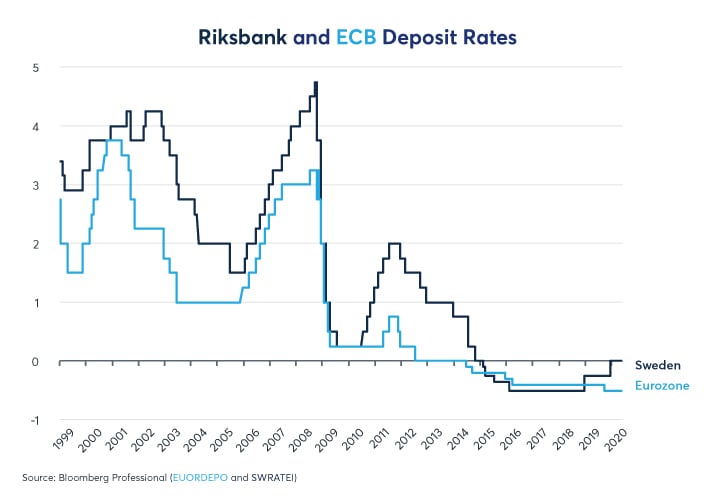

Partner Content (CME Group) – At the end of 2019, Sweden’s Riksbank initiated a policy change at a time when the much larger European Central Bank (ECB) announced its determination to persist with its negative interest rate policy. The Swedish central bank did something that no major central bank has done during the past six months: increase interest rates. However, this wasn’t merely a normal interest rate hike from one level to another above zero; the Riksbank raised rates from -25 basis points (bps) to zero, becoming the first central bank to exit negative interest rates (Figure 1).

Under normal circumstances, it would have been interesting to watch how Sweden’s economy and currency behaved with interest rates no longer in the negative. Would there be any perceptible difference in the trajectory of Sweden’s economy and exchange rate with respect to that of the Eurozone, Denmark and Switzerland, all of which still maintain negative central bank policy rates? Even under the best of circumstances, this couldn’t have been a controlled experiment. Sweden has a highly open economy. Exports account for 27% of its GDP, and 48% of those exports head to countries whose central banks impose negative short-term interest rates. So, even under ideal circumstances, Sweden’s economy would have been indirectly influenced by the negative short-term interest rate polices of its close trading partners.

That said, circumstances for observing the impact of Sweden ending its negative policy rates have been far from ideal. As the coronavirus spread around the world, countries adopted very different strategies to deal with its fallout. Many Eurozone nations went into lockdown. By contrast, Sweden took a different path: it closed high schools and universities, discouraged its citizens from domestic travel and largely closed its borders to international travel, while leaving primary schools and businesses, including bars and restaurants, open, along with parks and playgrounds. Sweden’s economic activity fell but, as of the end of the first quarter, it hadn’t fallen as much as the Eurozone average (Figure 2). So far, the Riksbank has resisted returning its policy rate to negative territory, while the ECB lowered its policy rate from -0.4% to -0.5%.

The trajectory of Sweden’s GDP relative to that of the Eurozone remains a question mark. While Sweden’s economy outperformed the Eurozone in Q1, Eurozone nations such as France, Italy and Spain have begun gradually reopening their economies. Moreover, Sweden’s exports to the Eurozone, which amount to 10% of GDP (and over 12% if one counts Denmark, who’s currency is pegged to the euro). Sweden’s exports will almost certainly suffer as a result of the damage to the Eurozone economy where activity in some nations fell by over 25% during March and April. Since export agreements are often negotiated several months in advance, the extent of the economic damage to Sweden may not become fully apparent until this summer.

The exchange rate between Sweden’s krona (SEK) and the euro (EUR) appears to be heavily reliant on Sweden’s trade balance relative to that of the Eurozone. It’s been a rough seven years for EUR. Since the end of 2012, EUR has fallen 19% versus the US dollar (USD). As bad as that is, it’s much better than the SEK, which, over the same period, slid 19% versus EUR and 34% versus USD. SEK hasn’t traded this low versus EUR since the depths of the financial crisis in early 2009 (Figure 3). Currently, SEKEUR is about 15% below its average level of the past two decades.

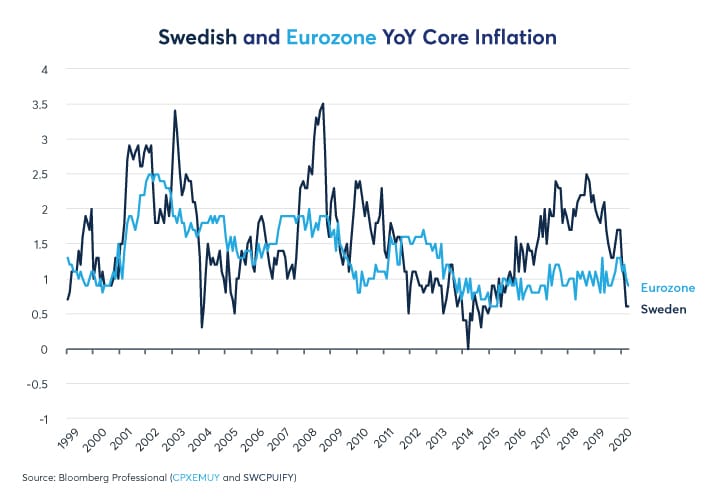

Inflation, unemployment and GDP growth don’t really explain SEK’s underperformance. Sweden’s inflation rate has been more volatile than that of the Eurozone but not consistently higher (Figure 4). Before the pandemic hit, Sweden’s unemployment rate was nearly always lower than that of the Eurozone (Figure 5), although it wasn’t falling as quickly. For the most part, Sweden’s real GDP grew more quickly than that of the Eurozone, which would normally be an argument for a stronger currency rather than a weaker one.

The one factor that appears to explain SEK’s weakness is trade. Sweden’s trade surplus has been shrinking since 2007. Starting in 2012, the Eurozone moved into a trade surplus, owing to a weaker EUR and lower wages in places like Greece, Portugal and Spain improving competitiveness while limiting demand for foreign products. Meanwhile, Sweden’s trade surplus continued to shrink. As of 2018, the last year for which we have complete data, Sweden and the Eurozone had similar trade balances with respect to their GDPs (Figure 6).

As such, the future of the SEKEUR exchange rate may be driven by trade and Sweden’s relative competitiveness with respect to the Eurozone, Denmark and its other trading partners. To that end, the relatively strong performance of Sweden’s economy so far in 2020 could lead to a further decline in the Sweden’s trade surplus. Though hardly unscathed by the pandemic, Sweden’s imports of goods from Europe and elsewhere might not fall as much as Sweden’s exports. If that’s the case, it could ultimately prove bearish for SEK, which might fall further to keep Sweden’s exports competitive with its peers. On the other hand, if Sweden’s economy remains more resilient than the Eurozone’s, that could work to SEK’s advantage.

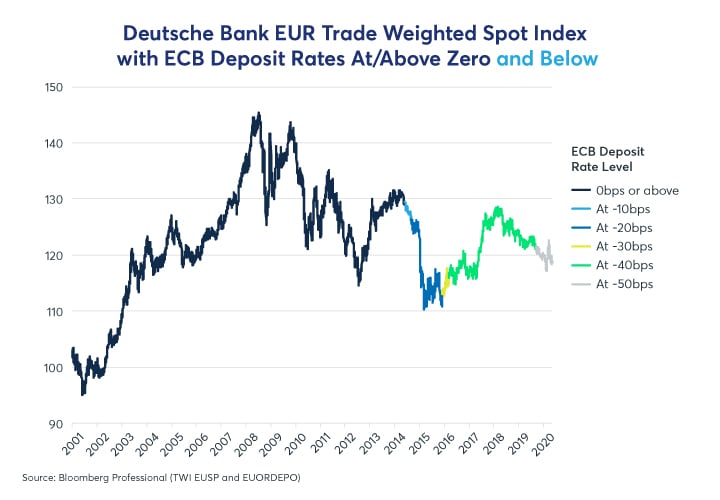

So far, among the currencies whose central banks have experimented with negative rates, SEK is the only one that has declined on a trade weighted basis (Figure 7). As the Riksbank took rates to as low as -50bps, SEK fell, although less rapidly than it had prior to the advent of negative policy rates in 2014. This begs the question: is ending the negative rates policy likely to be bullish or bearish for SEK?

Among the other currencies whose central banks have gone to negative rates, most of them have strengthened. The Japanese yen began rallying the day after the Bank of Japan set policy rates to negative in 2016 (Figure 8). Something similar happened in Switzerland (Figure 9) as the Swiss National Bank cut rates to negative levels. In the Eurozone, the initial cut to zero rates coincided with a selloff in EUR but subsequent moves deeper into negative interest rate territory have not been associated with further EUR weakness (Figure 10). And herein lies the irony: perhaps negative interest rates tighten rather than loosen monetary policy by acting as a tax on banks. If so, perhaps raising rates to zero will mitigate downside risks to Sweden’s financial system and economy, while helping SEK to fall further, supporting Sweden’s exports.

Bottom Line

- In December 2019, Riksbank became first central bank to end negative interest rates

- The ECB has moved deeper into negative interest rate territory

- SEK has been falling versus EUR since 2012, pressured by a narrowing trade surplus

- Sweden’s pandemic response has been different from many Eurozone nations

Picture: (c) aboutpixel.de—Stahn Melanie