Stockholm (HedgeNordic) – The asset management arm of Swiss bank UBS has launched a portfolio that solely invests in female-led hedge funds in an effort to spot fresh talent and improve diversity in the male-dominated industry, according to the Financial Times. The UBS Carmen portfolio will aim to allocate to 10-15 funds globally where women are sole or joint managers or have significant influence over the research behind algorithms in the case of systematic vehicles.

According to Preqin, female representation in hedge funds equals 18.6 percent, the second-lowest across seven alternative asset classes. The proportion of women who make it to the senior ranks in the hedge fund industry sits at a lower 10.9 percent. The Financial Times writes that UBS has built a database of more than 340 women who are sole or joint managers, or in the case of computer-driven vehicles, have significant influence over the research behind the algorithms. The UBS Carmen portfolio will be actively managed using quantitative and other analysis to select the underlying funds.

“Women-led funds struggle to attract as much capital as male-led peers.”

According to the Financial Times, Claire Tucker, senior investment officer at UBS’s hedge funds unit, said that women had been “under-represented, particularly on the investment side, despite a lack of evidence justifying that by skill or performance differences.” Tucker went on to emphasize that “women-led funds struggle to attract as much capital as male-led peers,” noting that “there has been an increase in client interest in diversity.” Tucker said that UBS had been “asking more difficult questions [of hedge funds], such as: ‘Why are there no women on the investment team?’”

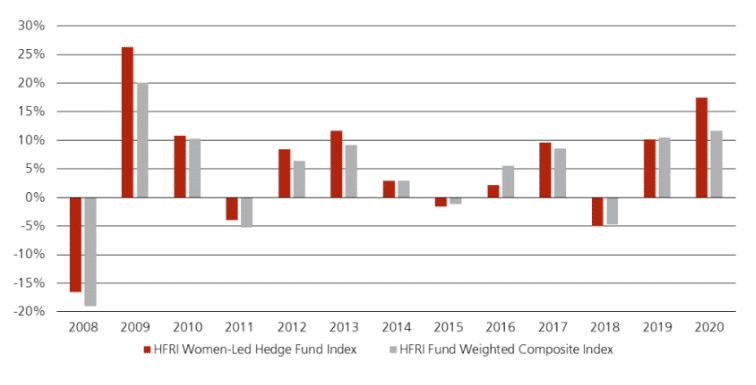

Women-led hedge funds were able to limit losses better than the funds run by men during the market plunge at the beginning of last year while also profiting from the subsequent market rebound. The HFR Women Access index, which tracks the performance of women-run hedge funds, returned 6.5 percent in the first half of 2021, while the HFRI 500 Fund Weighted Composite was up 9.2 percent.

Photo by Tim Mossholder on Unsplash