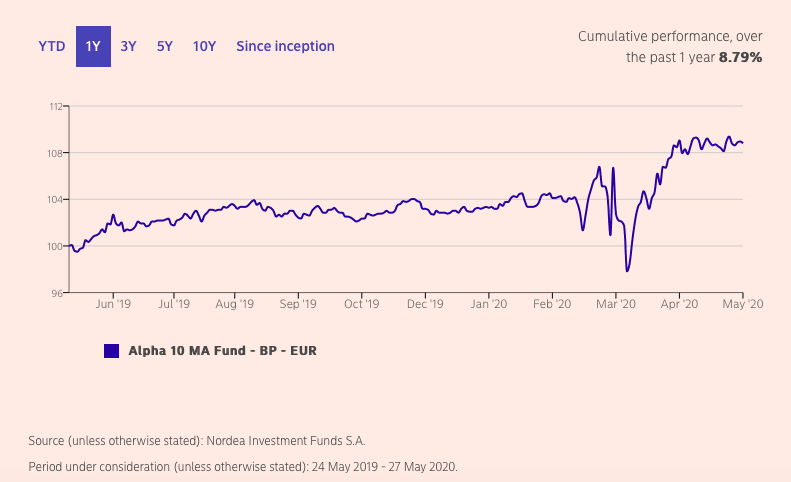

Stockholm (HedgeNordic) – Nordea’s Alpha 10 MA Fund gained 3.3 percent in March and 4.2 percent in April, making the multi-asset, multi-strategy fund one of the few funds that made money in both periods. Alpha 10 MA Fund, one of the three Alpha products managed by Nordea’s multi-asset investment team headed by Asbjørn Trolle Hansen (pictured), is up 5.7 percent year-to-date through May 27.

In Nordea’s weekly webinar Morning Espresso, Hansen says that “unfortunately, we do not have the ability of just X-Raying what is going to happen a month from now.” The strong year-to-date performance of Nordea’s Alpha family – comprised of Alpha 7 MA Fund, Alpha 10 MA Fund and Alpha 15 MA Fund – stemmed from the combination of several types of uncorrelated strategies. “Our approach is that we have these diversifiers, some of the classical ones with bonds, but we also have some more special ones that we have been working with over the last ten years,” explains Hansen.

Nordea’s multi-asset investment team leverages on 15 years of research to bundle traditional and alternative premia in six SuperStrategies that are split into a Risk Balancing bucket and a Directional one. The Risk Balancing bucket includes four strategies that mix risk-on and risk-off premia, while the two strategies in the Directional bucket are designed to predominantly harvest directional premia. “Our recipe is not so secret but rather one of diversification,” emphasizes Hansen in Nordea’s weekly webinar. According to Hansen, bonds act as a diversifier some of the time, but not always. “It was very good that we had these very special auto-diversifiers that we have been working on for so long.”

Hansen points out that incorporating more strategies that perform in risk-off environments paid off. “We are going to continue to work on that, to expand that concept,” says Hansen. “We want to gain robustness and maybe reel in more strategies that can help balance the portfolio.” According to Hansen, “you never know what’s in front of you, which is why diversification is good.” And more importantly, “you don’t always need to know what’s in front of you.”

Diversifiers Don’t Always Work Like a Clock

Although Nordea’s Alpha 10 MA Fund ended both March and April in the green, there was some unusual volatility in performance during the month of March. “There was a bit of reallocation between some of these defensive strategies protecting the equity book,” says Hansen. “What led to the performance volatility was the slippage in this hedging that you can sometimes have,” he emphasizes. “You can do this currency overlay to protect the equity beta and the effectiveness of that can vary quite a bit.” Similarly, a long/short equity strategy “may also be asynchronous in protectionability.” The diversification “does not always work like a clock,” acknowledges Hansen.

“There can be slippage in the way this hedging works, and this led to the volatility,” Hansen sums up. In addition, “some of these strategies have positive convexity,” he adds. “When equities sell-off, the effectiveness of some of these strategies accelerates because of the positive convexity,” explains Hansen. “These two things triggered some volatility.” Eventually, however, the diversifiers “worked as expected” and brought along the expected diversification benefits.

Nordea’s Alpha family of three vehicles all share the same investment approach but exhibit different risk-return profiles. The flagship product, Alpha 10 MA Fund, had €2.87 billion in assets under management at the end of April, while the three-fund family managed about €5.3 billion in assets at the end of last month.