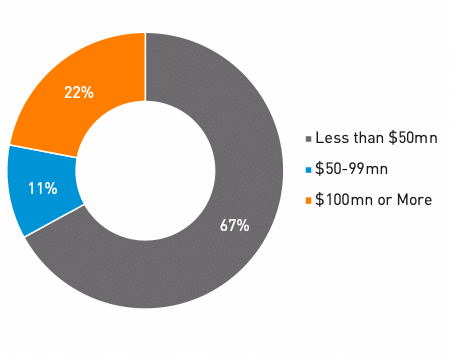

Stockholm (HedgeNordic) – Hedge funds recouped the losses incurred in February and March after a strong second quarter, but hedge fund investors are not in a hurry to commit fresh capital. About two-thirds of hedge fund mandates issued by allocators in the second quarter were for total commitments of less than $50 million, writes Preqin. There were no mandates issued for investments of $300 million or more, down from nine percent in the first quarter.

“Hedge funds were buoyed by a general market bounceback in Q2, and were able to wipe out losses incurred in Q1,” Christopher Beales, Hedge Fund Spokesperson, said in a statement. “There is an opportunity for funds to capitalize on investors’ shift in sentiment if they can demonstrate their defensive capabilities, but it will still be an uphill battle,” he continued. However, “overall sentiment remains low, and new funds in particular face a challenge in convincing investors to take a chance on them,” pointed out Beales.

About 67 percent of mandates issued by investors in the second quarter were for total commitments of $50 million or less, equal with the proportion recorded in the first quarter. In the second quarter, however, larger mandates became less common. According to Preqin, there were no mandates issued for investments of $300 million or more in size in the second quarter, down from nine percent in the first quarter. “Hedge fund investors were cautious in the second quarter of 2020,” writes Preqin.

Based on fund searches in the second quarter, investors had the most appetite for long/short equity strategies, “perhaps in anticipation of equity markets’ continued recovery.” Long/short equity strategies featured in 64 percent of mandates. Long/short credit strategies, meanwhile, appeared in 36 percent of mandates, up from 23 percent in the first quarter. “Amid dislocated credit prices and potential distressed opportunities, a number of managers announced plans to target the credit space in Q2 2020,” writes Preqin. There was no appetite for funds of hedge funds, as no active mandates for this group were issued in the second quarter.

Photo by Mika Baumeister on Unsplash