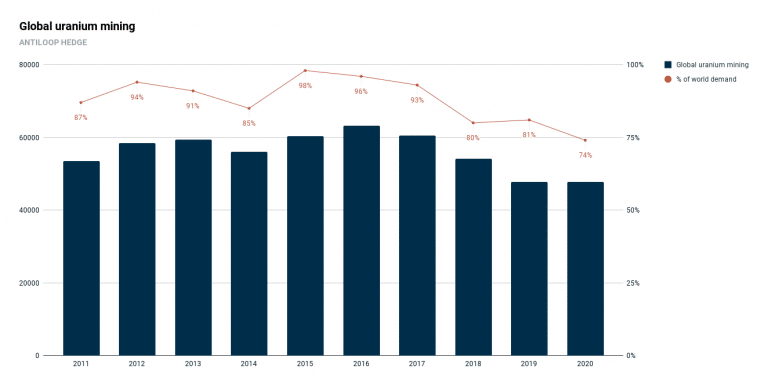

Supply Problem

Since the US and Russia decided to dismantle their nuclear weapons after the second world war, rest-fuel from the weapons has been used as fuel to generate nuclear power. Today, there is not much left of that storage, meaning we will have to mine more to answer to the growing demand. Last year, the global mining production amounted to 47 731 tonnes of uranium, or, 74 percent of the total demand.

About 10 tonnes of natural uranium go into producing one tonne of low-enriched uranium fuel, which is what is most commonly used. One tonne can then be used to generate about 400 million kWh of electricity, so present-day reactors require about 70 000 metric tons of natural uranium a year (Fetter, 2021), meaning the 50 000 tonnes of uranium mined in 2020 is already less than the real demand.

With the spot price falling since 2007, the incentives to invest in and set up a new uranium mine have been close to non-existent, and that becomes even more clear when realizing that the newest uranium mine to open did so almost 15 years ago.

Of the mines currently in operation, Cigar Lake in Canada is by far the biggest producer and accounts for 8 percent of the total mining production each year. In 2019, Cigar Lake produced 8.5 million pounds of uranium, however, due to covid-19 shutdowns, and now a wildfire in the area forcing another temporary suspension of production, they estimate that they will only be able to mine around half of that. Although it is unclear for how long the mine will remain closed, it will with no doubt have big consequences for the global uranium supply.

The Future Generation Mix

That I believe that nuclear will be a bigger part of the energy generation mix in the future, does not at all mean that I don’t feel the same way about renewable sources like solar or wind. About 70 percent of the investments in power generation are going to projects and companies focusing on developing renewable energy (International Energy Agency, 2021). And thanks to the last decade’s rapid technology improvements and cost reductions, a dollar spent on wind and solar photovoltaic deployment today results in four times more electricity than a dollar spent on the same technologies ten years ago.

But, this alone won’t be enough. If we are to reach the net-zero goal before 2050, we need more options, and it is clear, also from a political perspective, that nuclear is beginning to take a bigger role to achieve this goal. Nuclear has been stigmatized, but as technological development is moving forward, so is the safety around these power plants.

Nevertheless, the case for nuclear power remains strong, based on all evidence considering social, economical, and environmental factors. All forms of energy generation carry risks. However, a lack of safety goals, differences in risk perception, methods, values, and distrust threaten to prevent the society from achieving optimal solutions regarding risks and benefits.

Right now, the world is investing heavily in the future generation mix. A set of low-carbon sources will together fuel the world’s energy demand and fossil fuels will at some point become history. However, it is clear to me that nuclear power is part of the future rather than the past.

Image by WikiImages from Pixabay