Partner Content (CME Group) – Volatility can change frequently and, sometimes, dramatically. Change can create opportunity. Today, many market participants view volatility not only as a concept, but as a tradeable measure.

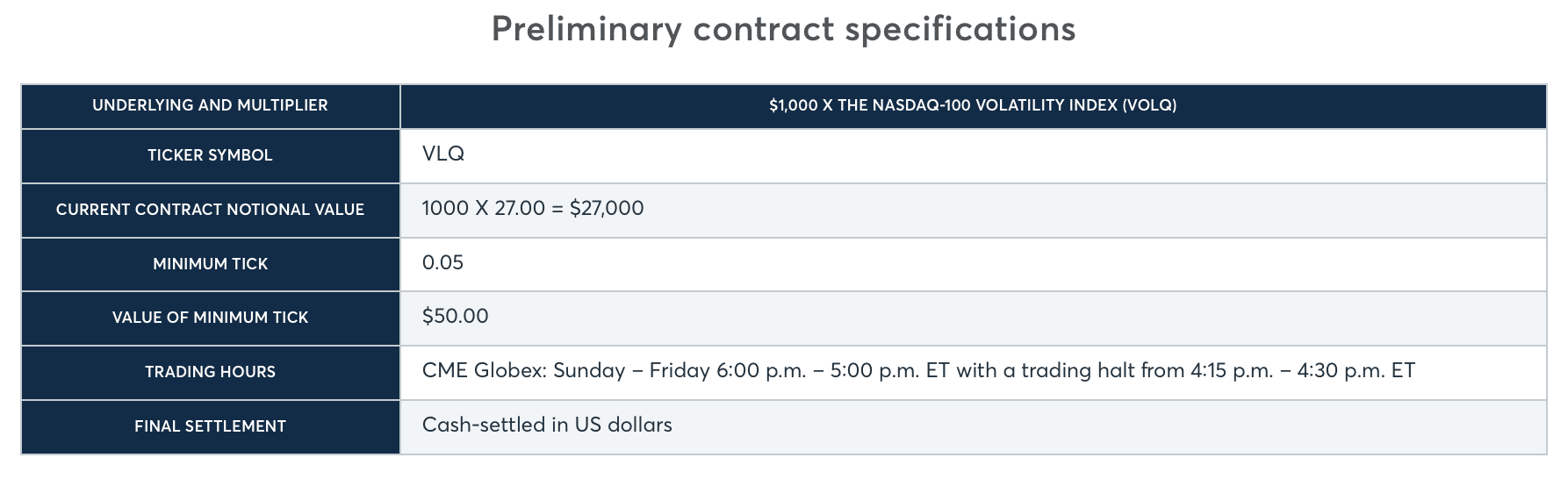

Nasdaq-100 Volatility Index futures, or VolQ futures, provide a way to hedge exposure to, or express a view on, the implied volatility of the Nasdaq-100 Index.

About the underlying index

The VolQ Index underlying the futures contract is an at-the-money focused approach to volatility measurement. The index is calculated based on the values of 32 Nasdaq-100 Index options: the two nearest in-the-money and out-of-the-money puts and calls for the next four weekly expirations.

VolQ futures estimate the implied volatility of at-the money options with 30 days until expiration. Therefore, at any given time, the futures reflect an estimate of forward volatility, which is the expected volatility of the Nasdaq-100 Index for the 30-day period that starts on the futures expiration date.