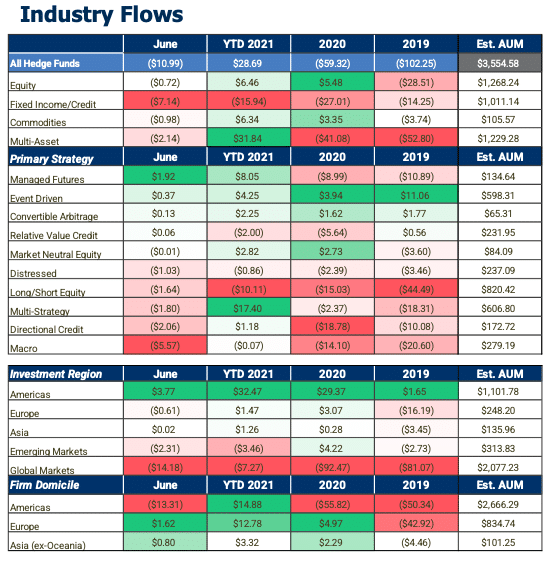

Stockholm (HedgeNordic) – The global hedge fund industry ended the first half of this year with a second month of outflows, as investors withdrew about $11.0 billion from the industry during the month of June, according to eVestment. However, net flows for the first half of 2021 remain positive at $28.7 billion.

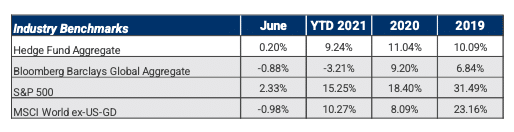

At the mid-way point of 2021, the hedge fund industry recouped almost half of the $59.3 billion investors pulled from hedge funds last year, according to eVestment data. The industry’s strong performance in the first half of the year – the average hedge fund gained 9.2 percent year-to-date through the end of June – propelled the industry’s assets under management to $3.55 trillion.

“The June data does not paint a negative portrait overall,” says Peter Laurelli, eVestment’s Global Head of Research. “The volume of net flow was relatively light and the proportion of products with redemptions in June was below the prior five-year average. While net outflows are by definition a negative, the redemptions in June are not overly concerning amid an otherwise positive year for the hedge fund business.”

Managed futures funds received the highest investor interest in June, with the group attracting a net $1.92 billion during the month. Managed futures vehicles received an estimated $8.05 billion in net inflows in the first half of the year. “From Q2 2018 through Q2 2020, Managed Futures funds had net outflows in every single quarter,” says Laurelli. “But the onset of the pandemic appeared to change investors’ sentiment to the group,” he continues. “Performance has been a key theme for relative success within the group this year. Managed Futures products dominating the inflow picture in 2021 returned an average of almost 9% last year and just over 8% so far this year.”

“From Q2 2018 through Q2 2020, Managed Futures funds had net outflows in every single quarter. But the onset of the pandemic appeared to change investors’ sentiment to the group.”

Macro funds, meanwhile, experienced net outflows of $5.57 billion during June, pushing year-to-date asset flows into negative territory at $70 million. Discretional credit funds also experienced large investor redemptions last month, with investors pulling $2.06 billion from this group in June. The group’s estimated net flows remain in positive territory at $1.18 billion at the mid-point of the year.

eVestment’s Hedge Fund Industry Asset Flow Report for June 2021:

Photo by kaleb tapp on Unsplash