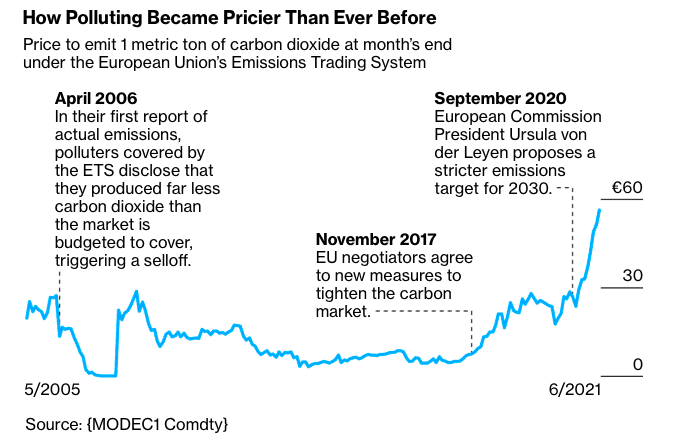

Stockholm (HedgeNordic) – The European Union launched its Emissions Trading System (EU ETS) in 2005 in an effort to create incentives for power generation and energy-intensive industries to slash CO2 emissions. With some of the system’s structural deficiencies of oversupply now fixed, the European Green Deal unveiled this July and broader efforts to cut carbon emissions, the price of carbon credits traded in Europe soared to over €50 per metric ton of carbon dioxide. With the price of carbon credits expected to climb higher, many new carbon-credit-trading funds have been popping up, including hedge fund firm Northlander Commodity Advisors founded and managed by a Swede out of London.

Ulf Ek, who grew up in the town of Töreboda some 300 kilometers away from Stockholm, launched Northlander Commodity Advisors in London in 2013 to bet on the price of carbon emissions going higher. “If you buy carbon emissions, you drive prices up,” Ek tells Bloomberg. “Greed can be a wonderful thing when it works for the benefit of the environment.” With the EU ETS, the European Union has created a market mechanism for putting a price on pollution, which is designed to speed up the shift away from fossil fuels. It becomes more expensive to burn coal and gas with higher carbon prices.

The EU Emissions Trading System works on the principle of ‘cap-and-trade’ by setting an absolute ‘cap’ on the total amount of certain greenhouse gases that can be emitted each year by the entities covered by the system. This cap is reduced over time to drive a decrease in total emissions. EU allowances or carbon permits are auctioned off or allocated for free and can be subsequently traded. At the end of each year, regulated entities must surrender enough allowances to cover all of their emissions. Higher prices for carbon permits encourage companies to invest in alternatives rather than to pay for the right to pollute.

Whereas some argue that many companies may not afford investments in greener technologies due to carbon prices growing too fast, Ulf Ek believes the rapid rise in carbon prices is part of a Darwinian natural selection process. “The firms that are prepared, they will do all right, and the ones that aren’t will fail,” Ek, who used to trade European electricity and gas contracts for about two decades at Enron and Deutsche Bank AG, tells Bloomberg. “The quicker the price goes up, the sooner they’ll invest.”

“We can actually make money in an opportunity that will help the environment.”

Ulf Ek launched his Northlander Environmental Fund to bet on the rise of carbon prices in the European Union, smaller carbon markets in the United States and even new ones in the United Kingdom and Asia. “We can actually make money in an opportunity that will help the environment,” Ek tells Bloomberg. “I can contribute a lot more to a reduction of climate change than I could ever do by giving money to charities.”

Corrections:

Northlander Commodity Advisors was launched in 2013. An earlier version of this article incorrectly said that Northlander Commodity Advisors was launched “earlier this year.” (Corrected on December 8).

Photo by Chris LeBoutillier on Unsplash