Stockholm (HedgeNordic) – Nordic hedge funds lost 0.9 percent on average in October (90 percent reported), ending a six-month streak of positive returns. The Nordic hedge fund industry, as reflected by the Nordic Hedge Index, is up 1.8 percent year-to-date through the end of October.

Month in Review – October 2020

All five strategy categories in the Nordic Hedge Index posted losses for the month of October. CTAs, equity and multi-strategy hedge funds led the losses, whereas fixed-income hedge funds edged down by an estimated 0.1 percent last month. Fixed-income vehicles, one of the two strategy groups in positive territory for the year, advanced 2.4 percent on average in the first ten months of 2020. Equity hedge funds fell by 1.3 percent on average in October, trimming the group’s year-to-date advance to 5.0 percent. CTAs and multi-strategy hedge funds were down by a similar 1.3 percent last month. Funds of hedge funds, meanwhile, were down an estimated 0.4 percent in October.

At a country level, the Danish hedge fund industry incurred the smallest loss in the Nordic region last month, with Danish hedge funds edging down by 0.3 percent on average. Danish hedge funds, this year’s best-performing group at a country level, gained 2.7 percent in the first ten months of 2020. Swedish hedge funds, which account for the largest portion of the Nordic hedge fund industry with 77 listed funds, were down 1.1 percent on average last month to trim the group’s year-to-date advance to 1.2 percent. Finnish hedge funds lost 2.0 percent on average last month, cutting the year-to-date performance to 1.9 percent. Norwegian funds, meanwhile, were down 1.0 percent in October, which brought the group’s 2020 advance to 2.1 percent.

The dispersion between last month’s best- and worst-performing members of the Nordic Hedge Index decreased month-over-month, but the magnitude of losses for bottom performers was larger than the magnitude of gains for top performers. In October, the top 20 percent of Nordic hedge funds advanced 1.9 percent on average, while the bottom 20 percent lost 3.7 percent on average. In September, the 20 percent were up 3.5 percent on average and the bottom 20 percent lost 2.7 percent on average. About one in every four members of the Nordic Hedge Index with reported October figures posted gains last month.

Top Performers

Thematic-focused long/short equity fund St. Petri L/S was last month’s best-performing member of the Nordic Hedge Index with a gain of 8.6 percent, which brought the fund’s year-to-date advance to 65.7 percent. The fund managed by Michal Danielewicz and Jens Larsson out of Copenhagen currently ranks as this year’s best-performing hedge fund in the Nordics. Energy transition-focused Proxy Renewable Long/Short Energy followed suit with a monthly gain of 8.1 percent, which brought the fund’s performance for the year further into positive territory at 48.6 percent.

Polar Multi Asset, an Oslo-based multi-strategy hedge fund that has been maintaining a big short bet against equity markets, advanced 8.0 percent in October to recoup some of the losses incurred during the summer and take the fund’s year-to-date performance back in positive territory at 6.4 percent. RPM Galaxy, one of the two CTA vehicles of RPM Risk & Portfolio Management, gained 7.0 percent in October to trim the year-to-date decline to 8.6 percent. Climate-focused market-neutral equity fund Coeli Energy Transition advanced 3.0 percent in October, taking its year-to-date performance in positive territory at 0.9 percent.

Biggest Positive Surprises

Hedge funds exhibit different risk-return profiles and hence experience different levels of volatility in their returns. With a gain of 8.7 percent for October, St. Petri L/S experienced the biggest surprise last month relative to its historical level of volatility. Last month’s gain was 2.3 standard deviations above zero. Paradigm-focused long/short equity fund Adaptive Paradigm Alpha, meanwhile, gained 1.2 percent in October, which was 2.2 standard deviations above zero.

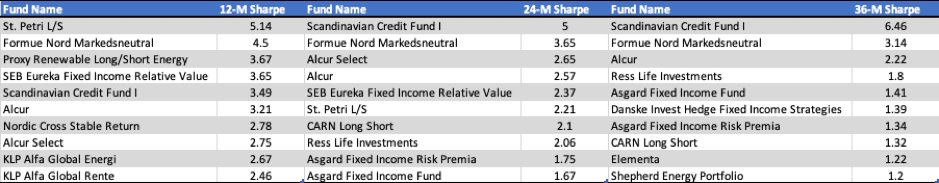

Highest Sharpe Ratios

Given the heterogeneous nature of hedge fund strategies, absolute performance numbers do not always reflect how successful hedge funds are. Risk-adjusted measures such as the Sharpe ratio are a good starting point in the process of identifying the best-performing hedge funds. The three tables below display the Nordic hedge funds with the highest Sharpe ratios over the past 12 months, past 24 months and 36 months.

The Month in Review for October can be downloaded below:

Photo by Maddi Bazzocco on Unsplash