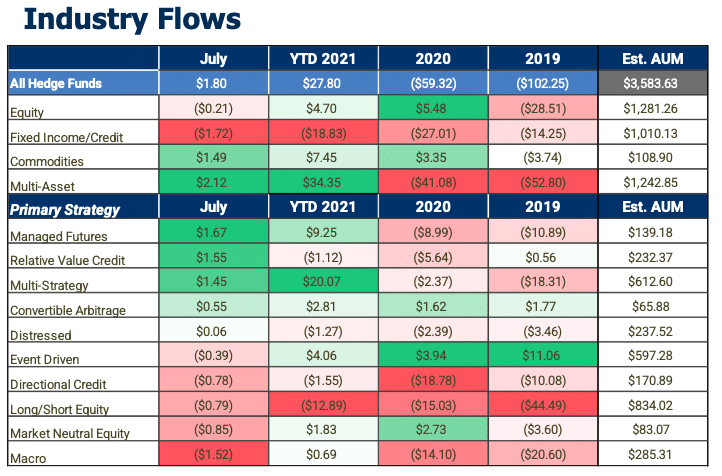

Stockholm (HedgeNordic) – Hedge fund asset flows returned to a positive trajectory in July after settling the month of June in the red. Hedge funds attracted net inflows of $1.8 billion last month, bringing year-to-date net inflows to $27.8 billion, according to eVestment’s Hedge Fund Asset Flows Report for July.

“This year continue to feel like a decent one for the industry, but it’s absolutely not being felt by all, or even by the majority for that matter.”

Managed futures, relative-value credit, and multi-strategy funds received the highest net inflows during July. With net inflows of $1.67 billion for July, managed futures funds enjoyed net inflows in six out of seven months this year. According to eVestment, more than half of managed futures funds received net inflows this year.

Relative-value credit and multi-strategy funds were also among the big asset gainers in July, with relative-value credit funds pulling in $1.55 billion during the month. Net inflows returned to multi-strategy funds, which had enjoyed five consecutive months of net inflows before experiencing net outflows in June. Multi-strategy funds attracted $1.45 billion in net inflows during July, which brought the figure of net inflows for the first seven months of 2021 to $20.7 billion.

With an estimated $1.52 billion in net redemptions, macro managers experienced the largest net outflows as a group in July. The net flows for macro funds were negative for a second consecutive month, though at less than half the prior month’s level. Meanwhile, long/short equity managers experienced net outflows of $0.79 billion in July to take the year-to-date net outflows to $12.89 billion.

“Wide-felt success hasn’t defined the hedge fund industry for a long time, but this year has shown some improvements in the breadth of success metrics.”

“This year continue to feel like a decent one for the industry, but it’s absolutely not being felt by all, or even by the majority for that matter,” says Peter Laurelli, eVestment’s Global Head of Research. “Wide-felt success hasn’t defined the hedge fund industry for a long time, but this year has shown some improvements in the breadth of success metrics. With a global landscape that has continued to highlight uncertainty, it would be surprising to see interest in the industry shift meaningfully in the second half of 2021.”

eVestment ’sHedge Fund Industry Asset Flow Report for July 2021:

Photo by Susan Q Yin on Unsplash